The Nation's Fiscal Health: Action Is Needed to Address the Federal Government's Fiscal Future

Fast Facts

This report provides an update on the nation's fiscal health as of the end of FY 2018, and describes its likely fiscal future if policies don’t change.

Among its findings:

The federal government’s current fiscal path is unsustainable

The federal deficit increased to $779 billion—and will reach $1 trillion in the next few years for the first time since 2012

Publicly held debt was 78% of GDP at the end of FY 2018 and will surpass its historical high of 106% within 13 to 20 years—sooner than projected last year

Other agencies join GAO in saying that the longer action is delayed, the greater and more drastic the changes will have to be

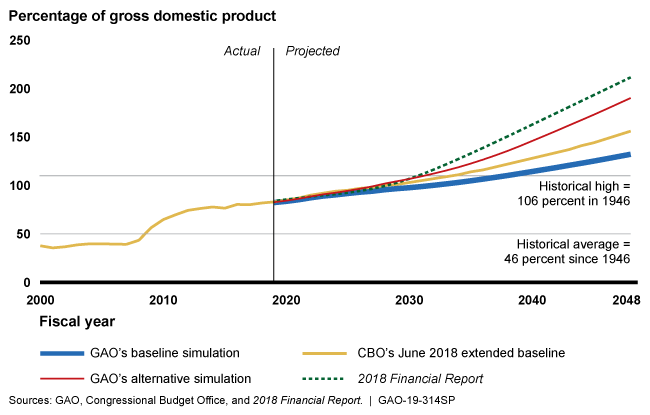

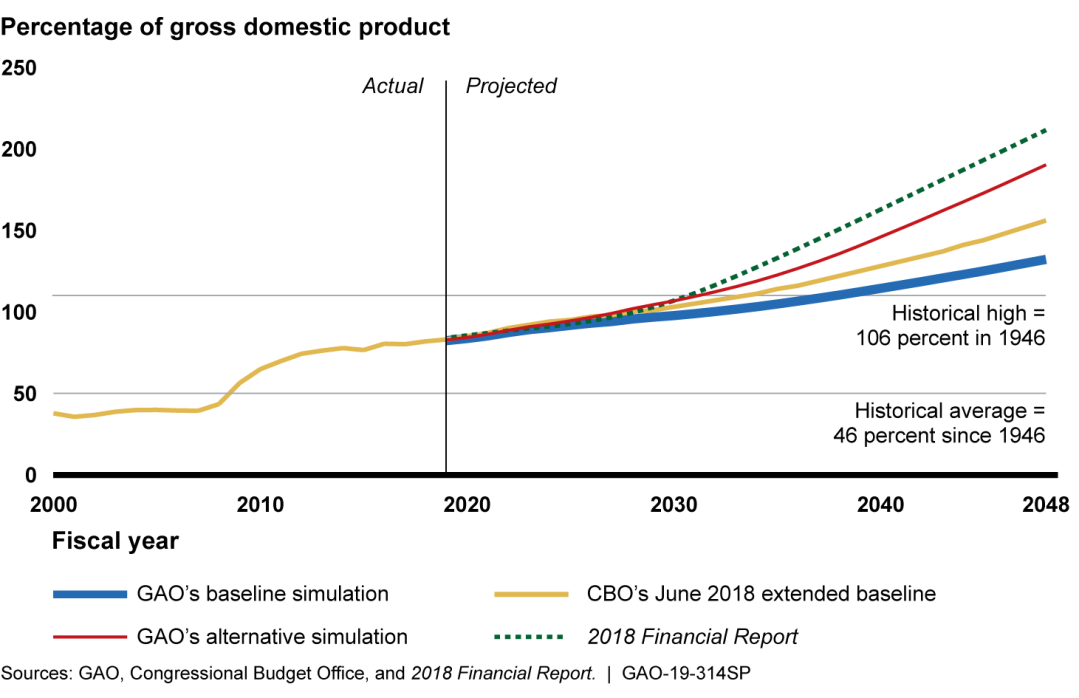

The 2018 Financial Report, the Congressional Budget Office, and GAO all project that federal debt held by the public will continue to grow unsustainably into the future.

Graphic shows 4 projections of debt increasing

Highlights

Congress and the administration face serious economic, security, and social challenges that will require difficult policy choices in the near term in setting national priorities and chartering a path forward for economic growth. This will influence the level of federal spending and how the government obtains needed resources. At the same time, the federal government is highly leveraged in debt by historical norms.

A broad plan is needed to put the federal government on a sustainable long-term fiscal path. This report describes the fiscal condition of the U.S. government as of the end of fiscal year 2018 and its future unsustainable fiscal path absent policy changes. It draws on the Fiscal Year 2018 Financial Report of the United States Government (2018 Financial Report) and GAO’s audit of the government’s consolidated financial statements.

Significant Changes to the Government’s Fiscal Conditionin Fiscal Year 2018

According to the 2018 Financial Report, the federal deficit in fiscal year 2018 increased to $779 billion—up from $666 billion in fiscal year 2017. Federal receipts increased by $14 billion, but that was outweighed by a $127 billion increase in spending driven by, among other things, increases in defense, interest on debt held by the public (net interest), Social Security, Medicaid, and disaster relief and flood insurance. Debt held by the public increased from 76 percent of gross domestic product (GDP) at the end of fiscal year 2017 to 78 percent of GDP at the end of fiscal year 2018. By comparison, debt has averaged 46 percent of GDP since 1946.

