Federal Trust Funds and Other Dedicated Funds: Fiscal Sustainability Is a Growing Concern for Some Key Funds

Fast Facts

Every major federal department has at least 2 trust funds or dedicated funds that pay for key programs. The money comes from related taxes, fees, and premiums—e.g., U.S. postage stamp revenue goes to the Postal Service Fund.

The overall federal trust fund balance is expected to start declining in 2022 as balances in the Medicare and Social Security trust funds drop. The government is projected to borrow the difference—which isn’t sustainable.

Of our 13 case study funds, 11 received general revenue in addition to dedicated revenue. For example, the 2015 Highway Trust Fund reauthorization provided $70 billion in general revenue to the fund.

Entrance to the Department of the Treasury

Highlights

What GAO Found

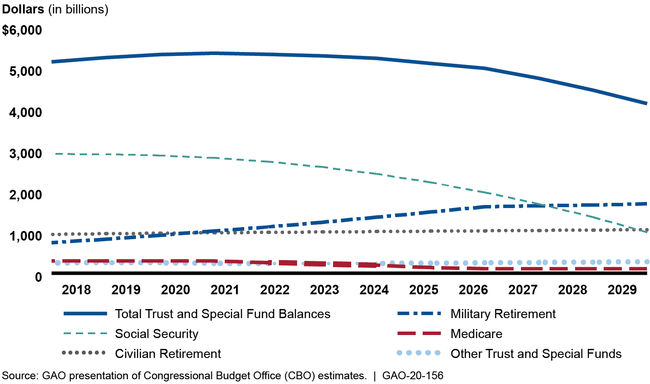

Every major federal department has at least two trust funds or other dedicated funds. According to GAO analysis of Office of Management and Budget (OMB) data, balances in these funds, which can be used to support covered programs, grew 13 percent in nominal terms from fiscal year 2014 through 2018. Fund balances are affected by complex interactions of factors, but the total increase was driven largely by military and civilian retirement fund balances. The Congressional Budget Office (CBO) projects the total balance to start declining in fiscal year 2022 as decreases in Medicare and Social Security will exceed increases in military and civilian retirement balances. To offset the overall decrease, the federal government is projected to borrow more from the public.

CBO Projects Total Trust and Special Fund Balance Will Decline Starting in 2022

GAO found that 11 of 13 case studies recently received general revenue—collections that are not dedicated by law for a specific purpose. For example, medical insurance premiums for Medicare Part B are set to cover 25 percent of expected costs; the remaining 75 percent are covered by general revenues. Even funds that rely primarily on their dedicated collections may not be fiscally sustainable. For example, the Social Security Old-Age and Survivors Insurance Trust Fund only uses dedicated collections for benefit payments, but its balances are projected to be depleted by 2034.

Nearly 98 percent of outlays and transfers from trust funds and other dedicated funds was through mandatory authority, which allows agencies to make payments without further congressional action. Most of the 23 largest funds also have entitlement authority, which generally requires payments to eligible parties based on legal requirements. Status as a trust fund, mandatory program, or entitlement does not prevent Congress and the President from changing related laws to alter future collections or payments.

Why GAO Did This Study

Some of the largest federal programs, including Medicare, Social Security, and postal services, are funded through trust funds and other dedicated funds, which link collections that have been dedicated to a specific purpose with the expenditures of those collections. While these funds have the ability to retain accumulated balances, these collections do not necessarily fund the full current or future cost of the government's commitments to the designated beneficiaries.

GAO was asked to review issues related to federal trust funds and other dedicated funds. This report examines (1) how the size and scope of federal trust funds and other dedicated funds in the federal budget have changed over time, (2) the extent to which these funds are supported by their dedicated collections, and (3) the extent to which these funds support mandatory programs, including major entitlement programs.

GAO analyzed OMB data on trust funds and other dedicated funds for fiscal year 2014 through 2018 and the Department of the Treasury's (Treasury) Fiscal Year 2018 Combined Statement of Receipts, Outlays, and Balances. GAO also examined 13 case study accounts in nine agencies, selected to include the largest of each type of these funds and a variety of program designs. GAO reviewed agency reports, CBO trust fund estimates for 2018 and projections for 2019 to 2029, and prior GAO reports, and interviewed OMB staff and officials from Treasury and each of the case study agencies. GAO also is providing an online dataset of these funds at https://www.gao.gov/products/GAO-20-156 .

For more information, contact Tranchau (Kris) T. Nguyen at (202) 512-6806 or nguyentt@gao.gov.