Tobacco User Fees: Further Action Needed to Ensure Calculations Are Based on Complete and Accurate Data

Fast Facts

The Food and Drug Administration charges tobacco manufacturers a fee to fund regulation activities (such as educating the public about risks associated with tobacco). These fees, which are based on companies’ market shares, were about $635 million in FY 2017.

FDA is supposed to check its fee calculations and make adjustments at the end of each year, but the most recent adjustment was completed for fiscal year 2015. Challenges in obtaining the needed data from 2 other agencies have delayed the process.

To help avert future delays, we recommended that FDA work with the agencies to get the needed information in a more timely manner.

Six Classes of Tobacco Products Are Subject to FDA Tobacco User Fees

Illustration showing the 6 classes are cigarettes, snuff, chewing tobacco, roll-your-own tobacco, pipe tobacco, and cigars

Highlights

What GAO Found

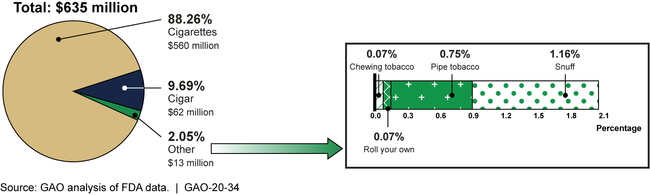

In fiscal year 2017, the latest data available at the time of our analysis, the Food and Drug Administration (FDA) assessed about $635 million in user fees to tobacco manufacturers and importers of six classes of FDA-regulated tobacco products—cigarettes, snuff, chewing tobacco, roll-your-own tobacco, pipe tobacco, and cigars. (See figure.)

User Fees Assessed by Tobacco Product Class, Fiscal Year 2017

FDA has a process that is designed to ensure accurate calculation, billing, and collection of tobacco user fees. However, the agency has not completed a key step in this process—its year-end reconciliation—since doing so for fiscal year 2015. FDA procedures provide that the agency will conduct this year-end reconciliation annually after receiving necessary data from the Department of the Treasury's Alcohol and Tobacco Tax and Trade Bureau (TTB) and U.S. Customs and Border Protection (CBP). FDA relies on this year-end reconciliation to ensure that its user fee calculations are based on complete and accurate data—that is, that all manufacturers and importers subject to tobacco user fees were assessed fees correctly, based on accurate market share data. Incomplete or inaccurate data for one manufacturer or importer affects the market share—and the user fee amount—for all other manufacturers and importers in its product class.

FDA has not completed this year-end reconciliation in recent years because of delays in obtaining the quality data it needs from TTB and CBP. While FDA has reported receiving most of the data for fiscal years 2016 through 2018 and has plans for completing the reconciliation for those years, the agency faces a risk of repeating delays in its reconciliation efforts in the future because it does not have reasonable assurance that it will receive quality data in a timely manner moving forward. Until FDA consults with TTB and CBP to determine and document the procedures and time frames that will allow FDA to obtain the quality data it needs to complete this key step in a timely manner, the agency risks repeating these delays.

Why GAO Did This Study

Tobacco use causes more than 480,000 deaths each year, according to the Department of Health and Human Services (HHS). To protect the public, the Family Smoking Prevention and Tobacco Control Act granted FDA, an agency within HHS, authority to regulate tobacco products. To fund FDA's tobacco regulation activities—such as those aimed at preventing youth use of tobacco products—the act authorizes FDA to assess and collect a specified total amount of user fees from tobacco manufacturers and importers each fiscal year. The total amount of user fees are to be allocated based on the individual manufacturers' and importers' market share in six FDA-regulated tobacco product classes.

GAO was asked to review FDA's tobacco user fees. This report examines FDA's process for the calculation, billing, and collection of these fees. GAO reviewed the relevant law and regulations, as well as FDA policies and procedures, and interviewed FDA officials.

Recommendations

GAO is recommending that FDA consult with TTB and CBP to determine and document procedures for FDA to obtain quality data so the agency can complete its annual reconciliation process in a timely manner. HHS agreed with GAO's recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Food and Drug Administration | The Commissioner of FDA should consult with TTB and CBP to determine and document—for example in Memorandums of Understanding or other written agreements—procedures and time frames for FDA to receive quality data from TTB and CBP that will allow FDA to complete its reconciliation process in a timely manner. (Recommendation 1) |

FDA concurred with this recommendation. In June 2022, FDA's Center for Tobacco Products and the Tobacco Tax and Trade Bureau (TTB) finalized and signed a written agreement documenting the data and information needed from TTB for FDA to perform its annual reconciliation process. It includes procedures and time frames for receiving this information in a timely manner. FDA's action meets the intent of our recommendation.

|