Small Business Administration: Steps Taken to Verify Tribal Recognition for 8(a) Program

Fast Facts

The Small Business Administration's 8(a) program offers assistance for business owners from socially and economically disadvantaged groups—such as federally or state-recognized Indian tribes.

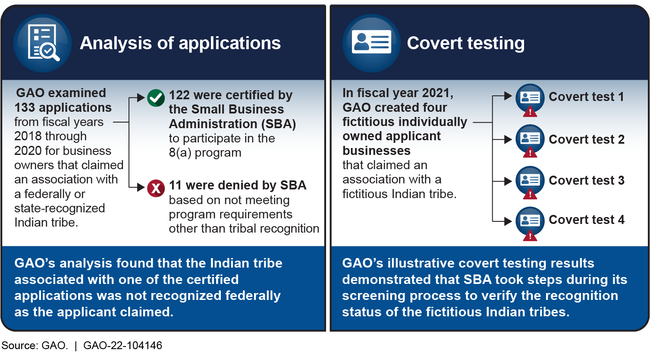

SBA doesn't have formal procedures for verifying whether the tribes listed in program applications are recognized. But when we reviewed the 133 applications claiming tribal association, all but one of them was with a recognized tribe. SBA is taking steps to terminate that one business from the program.

We also submitted 4 applications from fake businesses claiming association with fictitious tribes. SBA took steps to verify the tribal recognition of all 4.

Highlights

What GAO Found

The U.S. Small Business Administration's (SBA) 8(a) Business Development program was created to help develop small businesses owned and controlled by socially and economically disadvantaged individuals and entities, including Indian tribes that are federally or state-recognized. The program provides such businesses with an opportunity to compete on an equal basis in the American economy. Specifically, businesses that participate in the 8(a) program can receive federal contracts that have been set aside for 8(a) program participants.

According to SBA's standard operating procedures, for businesses seeking entry into the program based on association with a recognized Indian tribe, SBA's Business Opportunity Specialists (BOS) are responsible for verifying tribal recognition during the application process. The BOS determines whether the Indian tribe is recognized for SBA purposes based on a review of the business applicant's supporting evidence compared to tribal information maintained at the federal or state government levels. The Department of Interior, Bureau of Indian Affairs (BIA) publishes an annual list of all federally recognized Indian tribes. Additionally, some state governments publish information regarding the Indian tribes that they have recognized.

GAO's analysis of application data for fiscal years 2018 through 2020 indicates that all but one of the 122 participating 8(a) businesses were associated with a recognized Indian tribe as claimed. As a result of this finding, SBA officials told GAO that SBA is initiating steps to terminate that one business's participation in the 8(a) program. Further, GAO's illustrative covert testing results demonstrated that SBA took steps to verify the recognition status of fictitious Indian tribes, despite not yet documenting formal procedures for verifying tribal recognition.

Results from GAO's Evaluation of SBA's Verification of Tribal Recognition

Why GAO Did This Study

According to SBA officials, in fiscal year 2020, federal 8(a) contract obligations for the overall SBA 8(a) program totaled about $19.7 billion and 3,364 8(a) participants were awarded federal 8(a) contracts for the same period.

Prior GAO and SBA Office of Inspector General (OIG) reports identified challenges regarding SBA's oversight of the 8(a) program. For example, in March 2021, the OIG reported that SBA had no formal procedures for verifying the tribal recognition status of Indian tribes associated with 8(a) applications, which SBA plans to address by December 2021.

GAO was asked to evaluate the effectiveness of SBA's verification of the tribal recognition of the Indian tribe associated with 8(a) businesses applying to the program. This report addresses: (1) the extent to which business applicants certified to participate in the 8(a) program were associated with a recognized Indian tribe as claimed for fiscal years 2018 through 2020; and (2) what covert testing results demonstrated about SBA's verification of tribal recognition status in fiscal year 2021.

GAO compared SBA's tribal name data to information maintained by the BIA and research GAO conducted previously. GAO also used covert tests to assess whether SBA took steps to verify tribal recognition of fictitious Indian tribes associated with GAO's fictitious applications. These tests were illustrative and cannot be generalized to all applications.

For more information, contact Seto J. Bagdoyan at (202) 512-6722 or bagdoyans@gao.gov or James (Howard) Arp at (202) 512-6722 or arpj@gao.gov.