State and Local Governments' Fiscal Outlook: 2019 Update

Fast Facts

What's the latest thinking regarding the fiscal health of state and local governments across the nation?

The 2019 update to our annual outlook on the fiscal condition of states and localities suggests that the sector will have an increasingly tough time covering its bills over the next 50 years. Although our model shows revenue will increase, spending will likely rise faster—driven largely by health care costs, including Medicaid spending. Revenues may be insufficient to sustain the amount of government service currently provided.

State flags

Highlights

What GAO Found

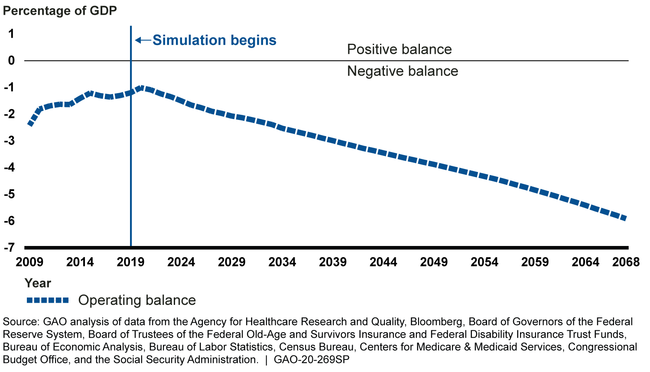

GAO's simulations suggest that state and local governments will likely face an increasing difference between expenditures and revenues during the next 50 years as reflected by the operating balance—a measure of the sector's ability to cover its current expenditures out of its current revenues. While both expenditures and revenues are projected to increase as a percentage of United States' gross domestic product (GDP), a difference between the two is projected to persist because expenditures are expected to grow faster than revenues throughout the simulation period. The sector would need to make changes to avoid fiscal imbalance and assure that revenues are at least equal to expenditures.

State and Local Government Sector Operating Balance as a Percentage of Gross Domestic Product (GDP), 2009 through 2068

GAO's simulations suggest that growth in the sector's overall expenditures is largely driven by health care, with states' share of Medicaid spending as the primary driver. These expenditures are projected to grow more than GDP each year. Employee compensation, the largest share of operating expenditures, decreases as a share of GDP during the simulation period. Health benefits are the only component of employee compensation that increase as a percentage of GDP. Revenues from federal grants to states and localities are also expected to increase during the simulation period, in part because of Medicaid grants to states.

GAO also conducts sensitivity analyses to see how the sector's outlook changes when using alternative assumptions of key model variables – economic growth, health care excess cost growth, and the real rate of return on pension assets. Using these alternative assumptions highlights the operating balance's sensitivity to changes and possible shifts in the future fiscal outcomes for the sector.

Why GAO Did This Study

Fiscal sustainability presents a national challenge shared by all levels of government. Since 2007, GAO has published simulations of long-term fiscal trends in the state and local government sector, which have consistently shown that the sector faces long-term fiscal pressures. While a great majority of states have requirements related to balancing their budgets, deficits can arise for reasons including planned annual revenues are not generated at the expected rate, demand for services exceeds planned expenditures, or both, resulting in a near-term operating deficit.

This report updates GAO's state and local fiscal model to simulate the fiscal outlook for the state and local government sector. This includes identifying the components of state and local expenditures likely to contribute to the sector's fiscal pressures as well as the effects of revenue changes on the sector's outlook.

GAO's model uses the Bureau of Economic Analysis's National Income and Product Accounts as the primary data source and presents the results in the aggregate for the state and local government sector as a whole. The model shows the expected level of receipts and expenditures for the sector until 2068, based on historical spending and revenue patterns. In addition, the model assumes that the current set of policies in place across state and local governments remains constant to show a simulated long-term outlook. Because the model covers the sector in the aggregate, the fiscal outcomes for individual states and localities cannot be identified.

For more information, contact Michelle Sager at (202) 512-6806 or sagerm@gao.gov or Oliver Richard, (202) 512-8424 or richardo@gao.gov.