Transforming Aviation: Congress Should Clarify Certain Tax Exemptions for Advanced Air Mobility

Fast Facts

"Advanced Air Mobility" services could soon carry people or cargo on revolutionary aircraft that can take off and land vertically and leave a smaller carbon footprint.

Taxes on airspace users support FAA operations and help finance airport infrastructure. Some users qualify for tax exemptions, such as for medical transport services. But current tax laws don't define some of these new aircraft. For example, certain tax exemptions depend on aircraft type, e.g., "helicopter" vs. "fixed-wing aircraft," but some new aircraft may share features with both types.

Congress should consider clarifying definitions of these aircraft in tax law.

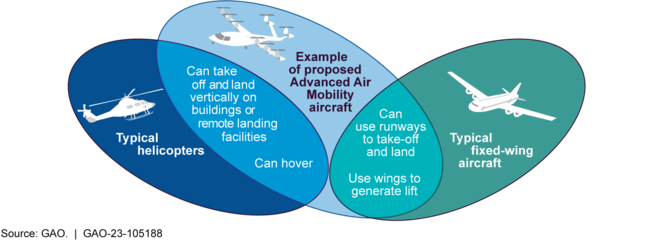

An aircraft like this would share features with helicopter and fixed-wing aircraft types

Highlights

What GAO Found

Advanced air mobility is an emerging form of air transportation that may use aircraft with electrified propulsion systems, increased levels of automation, and vertical take-off and landing capabilities to transport people and cargo. Stakeholders GAO interviewed said that individual infrastructure projects to support such operations (such as take-off and landing sites at airports, hospitals, and parking garages), could cost between $500,000 and more than $10 million apiece. These costs may vary by each project's location, scope of construction, and electrification needs.

Stakeholders expect private funding to play a prominent role in initial infrastructure, though they anticipate public funding may increase over time. Stakeholders noted the balance of public and private funding could affect (1) the speed and ingenuity of infrastructure development; (2) the interoperability of infrastructure; and (3) communities' access to advanced air mobility services.

Taxes applicable to airspace users that fund the aviation system will apply to advanced air mobility operations. However, it is unclear how exemptions for some of these taxes would apply to these operations. For example, eligibility for some tax exemptions depends on the type of aircraft used, such as whether it is a helicopter versus a fixed-wing aircraft. However, “helicopter” and “fixed-wing” are not defined in tax law, and advanced air mobility aircraft can share features with both (see figure).

Shared Features of Proposed Advanced Air Mobility Aircraft and Typical Aircraft

While the current aviation financing system has been amended over time, existing tax law does not address how to classify some emerging advanced air mobility aircraft. Internal Revenue Service (IRS) officials said that in the absence of congressional clarification, the agency might face challenges in determining the applicability of tax exemptions for these operations when they begin. Officials said that congressional clarification would provide a framework for the agency to administer the tax law efficiently and effectively. For example, such clarity would facilitate more consistent tax treatment and reduce litigation that the federal government might otherwise face.

Why GAO Did This Study

Advanced air mobility manufacturers are currently testing their aircraft, with a few companies planning to begin commercial operations in 2025. The Federal Aviation Administration (FAA) will have to certify and integrate these aircraft into the national airspace system. Most of FAA's budget flows from a trust fund supported by various taxes paid by aviation users. Federal tax law administered by the IRS determines whether taxpayers qualify for exemptions to these taxes.

GAO was asked to review funding and infrastructure issues associated with advanced air mobility. This report examines (1) the anticipated capital costs of advanced air mobility infrastructure, (2) stakeholder considerations for infrastructure funding, and (3) the extent to which taxes that support the aviation trust fund apply to advanced air mobility, among other topics.

GAO reviewed laws, regulations, case law, revenue rulings, and other memorandums associated with aviation taxes. GAO interviewed FAA and IRS officials and 25 stakeholders, including academics, trade associations, and aircraft manufacturers. GAO identified these stakeholders through a literature search and consultations with internal and external subject matter experts.

Recommendations

Congress should consider clarifying how advanced air mobility aircraft are defined for the purpose of tax exemptions.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider legislation to clarify how AAM aircraft should be defined for the purpose of exemptions related to taxes that fund the Airport and Airway Trust Fund (AATF). This might include clarifying whether AATF excise tax exemptions should be determined in accordance with the take-off versus in-flight lift mechanism, creating new aircraft category types, further defining jet aircraft as it relates to newer technologies, or other approaches. (Matter for Consideration 1). | As of February 2026, legislation designed to address this issue has not been introduced in the 119th session of Congress. We will continue to monitor congressional efforts regarding this recommendation. |