The Nation's Fiscal Health: Action Is Needed to Address the Federal Government's Fiscal Future

Fast Facts

We testified about the federal government’s fiscal condition at the end of FY 2019 and the unsustainable path it is on if policies don’t change.

Among our findings:

Publicly held debt rose to 79% of GDP. The Congressional Budget Office and our new report both project it will continue to grow

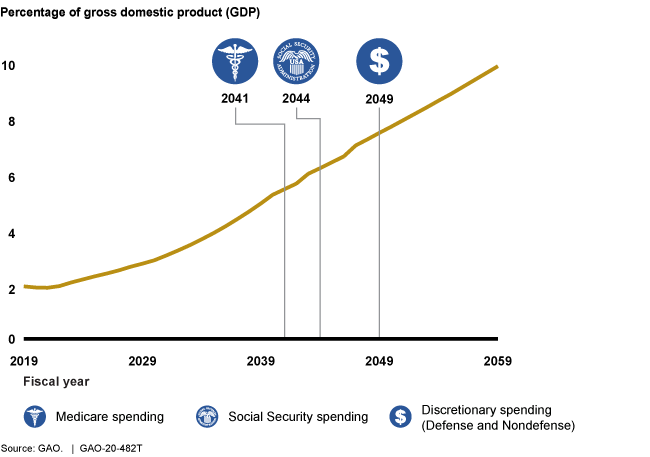

Interest on the debt is the fastest growing item in the budget; it is projected to be the largest spending category by 2049

The longer action is delayed, the more drastic changes will have to be

Spending on national debt interest will exceed Medicare, Social Security, and discretionary spending in the years shown below

Line graph showing spending on national debt interest exceeding spending on Medicare in 2041, Social Security in 2044, and discretionary spending in 2049

Highlights

What GAO Found

This testimony summarizes information contained in GAO's March 2020 report, entitled The Nation’s Fiscal Health: Action Is Needed to Address the Federal Government’s Fiscal Future (GAO-20-403SP).

Long-term fiscal projections by GAO, the Congressional Budget Office (CBO), and in the 2019 Financial Report of the U.S. Government (2019 Financial Report) all show that, absent policy changes, the federal government continues to face an unsustainable long-term fiscal path. Although the assumptions in each of these projections vary somewhat, all result in the same conclusion: over the long term, the imbalance between spending and revenue that is built into current law and policy will lead to (1) deficits exceeding $1 trillion each year beginning in fiscal year 2020 and (2) both the annual deficit and the cumulative total debt held by the public continuing to grow as shares of gross domestic product (GDP). This situation—in which debt grows faster than GDP—means the current federal fiscal path is unsustainable.

To change the long-term fiscal path, policymakers will need to consider policy changes to the entire range of federal activities, both revenue (including tax expenditures) and spending (entitlement programs, other mandatory spending, and discretionary spending). As Congress considers changes in revenue and spending policies to improve the federal government’s long-term fiscal path, it will also need to consider other approaches for managing the level of debt.

For further information, please contact Susan J. Irving, Senior Advisor to the Comptroller General, Debt and Fiscal Issues, who may be reached at (202) 512-6806 or IrvingS@gao.gov; Robert F. Dacey, Chief Accountant, who may be reached at (202) 512-3406 or daceyr@gao.gov; or Dawn B. Simpson, Director, Financial Management and Assurance, who may be reached at (202) 512-3406 or simpsondb@gao.gov.