Student Loans: Education Has Increased Federal Cost Estimates of Direct Loans by Billions Due to Programmatic and Other Changes

Fast Facts

The federal Direct Loan program helps students and their parents pay for higher education.

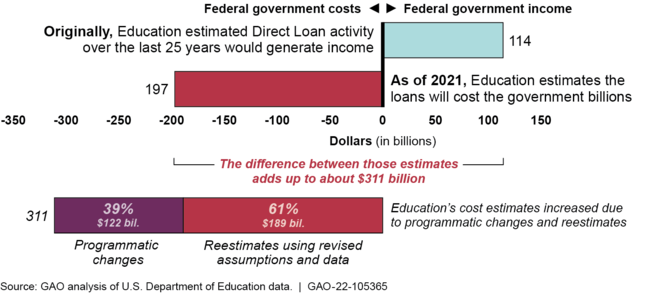

The Department of Education's estimates of the program's cost have increased substantially over the last 25 years: shifting from generating $114 billion in income for the government to costing $197 billion.

Cost estimates increased because of changes to the program and Education's assumptions about how the loans will be repaid. These changes make Direct Loan costs hard to estimate. For example, borrowers in Income-Driven Repayment plans can have different payment amounts when their income or family size changes.

Highlights

What GAO Found

Although the Department of Education originally estimated federal Direct Loans made in the last 25 years would generate billions in income for the federal government, its current estimates show these loans will cost the government billions. Education originally estimated these loans to generate $114 billion in income for the government. Although actual costs cannot be known until the end of the loan terms, as of fiscal year 2021 these loans are estimated to cost the federal government $197 billion. This swing of $311 billion was driven both by programmatic changes and by reestimates using revised assumptions (e.g., economic factors and loan performance) as additional data became available (see figure).

Original and Current (Fiscal Year 2021) Estimated Cost or Income for Direct Loans Made in Fiscal Years 1997–2021

The largest estimated cost increases—$102 billion in total—stemmed from emergency relief provided to most federal student loan borrowers under the CARES Act and related administrative actions in response to the COVID-19 pandemic. This relief included suspending (1) all payments due, (2) interest accrual, and (3) involuntary collections for loans in default. The suspensions, which are programmatic changes dating back to March 13, 2020, are currently set to expire on August 31, 2022. Reestimates based on updated data and assumptions about borrowers in Income-Driven Repayment plans also substantially increased estimated costs.

Among the factors that make estimating the cost of Direct Loans difficult are the lack of historical data when new programmatic changes are introduced, and assumptions Education must make about borrower behavior over the life of the loan. For example, the monthly payment amount for borrowers in Income-Driven Repayment plans can change based on their economic situation. Using a hypothetical group of borrowers, GAO found that borrowers' income growth and inflation, which are difficult to predict, affect borrowers' payments. For example, GAO found that when income grows at a slower rate, borrowers' payments to the government decrease, which increase government costs.

Why GAO Did This Study

Over the last three decades, the Direct Loan program has grown in size and complexity, with almost $1.4 trillion in outstanding federal student loans. The Direct Loan program provides financial assistance to students and their parents to help pay for postsecondary education. GAO was asked to review changes in Education's cost estimates and factors contributing to them.

This report examines how and why Education's Direct Loan cost estimates have changed over time. GAO reviewed budget documents and data covering Direct Loans made from fiscal years 1997 through 2021. GAO also conducted a model-based analysis on a hypothetical group of borrowers beginning repayment to demonstrate how changing economic assumptions can affect both repayment plan selection and estimated loan payments. Additionally, GAO interviewed Education budget officials about their process for estimating student loan costs and how these estimates are calculated and documented.

A forthcoming report will examine government and private sector estimation methods and Education's approach to estimating Direct Loan costs.

Education provided written comments with additional context about some factors that contribute to its revised estimates. GAO is not making recommendations.

For more information, contact Melissa Emrey-Arras at (617) 788-0534 or emreyarrasm@gao.gov, Cheryl E. Clark at (202) 512-9377 or clarkce@gao.gov, or Lawrance L. Evans, Jr. at (202) 512-4802 or evansl@gao.gov.