Retirement Security: Older Women Report Facing a Financially Uncertain Future

Fast Facts

We testified about our recent report on the perspectives of women retirees on their financial security. We held 14 focus groups across the country. Every group was concerned about rising health care costs and each group discussed how a lack of personal finance education hurt their retirement security. Women in all groups also equated financial security in retirement with being able to maintain their independence.

We also analyzed data on the retirement security of older women and found:

Median household wealth was $250,000

Liquidity and traditional pensions were important at all levels of wealth

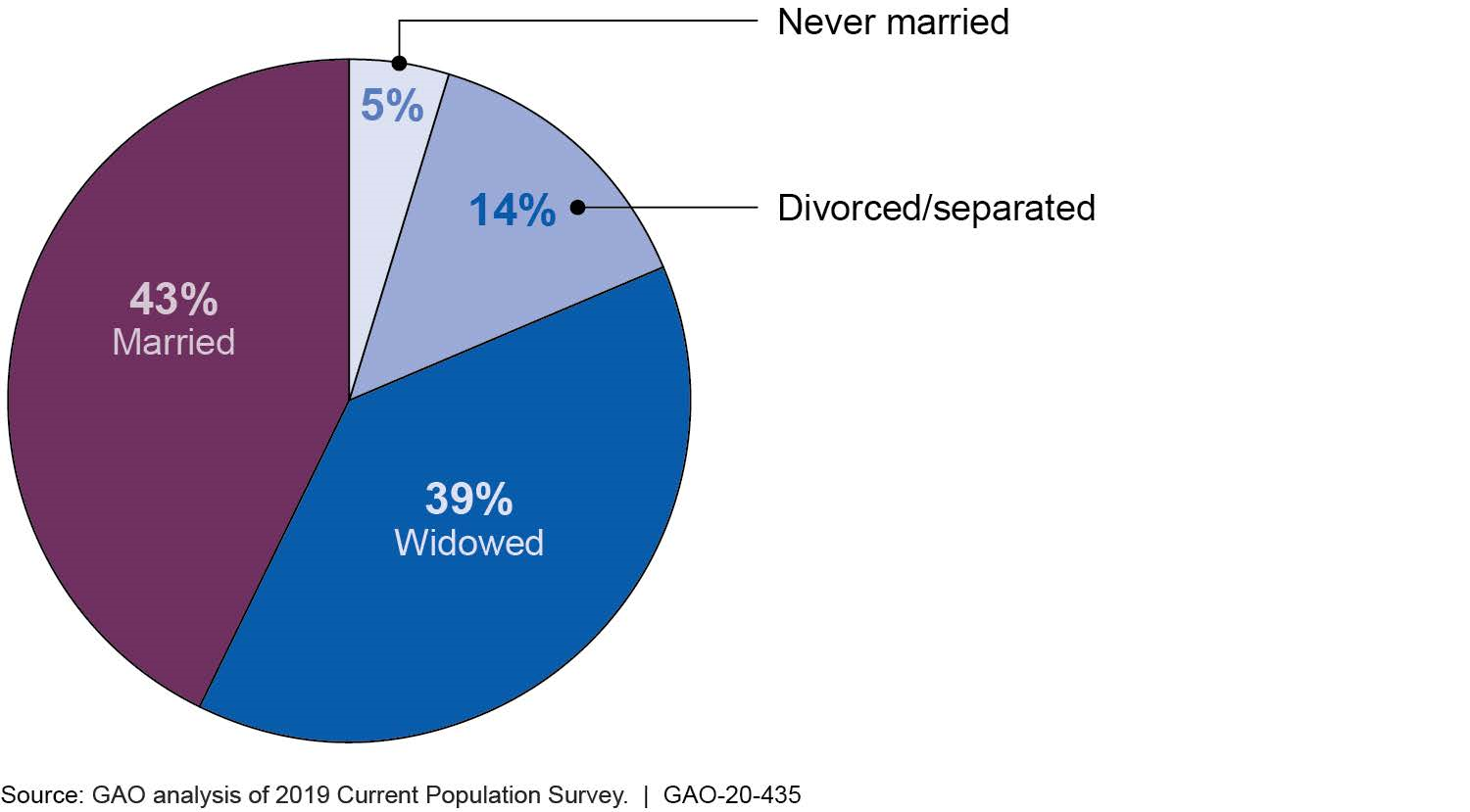

A large portion of women over 70 are widows

Highlights

What GAO Found

In all 14 focus groups GAO held with older women, women described some level of anxiety about financial security in retirement. Many expressed concerns about the future of Social Security and Medicare benefits, and the costs of health care and housing. Women in the groups also cited a range of experiences that hindered their retirement security, such as divorce or leaving the workforce before they planned to (see fig.). Women in all 14 focus groups said their lack of personal finance education negatively affected their ability to plan for retirement. Many shared ideas about personal finance education including the view that it should be incorporated into school curriculum starting in kindergarten and continuing through college, and should be available through all phases of life.

Women Age 70 and Over by Marital Status

Note: Percentages do not add up to 100 percent due to rounding

Individual women's financial security is also linked to their household where resources may be shared among household members. According to the 2016 Survey of Consumer Finances, among households with older women, about 23 percent of those with white respondents and 40 percent of those with African American respondents fell short of a measure of retirement confidence, indicating their income was not sufficient to maintain their standard of living. The likelihood of a household reporting high retirement confidence rose in certain cases. For example among households of similar wealth, those with greater liquidity in their portfolio and those with defined benefit plan income were more likely to report high retirement confidence.

Why GAO Did This Study

This testimony summarizes the information contained in GAO's July 2020 report, entitled Retirement Security: Older Women Report Facing a Financially Uncertain Future (GAO-20-435).

For more information, contact Tranchau Nguyen at (202) 512-2660 or NguyenTT@gao.gov.