Home Mortgage Disclosure Act: Reporting Exemptions Had a Minimal Impact on Data Availability, but Additional Information Would Enhance Oversight

Fast Facts

Since 2018, the Home Mortgage Disclosure Act requires lenders to report additional data from loan applications and originations—such as borrower credit scores—to help regulators oversee and enforce fair lending laws.

Banks and credit unions that don't do a lot of lending are exempt from this requirement. Although these exemptions minimally affected data availability, regulators still need to verify whether lenders are eligible to use them.

To do so, regulators need to know whether loans are open-end lines of credit—but eligible lenders are exempt from reporting this data.

Our recommendations are to help improve oversight over mortgage lending.

Highlights

What GAO Found

According to federal financial regulators, the additional Home Mortgage Disclosure Act (HMDA) data that some lenders have been required to report since 2018—such as debt-to-income ratio and credit score—help the regulators oversee and enforce fair lending laws. For example, the new HMDA data can help them identify discriminatory lending practices and prioritize fair lending examinations and investigations. These new data also help facilitate research about lending patterns, community credit needs, and financial market stability, according to researchers and advocacy organizations.

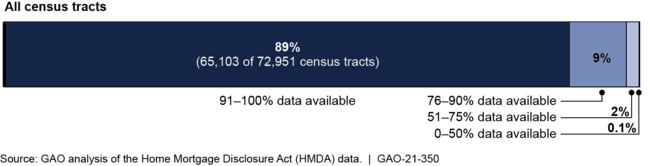

Lenders that meet specific statutory criteria are required to report certain data under HMDA, but are exempt from reporting almost all of the new additional HMDA data––referred to as partial exemption from HMDA reporting. GAO analysis found that these partial exemptions have had a limited impact on the overall availability of HMDA data. Nationwide, GAO found that 3 percent of the new HMDA data were not reported as a result of partial exemptions, for the 2018 and 2019 HMDA data GAO reviewed. At the local level, in the vast majority of census tracts, at least 91 percent of data GAO reviewed were available in 2019 (see figure). Partial exemptions did not disproportionately affect the availability of HMDA data GAO reviewed for borrowers of any race, ethnicity, or income level.

Impact of Partial Exemptions on HMDA Data Availability for Census Tracts, 2019

Note: All census tracts refers to those that reported home mortgage loan activity in 2019. The percentages of census tracts do not sum to 100 percent due to rounding.

With regard to oversight, regulators were unable to readily verify some lenders' eligibility for partial exemptions because not all HMDA reporting included data on whether each loan is an open-end line of credit. This data point is one of the new data points required since 2018, and lenders with exemptions are not required to provide it. Without it, however, it is difficult for regulators to determine if the lender is below the loan volume level required for partial exemption eligibility. The HMDA data that lenders with partial exemptions need not report are set in statute. If Congress were to make reporting of open-end lines of credit mandatory for all HMDA reporters, including those with partial exemption, regulators could more readily confirm lenders' eligibility for partial exemption. In addition, the Consumer Financial Protection Bureau (CFPB) has other data that are useful in determining lenders' eligibility, such as type of lender. CFPB does not plan to analyze these data for the other regulators, stating that they have access to the data through other sources. However, it would be more efficient—and reduce duplication of effort among regulators—for CFPB to synthesize and share data with regulators to assist them in assessing lenders' partial exemption compliance.

Why GAO Did This Study

HMDA generally requires mortgage lenders to collect and report certain information from loan applications and originations. Congress amended HMDA to require the reporting of additional data, but later provided regulatory relief to some smaller-volume banks and credit unions by exempting them from having to report almost all of the additional data.

The Economic Growth, Regulatory Relief, and Consumer Protection Act includes a provision for GAO to review how partial exemptions affect HMDA data availability at the national and local levels. This report (1) identifies the uses and benefits of the new HMDA data; (2) assesses how partial exemptions have changed the extent of HMDA data availability; and (3) examines federal regulators' oversight activities related to partial exemptions from HMDA reporting. GAO analyzed 2016–2019 HMDA data (the most recent years available) and reviewed federal interagency agreements and examination procedures. GAO interviewed federal officials and a variety of stakeholders, including academics, research and advocacy organizations, and industry groups.

Recommendations

Congress should consider requiring all HMDA reporters—including those with partial exemptions—to report whether loans are open-end lines of credit. In addition, GAO recommends that CFPB include additional information in the analysis it provides to the other regulators related to lender eligibility for partial exemptions. CFPB neither agreed nor disagreed with the recommendation, but noted the importance of sharing information.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider requiring all HMDA reporters to disclose whether a covered loan or application is for an open-end line of credit. (Matter for Consideration 1) | As of February 2026, Congress had taken no action. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Consumer Financial Protection Bureau | The Director of CFPB should provide the federal financial regulators with additional information in its analysis to help them oversee lenders' eligibility for partial exemptions and related HMDA reporting. (Recommendation 1) |

Consistent with our recommendation, in 2021 and 2022, CFPB shared information (known as a partial exemption report) with the other HMDA agencies to help them determine partial exemption compliance. CFPB officials noted the agency will continue to produce and share information with the other regulators on an annual basis moving forward.

|