Retirement Security: Recent Efforts by Other Countries to Expand Plan Coverage and Facilitate Savings

Fast Facts

Ensuring retirement income security for the aging U.S. workforce presents many challenges. People are increasingly responsible for their retirement planning, and as they live longer, they may outlive their savings.

We reviewed steps other countries have taken to promote retirement plan savings. International experts informed us of several efforts, including auto-enrollment—which can increase plan participation for eligible workers but may not reach others, such as part-time or self-employed workers.

Our review of these and other efforts can inform U.S. policymakers as they consider options to improve the nation's retirement security.

Highlights

What GAO Found

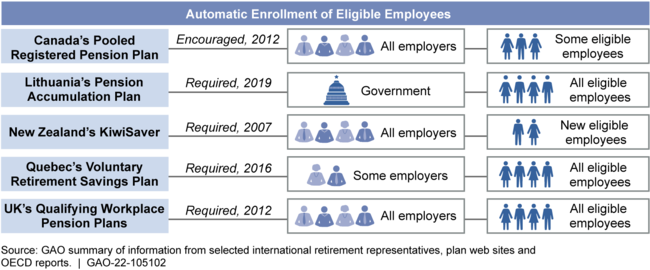

According to representatives GAO interviewed about selected international retirement savings plans, most of the plans require eligible employers to automatically enroll some of their workforce, unless workers explicitly opt out (see figure). This automatic enrollment is intended to help increase plan participation. However, those not automatically enrolled, including some self-employed and part-time workers, remain difficult to cover. For example, part-time employees must work for 24 months before becoming eligible for automatic enrollment in one plan GAO reviewed.

Automatic Enrollment of Eligible Employees, as Implemented in Selected Plans

The selected retirement savings plans use government and employer incentives to encourage workers to join or stay in a plan, according to the representatives. The plans with automatic enrollment incentivize participation by providing some tax benefits to employees, either when contributing or when withdrawing funds at retirement. Each plan also mandates or otherwise incentivizes employer contributions, which, according to retirement representatives, can encourage employee participation and bolster retirement savings. However, lower-income workers may not realize some tax benefits, and the self-employed do not receive the incentives that come with employer contributions.

Selected plans established default contribution rates and investments to facilitate employee participation and remove potential barriers to saving. Nearly all of the selected plans use default contribution rates between 3 and 5 percent of a worker's salary, according to retirement representatives, simplifying a key investment decision of how much to contribute. The plans also offer default investments that combine high- and low-risk funds to balance risk and growth, such as target date funds that adjust based on a worker's expected retirement date. According to the representatives GAO interviewed, default investments can be particularly important for workers with lower levels of financial literacy.

The selected plans also offer flexibilities to participants to adjust or access savings based on life circumstances, such as financial hardship. For example, some plans allow early withdrawal of retirement funds. However, representatives noted concerns that participants who withdraw too much of their money too soon can risk running out of funds later in retirement.

Why GAO Did This Study

The United States faces a range of challenges regarding how to ensure retirement income security for our aging workforce. As traditional pensions have become less common, more individuals are responsible for managing their own retirement savings. In doing so, they may face challenges accessing retirement plans through an employer; accumulating sufficient retirement savings; and ensuring that their accrued savings last through retirement. Other countries have begun to address similar challenges with various reforms to their retirement systems.

This report describes the views of international retirement representatives on policy options and trade-offs from account-based retirement savings reforms in other countries, intended to improve retirement security. These include (1) automatic enrollment of employees in retirement savings plans; (2) financial incentives for employees to contribute; (3) default plan options; and (4) plan flexibilities. GAO reporting on these reforms does not signify endorsement of any particular reform.

GAO interviewed representatives about retirement plans in five selected countries: Canada (the federal level and the province of Quebec), Lithuania, the Netherlands, New Zealand, and the United Kingdom. GAO selected the plans based on the range of strategies used to increase retirement plan coverage, recommendations from knowledgeable stakeholders, and comparability to the United States.

For more information, contact Tranchau (Kris) T. Nguyen at (202) 512-7215 or nguyentt@gao.gov.