Medicare Advantage: Continued Monitoring and Implementing GAO Recommendations Could Improve Oversight

Fast Facts

We testified about our work on oversight of Medicare Advantage, a private plan option for Medicare coverage.

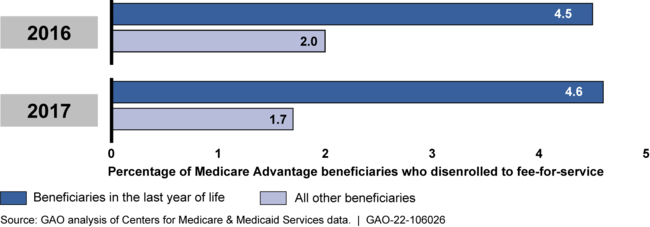

For example, we found that Medicare Advantage beneficiaries in the last year of life left the program to join traditional Medicare at twice the rate of other beneficiaries. This could indicate potential problems with their care.

The Medicare program, which includes Medicare Advantage, is on our High Risk List because of its size, complexity, and susceptibility to mismanagement and improper payments.

Highlights

What GAO Found

Under Medicare Advantage (MA), the Centers for Medicare & Medicaid Services (CMS) contracts with private MA organizations to provide health care coverage to Medicare beneficiaries. CMS pays MA organizations a fixed amount per beneficiary, which gives them an incentive to provide cost-effective and efficient care. CMS oversight of these organizations is designed to ensure that they do not respond to this incentive by inappropriately restricting beneficiaries' access to care. MA beneficiaries in the last year of life are generally in poorer health and often require high-cost care. High rates of disenrollment from MA to join traditional Medicare fee-for-service may indicate issues with the quality of care, such as potential limitations accessing specialized care under some MA organizations' provider networks. In 2021, GAO reported that MA beneficiaries in the last year of life disenrolled to join traditional Medicare at more than twice the rate of all other MA beneficiaries in both 2016 and 2017—the most current years of data at the time of GAO's analysis. GAO recommended—and CMS implemented—reviews of MA disenrollments by beneficiaries in the last year of life. In 2022, CMS analyzed disenrollments by MA beneficiaries for 2019 through 2021 and similarly found higher disenrollment rates by MA beneficiaries in the last year of life under certain MA organization contracts. Such findings underscore the value of continued monitoring. GAO also estimated that these disenrollments increased Medicare program costs by nearly half of a billion dollars each year in 2016 and 2017, as beneficiaries moved from MA's fixed payment arrangement to traditional Medicare, where Medicare payments are generally based on the costs of services provided.

Medicare Advantage Beneficiary Disenrollments to Join Medicare Fee-for-Service, 2016-2017

The data submitted by MA organizations on the services MA beneficiaries receive—known as encounter data—contain information on beneficiaries' clinical diagnoses. CMS uses the diagnoses to adjust payments to MA organizations by increasing or decreasing payments to reflect beneficiaries' projected health care costs. In 2014, GAO recommended that CMS validate MA encounter data for completeness and accuracy. However, as of June 2022, CMS had completed some, but not all, of the necessary steps. For example, CMS has not reviewed beneficiaries' medical records to verify the accuracy of the diagnosis information CMS uses in its risk adjustments. By using encounter data that have not been fully validated for completeness and accuracy, the soundness of adjustments to MA organization payments remains unsubstantiated.

Why GAO Did This Study

The Medicare program, which includes MA, is on GAO's High Risk List, because of its size, complexity, and susceptibility to mismanagement and improper payments. Under MA, CMS pays MA organizations a fixed monthly amount per Medicare beneficiary to provide health care coverage no matter how many services are provided or how much those services cost. These organizations can retain savings if their costs to provide services are lower than their payments, but can incur losses if their costs exceed payments. In 2021, Medicare paid MA organizations about $350 billion to provide health care benefits to about 27 million beneficiaries.

This testimony is based on GAO's prior work and focuses on, among other things, key findings and the status of CMS's efforts to implement GAO recommendations related to (1) monitoring disenrollments from MAOs by Medicare beneficiaries in the last year of life, and (2) validating encounter data used to risk adjust MA organization payments. This testimony draws from GAO reports on Medicare Advantage issued from 2014 through 2021 (GAO-21-482, GAO-16-76, GAO-15-710, and GAO-14-571). GAO also reviewed documents from CMS regarding steps taken to address GAO's recommendations.

For more information, contact Leslie V. Gordon at (202) 512-7114 or GordonLV@gao.gov.