Electronic Cigarettes: U.S. Imports, 2016-2018

Fast Facts

Over the last 15 years, use of electronic cigarettes in the United States has grown rapidly as use of traditional cigarettes declined. Most e-cigarettes sold here are thought to be imported.

The government began collecting data on imported e-cigarette devices, parts, and liquid in 2016. We analyzed these data for 2016-2018 and found:

The value of U.S. e-cigarette imports was $2.4 billion and brought $120 million in tariff revenue over that period.

China accounted for 97% of these e-cigarette imports by value, and

More than 271 million e-cigarette devices were imported.

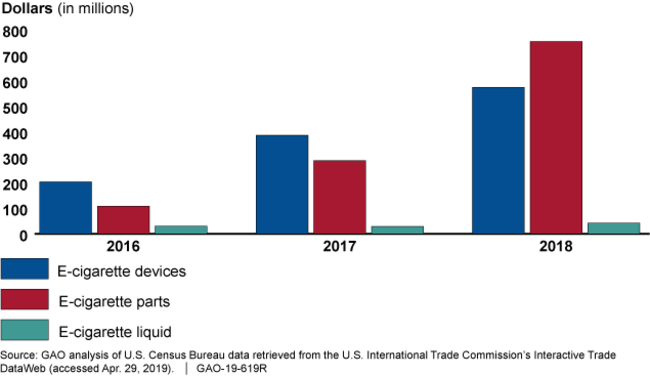

Customs Value of E-cigarette Devices, Parts, and Liquid Imported into the United States, 2016-2018

Bar charts showing increasing dollar values over time

Highlights

What GAO Found

The customs value of e-cigarette devices, parts, and liquid imported into the United States in 2016 through 2018 was $2.4 billion, resulting in $120 million in tariff revenue. E-cigarette devices and parts each accounted for about $1.2 billion (48 percent for each, or 96 percent for both), and e-cigarette liquid accounted for $101.5 million (4 percent) of the total customs value over that period. From 2016 to 2018, the customs value of all U.S. e-cigarette imports increased by 300 percent, with the highest increases associated with imported e-cigarette parts (594 percent) and one type of nicotine-containing e-cigarette liquid (582 percent). Although e-cigarettes were imported from 65 countries during this period, imports from China accounted for 97 percent of the customs value of all e-cigarette imports. U.S. e-cigarette imports cleared customs at 36 ports of entry; the top five ports of entry—Los Angeles, Cleveland, Chicago, Savannah, and Norfolk—accounted for 81 percent of the total customs value of U.S. e-cigarette imports from 2016 through 2018.

Why GAO Did This Study

Over the last 15 years, use of electronic cigarettes, known as e-cigarettes, in the United States has grown rapidly as use of traditional cigarettes declined among both adolescents and adults. As GAO reported in 2017, most e-cigarettes sold in the United States are thought to be imported. The U.S. government began collecting data specific to e-cigarette imports in January 2016, after the Committee for Statistical Annotation of Tariff Schedules established six new statistical reporting numbers for e-cigarette devices, parts, and liquid in the Harmonized Tariff Schedule of the United States (HTS). The six HTS statistical reporting numbers for U.S. e-cigarette imports cover devices with and without nicotine; parts with and without nicotine; and two types of nicotine-containing e-cigarette liquid. U.S. Customs and Border Protection collects U.S. import data from records submitted by importers, and the U.S. Census Bureau (Census) incorporates these data into its official trade statistics.

GAO was asked to report on e-cigarettes imported into the United States from 2016 through 2018. This report examines the customs value, tariff revenue, countries of origin, and ports of entry for e-cigarette devices, parts, and liquid imported during those years. GAO analyzed import data for the six statistical reporting numbers for e-cigarettes for calendar years 2016 through 2018. GAO used data that were available in April 2019 from the Interactive Tariff and Trade DataWeb database maintained by U.S. International Trade Commission, which incorporates U.S. trade statistics published by Census..

For more information, contact David Gootnick at (202) 512-3149 or gootnickd@gao.gov.