Long-Term Fiscal Projections Show the Federal Government is on an Unsustainable Fiscal Path

The 2018 Financial Report, the Congressional Budget Office (CBO), and GAO projections all show that, absent policy changes, the federal government’s fiscal path is unsustainable and that the debt-to-GDP ratio would surpass its historical high of 106 percent within 13 to 20 years (see figure).

Importance of Early Action:

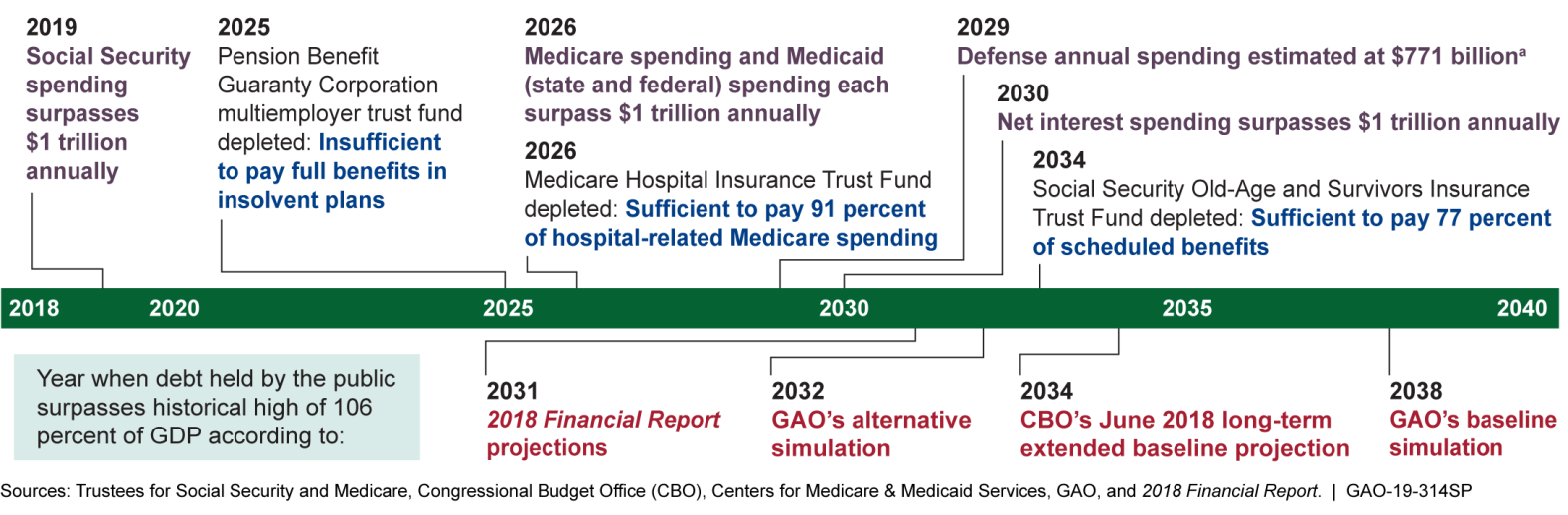

The 2018 Financial Report, CBO, and GAO state that the longer action is delayed, the greater and more drastic the changes will have to be. As shown below, major programs are projected to face financial challenges in the future.

aCBO did not report defense spending projections separately from total discretionary spending in its long-term projections after 2029.

Debt Limit is Not a Control on Debt: Alternative Approach Is Needed:

At the time of this report, Treasury is taking extraordinary actions to continue funding government activities since the debt limit suspension period ended on March 1, 2019. Failure to increase or suspend the debt limit in a timely manner disrupts the Treasury market and can increase borrowing costs. GAO has recommended possible alternative approaches to the current debt limit. Congress could consider these suggestions as part of a broader plan to put the government on a sustainable fiscal path.

Fiscal Risks Place Additional Pressure on the Federal Budget

Fiscal risks are responsibilities, programs, and activities that may legally commit or create expectations for future spending based on current policy, past practices, or other factors. These include risks stemming from unforeseen events to which the public expects a federal fiscal response, such as natural disasters and financial challenges.

Executive Agencies Have Opportunities to Contribute Toward Fiscal Health

Executive actions alone cannot put the U.S. government on a sustainable fiscal path, but it is important for agencies toact as stewards of federal resources. In prior work, GAO has identified numerous actions for executive agencies to contribute toward a more sustainable fiscal future.

- Actions needed to address improper payments: Reducing payments that should not have been made or that were made in an incorrect amount could yield significant savings. Reported improper payment estimates totaled about $151 billion for fiscal year 2018. Since fiscal year 2003, cumulative estimates have totaled about $1.5 trillion.

- Multiple strategies needed to address persistent tax gap: Reducing the gap between taxes owed and those paid could increase tax collections by billions annually. The average annual net tax gap is estimated to be $406 billion (for tax years 2008-2010).

- Continue to address duplication, overlap, and fragmentation: GAO has identified numerous areas to reduce, eliminate, or better manage fragmentation, overlap, or duplication; achieve cost savings; or enhance revenue. Actions taken so far by Congress and the executive branch have resulted in achieved and projected financial benefits of roughly $178 billion since fiscal year 2010.

- Action needed to improve information on programs and fiscal operations: Decision-making could be improved by ensuring the government’s financial statements are fully auditable and by increasing attention to tax expenditures—tax provisions that reduce tax liabilities. Estimated to collectively reduce tax revenue by over $1 trillion in fiscal year 2018, tax expenditures are not regularly reviewed and their outcomes are not measured as closely as spending programs’ outcomes.

For more information, contact Susan J. Irving at (202) 512-6806 or irvings@gao.gov.