National Credit Union Administration: Additional Actions Needed to Strengthen Oversight

Fast Facts

The National Credit Union Administration oversees federally insured credit unions and administers the fund that insures them. Credit union failures from 2010 through 2020 resulted in over $1.5 billion in losses to this fund. We analyzed the causes of failure and observed opportunities for NCUA to enhance its oversight.

For instance, NCUA did not always pursue enforcement actions aggressively enough or conduct post-mortem reviews of failed credit unions as required. We recommended that NCUA enhance its tracking of enforcement data, act earlier on indications of future problems, and complete post-mortem reviews in a timely manner.

Highlights

What GAO Found

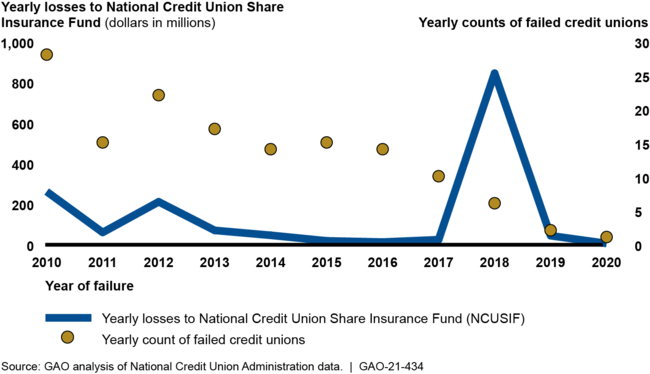

Credit union failures generally declined from 2010 through 2020, as did losses to the National Credit Union Share Insurance Fund (NCUSIF). But losses spiked in 2018 (see figure), largely due to failures of three credit unions with loans concentrated in taxi medallions with declining values. The National Credit Union Administration (NCUA) Office of Inspector General, which conducts material loss reviews (MLR) of certain credit union failures, attributed credit union failures and NCUSIF losses to weaknesses at credit unions and NCUA's oversight.

Trends in Credit Union Failures and Insurance Fund Losses, 2010–2020

NCUA has opportunities to improve its use of supervisory information to address deteriorating credit unions and its processes for reporting on failures, including:

NCUA examiners rate credit unions according to five individual components: Capital Adequacy, Asset Quality, Management, Earnings, and Liquidity/Asset-Liability Management (CAMEL), and assign a composite rating on their overall condition. NCUA places emphasis on the CAMEL composite ratings to guide its enforcement actions. However, GAO found that when one of a credit union's component ratings is worse than its composite rating, that credit union is more likely to deteriorate or fail. NCUA's policies do not explicitly address how to more fully leverage the component ratings individually to determine an appropriate enforcement action. By more fully leveraging the additional predictive value of the CAMEL component ratings, NCUA could take earlier, targeted supervisory action to help address credit union risks and mitigate losses to the NCUSIF.

NCUA did not always conduct post mortem reviews (13 of 44 as of April 2021) of certain failed credit unions (to determine causes for failure) and did not complete most reports (30 of 44) in the required time frame. NCUA's policies and procedures do not specify which office should ensure that reports are done and issued on time. Documenting the responsible office would help ensure reviews are conducted and provide useful and timely information.

Why GAO Did This Study

NCUA oversees federally insured credit unions and administers the NCUSIF (which insures the accounts of credit union members). Credit union failures—145 from 2010 through 2020—resulted in more than $1.55 billion in losses to the NCUSIF.

The Dodd-Frank Wall Street Reform and Consumer Protection Act contains a provision for GAO to review MLRs and make recommendations to improve NCUA's supervision of credit unions. Among its objectives, this report examines (1) credit union failures since 2010, and (2) NCUA use of supervisory information for deteriorating credit unions and its reporting on failures.

GAO analyzed data and information on credit unions' financial condition and NCUA supervisory activity. GAO examined credit union failures in 2010–2020, NCUA and Inspector General reviews of the failures, and the associated NCUSIF losses, and statistically modeled the relationship between examination findings and credit union deterioration and failure. GAO also interviewed NCUA officials.

Recommendations

GAO makes three recommendations to NCUA, including that it more fully leverage the component ratings that indicate credit union deterioration and that it document which office should ensure timely completion of post mortem reports on failed credit unions. NCUA agreed with all of the recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| National Credit Union Administration | The Executive Director should consider how to more fully leverage the information content from CAMEL component ratings into its composite ratings and informal and formal enforcement decisions, and update NCUA's policies and procedures, as appropriate. (Recommendation 1) |

NCUA is currently in the process of updating its guidance and manuals related to the treatment of the components that comprise the Capital adequacy, Asset quality, Management, Earnings, Liquidity, and Sensitivity to Market (CAMELS) ratings. We will continue to monitor the progress and updates to NCUA's guidance and manuals concerning the treatment of the component CAMELS ratings. As of October 2023, this recommendation remains open, as we await further documentation from NCUA since our report was issued related to how a deteriorating component CAMELS rating(s) will inform regulatory decision-making, including informal and formal enforcement actions. NCUA has indicated it is considering updates to the Enforcement Manual and Training in 2024 to address this recommendation.

|

| National Credit Union Administration | The Executive Director should take steps to improve the accuracy and reliability of supervisory data, such as by implementing the Modern Examination and Risk Identification Tool to readily aggregate supervisory data and incorporating all relevant data into the tool, including past administrative or enforcement actions. (Recommendation 2) |

NCUA has developed and implemented the Modern Examination and Risk Identification Tool (MERIT). As of December 31, 2021, examination staff were trained on MERIT and using the system for all new examinations and contacts. The Executive Director distributed a memo on August 31, 2021, on Quality Control for Audit Materials, which provided updated instructions to ensure a consistent protocol for ensuring the accuracy of retrieval and submission of data to OIG or external parties conducting a review of the NCUA. We also observed the MERIT User Guide, which provides instruction to staff on use of the tool. Concerning the tracking of supervisory data to include enforcement actions, NCUA has stated that this feature is not currently incorporated in MERIT, though it can be added in the future. We noted in our work that absent such a feature, NCUA would have to continue to rely on manual processes, which has resulted in unreliable data. As of September 2023, this recommendation remains open as Partially Addressed, absent a feature to track supervisory data to include enforcement actions. NCUA acknowledged they are considering options for enhancing MERIT further. Accordingly, we will continue to monitor the features available in MERIT and we may reassess the accuracy and reliability of the data in this new tool in future work.

|

| National Credit Union Administration | The Executive Director should document which NCUA office is responsible for ensuring completion of post mortem reports in the time frame required under NCUA policies and procedures and a process for compliance reviews by that office. (Recommendation 3) |

NCUA stated that the National Supervision Policy Manual (NSPM) was updated to include language assigning the Office of Examination and Insurance (E&I) as the office responsible for ensuring completion of postmortem reports within documented timeframes. Also, NCUA conveyed that the policy was updated to allow the agency to exercise discretion over when to extend the postmortem completion time and when to forgo completion of certain postmortems given competing priorities and/or low expected information value, with written approval from either the Executive Director or Director of E&I. We observed the updates in the NSPM (version 18.0) concerning post mortems and credit union closure/failure reporting.

|