Tax-Law Enforcement: IRS Could Better Leverage Existing Data to Identify Abusive Schemes Involving Tax-Exempt Entities

Fast Facts

When taxpayers overstate how much they've donated to charities on their tax forms, it improperly reduces their tax bills. In some cases, the charity is complicit, while in others, it is being exploited.

IRS’s different offices may find evidence of abusive schemes involving charities and other tax-exempt organizations in their audits.

Yet IRS doesn’t consistently analyze data from its offices to help identify these types of schemes—even though information about them may be available in existing databases.

We recommended that IRS improve its use of data, databases, and analytics to better combat this problem.

Itemized deduction form on clipboard, hand, pen

Highlights

What GAO Found

Taxpayers have used a variety of abusive tax schemes involving tax-exempt entities. In some schemes, the tax-exempt entity is complicit in the scheme, while in others it is not. For example, an abusive tax scheme could involve multiple donors grossly overvaluing charitable contributions, where the tax-exempt entity is not part of the scheme. Conversely, some patient assistance programs—which can help patients obtain medical care or medications—have been used by pharmaceutical manufacturers to make charitable donations that can be viewed as furthering private interests.

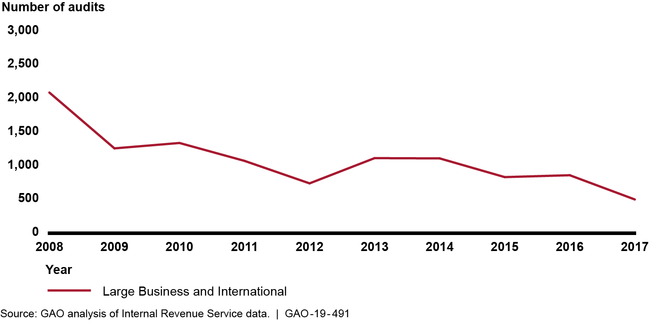

Internal Revenue Service (IRS) audits of abusive tax schemes are trending downward, as the figure below shows audits by IRS's Large Business and International division. This trend has occurred amid generally declining IRS resources and corresponds with an overall decrease in audit activity by IRS over recent years.

IRS has a variety of programs working collectively to identify abusive tax schemes involving tax-exempt entities, but some internal control weaknesses exist in its approach. For example, GAO found three ways that IRS data or programs were inconsistent with internal control standards for using quality information. First, database project codes used for identifying data on abusive tax schemes are not linked across IRS's audit divisions and do not consistently identify whether a tax-exempt entity was involved. Second, IRS has not leveraged a database with cross-divisional information to facilitate its analysis and monitoring of audit data across divisions. Finally, IRS has not used existing analytic tools to mine the narrative fields of tax forms. Doing so could provide audit leads on abusive schemes involving tax-exempt entities. These deficiencies inhibit IRS's ability to identify abusive tax schemes and develop responses to those schemes.

Large Business and International Abusive Transaction Audits, Fiscal Years 2008 through 2017

Why GAO Did This Study

Abusive tax schemes contribute to the tax gap and threaten the tax system's integrity. When abusive tax schemes involve tax-exempt entities, they also can erode the public's confidence in the charitable sector.

GAO was asked to review what is known about abusive transactions involving tax-exempt entities and how IRS addresses them. This report, among other things, (1) describes ways in which taxpayers have abused an entity's tax-exempt status; (2) examines trends in IRS's compliance efforts; and (3) assesses how IRS identifies emerging abusive tax schemes involving tax-exempt entities.

GAO reviewed research on tax schemes involving tax-exempt entities, and interviewed relevant professionals and researchers about tax schemes involving tax-exempt entities; compiled statistics from IRS audit and disclosure data; and compared documentation and testimony from IRS officials on IRS programs and guidance from its operating divisions with certain internal control and GAO fraud framework criteria.

Recommendations

GAO is making five recommendations to IRS to strengthen its internal controls, including that it link data across operating divisions, test the ability of a database to facilitate analysis of audit data, and use existing analytic tools to further mine information on tax forms. In commenting on a draft of this report, IRS agreed with all of GAO's recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should undertake a risk assessment of tax-exempt entity Form 8886-T filings. Based on the findings of the risk assessment, IRS should then determine whether steps are needed to increase compliance, such as, for example, through increased outreach to tax-exempt entities or assessment of nonfiling penalties. (Recommendation 1) |

IRS agreed with the recommendation. In July 2020, IRS's Tax Exempt/Government Entities (TE/GE) division undertook a risk assessment of Form 8886-Ts filed through 2017. This assessment also reviewed 322,800 Form 990 tax-exempt annual returns filed in 2017 and identified 55 entities that should have filed a Form 8886-T but did not. Because the assessment identified minimal risk, TE/GE concluded it should maintain its current compliance mechanisms for Form 8886-T and Form 990. In July 2021, IRS told GAO that it referred 55 tax-exempt entities identified in the risk assessment who should have filed Form 8886-T but did not for consideration of compliance action. In March 2022, IRS confirmed that it issued additional additional Internal Revenue Manual instructions so auditors in other operating divisions are familiar with TE/GE taxpayers and how to refer cases involving a tax-exempt entity participating in an abusive transaction to TE/GE. By assessing the Form 8886-T filings, IRS has reduced the risk that noncompliant tax-exempt entities will not be found in available data. Improving referrals also will help other parts of IRS ensure that steps are taken to identify potential noncompliance.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should link audit data on abusive tax schemes involving tax-exempt entities across operating divisions and use the linked data to assess emerging issues and develop policy responses. (Recommendation 2) |

