Private Student Loans: Clarification from CFPB Could Help Ensure More Consistent Opportunities and Treatment for Borrowers

Fast Facts

In May 2018, the Fair Credit Reporting Act was amended to allow some financial institutions—including banks—to voluntarily offer rehabilitation programs for borrowers who default on private student loans.

Borrowers who complete these programs can request to have the default removed from their credit reports, which could slightly improve their access to credit. Other financial institutions are also interested in offering these programs, but are not certain of their authority to do so.

We recommended that the Consumer Financial Protection Bureau clarify which types of financial institutions have the authority to implement these programs.

Cap, gown, cash.

Highlights

What GAO Found

The five largest banks that provide private student loans—student loans that are not guaranteed by the federal government—told GAO that they do not offer private student loan rehabilitation programs because few private student loan borrowers are in default, and because they already offer existing repayment programs to assist distressed borrowers. (Loan rehabilitation programs described in the Economic Growth, Regulatory Relief, and Consumer Protection Act (the Act) enable financial institutions to remove reported defaults from credit reports after borrowers make a number of consecutive, on-time payments.) Some nonbank private student loan lenders offer rehabilitation programs, but others do not, because they believe the Act does not authorize them to do so. Clarification of this matter by the Consumer Financial Protection Bureau (CFPB)—which oversees credit reporting and nonbank lenders—could enable more borrowers to participate in these programs or ensure that only eligible entities offer them.

Private student loan rehabilitation programs are expected to pose minimal additional risks to financial institutions. Private student loans compose a small portion of most banks' portfolios and have consistently low default rates. Banks mitigate credit risks by requiring cosigners for almost all private student loans. Rehabilitation programs are also unlikely to affect financial institutions' ability to make sound lending decisions, in part because the programs leave some derogatory credit information—such as delinquencies leading to the default—in the credit reports.

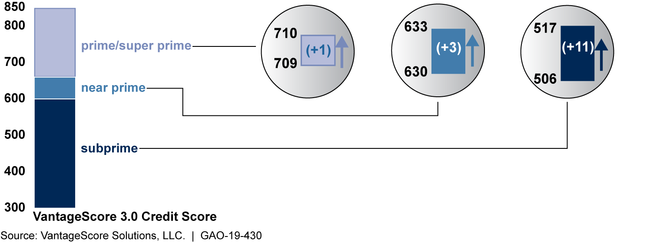

Borrowers completing private student loan rehabilitation programs would likely experience minimal improvement in their access to credit. Removing a student loan default from a credit profile would increase the borrower's credit score by only about 8 points, on average, according to a simulation that a credit scoring firm conducted for GAO. The effect of removing the default was greater for borrowers with lower credit scores and smaller for borrowers with higher credit scores (see figure). Reasons that removing a student loan default could have little effect on a credit score include that the delinquencies leading to that default—which also negatively affect credit scores—remain in the credit report and borrowers in default may already have poor credit.

Simulated Effects of Removing a Student Loan Default from Borrowers' Credit Reports

Note: A VantageScore 3.0 credit score models a borrower's credit risk based on elements such as payment history and amounts owed on credit accounts. The scores calculated represent a continuum of credit risk from subprime (highest risk) to super prime (lowest risk).

Why GAO Did This Study

The Economic Growth, Regulatory Relief, and Consumer Protection Act enabled lenders to offer a rehabilitation program to private student loan borrowers who have a reported default on their credit report. The lender may remove the reported default from credit reports if the borrower meets certain conditions. Congress included a provision in statute for GAO to review the implementation and effects of these programs.

This report examines (1) the factors affecting financial institutions' participation in private student loan rehabilitation programs, (2) the risks the programs may pose to financial institutions, and (3) the effects the programs may have on student loan borrowers' access to credit. GAO reviewed applicable statutes and agency guidance. GAO also asked a credit scoring firm to simulate the effect on borrowers' credit scores of removing student loan defaults. GAO also interviewed representatives of regulators, some of the largest private student loan lenders, other credit providers, credit bureaus, credit scoring firms, and industry and consumer advocacy organizations.

Recommendations

GAO is making two recommendations, including that CFPB provide written clarification to nonbank private student loan lenders on their authority to offer private student loan rehabilitation programs. CFPB does not plan to take action on this recommendation and stated that it was premature to take action on the second recommendation. GAO maintains that both recommendations are valid, as discussed in this report.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Consumer Financial Protection Bureau | The Director of CFPB should provide written clarification to nonbank private student loan lenders on their authorities under the Fair Credit Reporting Act to offer private student loan rehabilitation programs that include removing information from credit reports. (Recommendation 1) |

In April 2025, CFPB reported that they consider this recommendation closed and do not intend to take additional actions to close this recommendation. However, we believe the recommendation remains valid and will continue to follow up and update the status as appropriate.

|

| Consumer Financial Protection Bureau | The Director of CFPB, after consulting with the prudential regulators and relevant industry groups, should provide written clarification on what information in a consumer's credit report constitutes a private student loan reported "default" that may be removed after successful completion of a private student loan rehabilitation program. (Recommendation 2) |

CFPB was involved in a process led by the Consumer Data Industry Association (CDIA) to revise credit reporting guidelines for private student loan lenders. In mid-2020, CDIA issued revised guidelines which included new standards to use for the reporting of rehabilitated private student loans. The revised guidelines provide a consistent approach for all lenders and servicers to report the status of rehabilitated private student loans. CDIA developed the revised guidelines with significant collaboration from CFPB, the Department of Education, and student loan lending trade associations. The issuance of the revised credit reporting guidelines for private student loan rehabilitations, and CFPB's involvement in it, are consistent with our recommendation and address our concern that differences in how private student loan lenders were reporting information on rehabilitated private student loans could lead to varying effects on borrowers' credit scores and credit records.

|