Credit Reform: Transparency Needed for Evaluation of Potential Federal Involvement in Projects Seeking Loans

Fast Facts

Federal loans are available for projects that align with policy goals—such as infrastructure for clean water.

Before a 1990 law, agencies had to get appropriations from Congress for the full amount of any loans they made. The law allowed agencies to factor estimated repayments into the cost of some loans—letting them make more loans from smaller upfront appropriations. For example, in FY 2021, $7 billion in appropriations supported about $236 billion in loans.

Agencies can only do this if the loan is for a non-federal project. But it's unclear how the Office of Management and Budget determines that. We recommended that OMB publish its criteria.

Highlights

What GAO Found

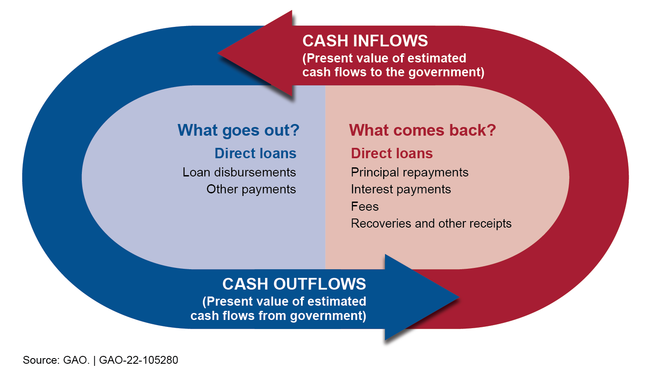

The Federal Credit Reform Act of 1990 (FCRA) allows special budgetary treatment for federal loans made to non-federal borrowers. Specifically, the subsidy cost of the loan (cash outflows minus inflows) is reflected in the budget in the year the loan is made. Prior to FCRA, the total amount of a direct loan was recorded as a cost in the year it was made. Repayments were not recorded until the years they were received. Under the special budgetary treatment FCRA affords, federal agencies can issue an amount of loans that is larger than the related appropriations they receive. For example, in fiscal year 2021, $7 billion in appropriations supported roughly $236 billion in direct loans.

Figure: Loan Subsidy Cost Components

The concept of non-federal borrower is not defined in FCRA. According to Office of Management and Budget (OMB) staff, classification of a borrower as non-federal depends on not only if the recipient is a non-federal entity but also if a loan is sought for a non-federal activity. If a proposed project is a federal activity, it is ineligible for special budgetary treatment under FCRA.

Of the six direct loan programs in GAO's review, one had published criteria for evaluating whether proposed financing applications would fund federal activities. Specifically, the Environmental Protection Agency (EPA), OMB, and the Department of the Treasury jointly published such criteria for EPA's Water Infrastructure Finance and Innovation Act (WIFIA) program. OMB staff said the concepts applied in the WIFIA criteria are generally applicable for all federal lending programs. However, OMB has not published government-wide criteria for evaluating potential federal involvement in projects seeking a federal loan.

Agency officials managing the other five programs in GAO's review were unaware that OMB considers the WIFIA criteria to be applicable to all federal loan programs. Without government-wide criteria, there could be inconsistent treatment of loans across the federal government. This, in turn, could make it harder for policymakers to assess and compare the cost of federal programs.

Why GAO Did This Study

FCRA was enacted to improve the accuracy of the cost of federal credit programs reported in the federal budget, among other things. It requires agencies to measure the government's cost of federal credit programs over the length of a loan. This facilitates better cost comparisons between credit and noncredit programs. FCRA applies only to loans and loan guarantees made to non-federal borrowers.

GAO was asked to review how the non-federal borrower concept is applied in practice. This report examines (1) OMB's policies for evaluating whether federal loan programs would potentially fund a federal borrower or federal activities; and (2) processes that selected agencies—EPA and the U.S. Departments of Agriculture and Transportation—use to screen loan applications for potential federal activities.

GAO analyzed policy and program documents and interviewed officials from six direct loan programs for infrastructure projects with the most obligations in fiscal year 2020. GAO also reviewed OMB policies and processes and interviewed OMB staff.

Recommendations

GAO recommends that OMB publish government-wide criteria agencies should consider when evaluating federal involvement in a potential project to help determine whether it is eligible for the special budgetary treatment under FCRA. OMB neither agreed nor disagreed with GAO's recommendation. OMB provided technical comments, which GAO incorporated as appropriate.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Office of Management and Budget | The Director of OMB should publish government-wide criteria outlining factors that agencies should consider when evaluating federal involvement in a potential project to help determine whether the project is eligible for the special budgetary treatment under FCRA. (Recommendation 1) |

In August 2022, OMB included a list of considerations that must be weighed when reviewing eligibility of proposed direct loans or loan guarantees for budgetary treatment outlined in the FCRA in the updated version of Preparation, Submission, and Execution of the Budget, Circular No. A-11.

|