IRS partially agreed with this recommendation. In responding to it, IRS said that it determined its systems are not programmed to accept national project codes. The IRS unit in charge of tax-exempt entity audits, the Tax Exempt and Government Entities division (TE/GE), assigns its own project codes and does not use the national codes that could link data across audit divisions. However, TE/GE in May 2021 devised a workaround to create a shared inventory listing of abusive tax-scheme cases pertinent to other audit divisions. Specifically, TE/GE manually updates audit database codes allowing other divisions to monitor shared inventory. In addition, IRS said TE/GE works routinely with other audit divisions and the Office of Research, Applied Analytics and Statistics to link and share audit data for compliance policy responses. IRS cited TE/GE's data-sharing efforts as contributing to current initiatives on high-wealth individuals' noncompliance, inappropriate Form 1040 Schedule C deductions, and an audit strategy approved in 2021 involving certain tax-exempt organizations. Because IRS's workaround and other information sharing efforts resulted in exposing different audit programs to tax-exempt entity audit data and helped develop audit policy responses, GAO considers this recommendation implemented. By better assuring enforcement on tax-exempt entities data are available across divisions, IRS is better positioned to formulate overall audit policy and is better able to combat abusive tax schemes involving tax-exempt entities.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should test the ability of the Return Inventory Classification System to facilitate analysis and monitoring of audit data across the operating divisions and to support the IRS's enforcement objectives. (Recommendation 3) |

The Internal Revenue Service (IRS) agreed with GAO's September 2019 recommendation and has taken steps to implement it. As of December 2021, IRS said it had held cross-business unit meetings to determine what data it can share among its audit divisions. IRS's Office of Research, Applied Analytics and Statistics was working on determining how to link audit data across divisions. Furthermore, the Tax Exempt/Government Entities division, which has audit responsibility over tax-exempt entities, was developing a cost estimate to determine if RICS can be used to link data across divisions. IRS expected to complete these efforts in 2022, and it was continuing its efforts as of May 2023. As of January 2025, IRS had not provided an update on additional actions it planned. Successfully completing these actions will improve IRS's ability to detect abusive tax schemes using existing data and improve compliance. GAO will continue to monitor IRS's progress.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should use existing data analytic tools to further mine Form 8886 and Form 8918 data, which could be used to find audit leads on tax-exempt entity involvement in potentially abusive tax schemes. (Recommendation 4) |

The Internal Revenue Service (IRS) agreed with GAO's September 2019 recommendation. In response, IRS further studied noncompliance related to Form 8886-T, Reportable Transaction Disclosure Statement, and Form 990, Return of Organization Exempt from Income Tax. Ultimately, in May 2025, IRS said it did not find sufficient evidence to keep developing specific tools for assessing Form 8886-T filings. IRS's Tax Exempt and Government Entities division (TE/GE) also said that it did not find sufficient evidence of noncompliance to warrant additional studies of Form 8918, Material Adviser Disclosure Statement. In lieu of developing new tools, IRS has taken other actions to enhance oversight of potential abusive schemes involving tax-exempt entities. In May 2025 and in June 2024, IRS issued new Internal Revenue Manual guidance to formalized information sharing between the Office of Tax Shelter Analysis (OTSA) and Tax-Exempt & Government Entities Division (TE/GE). TE/GE also now receives Form 8886-T data from OTSA that ties TE/GE returns to associated shelter schemes. While IRS did not develop the tools we suggested, its actions to increase use of the disclosure forms and identify potential abusive tax schemes involving tax-exempt entities fulfill the spirit of the recommendation. Because of these changes, IRS has enhanced its capability to identify and combat abusive tax schemes that involve tax-exempt entities.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should develop guidance to help managers ensure referrals about abusive schemes involving tax-exempt entities are made across operating divisions. This could be accomplished by, for example, adopting specific guidance for audit managers to look for referral accuracy in their reviews of case closings. (Recommendation 5) |

IRS agreed with GAO's September 2019 recommendation and took action to update the Internal Revenue Manual (IRM) to ensure managers review auditors' work and identify referrals that should have been made during case closings; and specifically direct managers to assess whether auditors correctly identified referrals involving abusive tax schemes. In September 2019, the Tax-Exempt/Government Entities (TE/GE) division updated its IRM guidance including when to prepare a referral and a link to additional instructions on how to complete the referral form. In January 2021, IRS also shared a training video with step-by-step instructions for making a referral to TE/GE. In January 2021, the Small Business and Self-Employed (SB/SE) division updated its IRM guidance with referral preparation instructions and specifically states that the SB/SE manager should ensure appropriate cases are referred to TE/GE. In September 2021, the Large Business and International (LB&I) division added IRM guidance with similar instructions on preparing a referral and specific direction that the case manager should ensure the case is referred to TE/GE. SB/SE and LB&I sent division-wide emails alerting their employees about the updated referral guidance. By improving its guidance and manager reviews of referrals, IRS has reduced the risk of the responsible divisions not reviewing audit cases that they should review and overlooking noncompliance of tax schemes involving tax-exempt entities.

|