Securities Regulation: SEC Inspections of Financial Industry Regulatory Authority's Governance Were Consistent with Internal Guidance

Highlights

What GAO Found

Since fiscal year 2015, Securities and Exchange Commission (SEC) examinations of the Financial Industry Regulatory Authority, Inc. (FINRA) covered each of the 10 areas specified in Section 964 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act), such as governance, funding, and transparency. The most commonly covered area was FINRA examinations of its members.

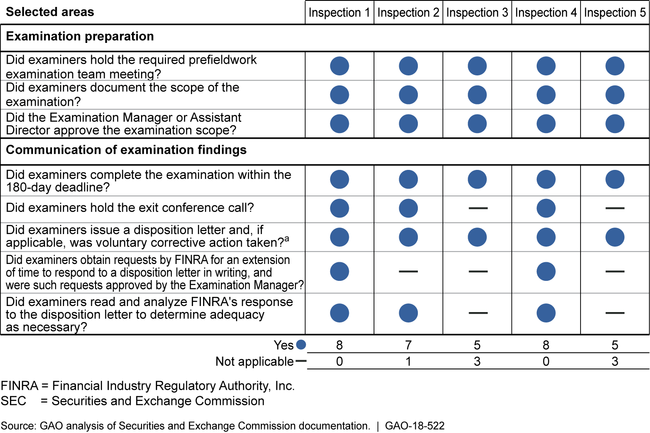

Selected SEC guidance used to examine FINRA, including requirements for planning, prefieldwork scoping, and communicating findings, was consistent with generally accepted government auditing standards, and SEC inspections of FINRA were consistent with SEC's guidance. The five governance-related inspections of FINRA that GAO reviewed were consistent with SEC guidance for planning examinations and communicating findings (see fig.). Not all the requirements were applicable (because in certain instances completion of one requirement eliminated the need to satisfy others).

Figure: Extent to Which SEC Followed Its Requirements for Five Governance-Related Inspections It Performed of FINRA, Fiscal Years 2015–2017

Note: The inspections evaluated the following FINRA areas: code of conduct, executive and employee compensation practices, investment portfolio, compliance resource provider, and funding for regulatory service agreements. Certain selected areas are not applicable because completion of one requirement eliminated the need to satisfy others. For instance, one inspection did not have material findings and therefore examiners did not need to hold an exit conference call.

aA disposition letter represents a deficiency, no-further-action, unresolved issue, or close-out letter.

Why GAO Did This Study

The securities industry is generally regulated by a combination of federal and industry oversight. FINRA, a self-regulatory organization, is responsible for regulating securities firms doing business with the public in the United States. SEC oversees FINRA's operations and programs.

Section 964 of the Dodd-Frank Act includes a provision for GAO, following an initial report, to triennially review and report on aspects of SEC's oversight of FINRA. GAO issued its first report in May 2012 (GAO-12-625) and its second report in April 2015 (GAO-15-376).

This report (1) determines if SEC's oversight of FINRA included the 10 areas specified in Section 964 of the Dodd-Frank Act and (2) evaluates the extent to which selected SEC internal guidance for examinations of FINRA follows generally accepted government auditing standards and the extent to which SEC's examinations of FINRA's governance practices followed SEC internal guidance. GAO reviewed all SEC examinations relating to a Section 964 area completed since fiscal year 2015 (including five that were governance-related), reviewed certain SEC procedures used to examine self-regulatory organizations against Government Auditing Standards, and compared completed inspections against SEC guidance. GAO also interviewed SEC and FINRA staff.

Recommendations

GAO is not making any recommendations. SEC agreed with GAO's findings.