Solid Rocket Motors: DOD and Industry Are Addressing Challenges to Minimize Supply Concerns

Fast Facts

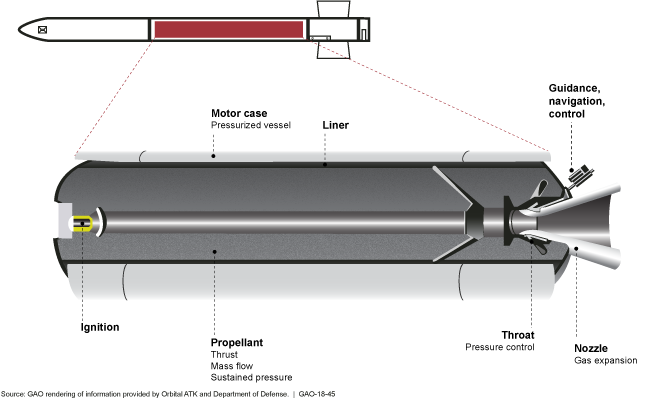

Solid rocket motor (SRM) propulsion systems play an important role in the nation's defense. Using a solid propellant that expels hot gases when combusted, SRMs provide the thrust behind a variety of DOD's missiles—from short-range tactical missiles to longer-range strategic ones.

But the industrial base for SRMs has shifted. U.S. manufacturers have consolidated, and foreign-owned manufacturers have entered the market. According to one estimate, the number of suppliers of raw materials, components, and sub-systems fell from 5,000 to 1,000 over the last 20 years. In this report, we examine SRM trends, risks, and opportunities.

Simplified Illustration of a Solid Rocket Motor

Illustration of a solid rocket motor.

Highlights

What GAO Found

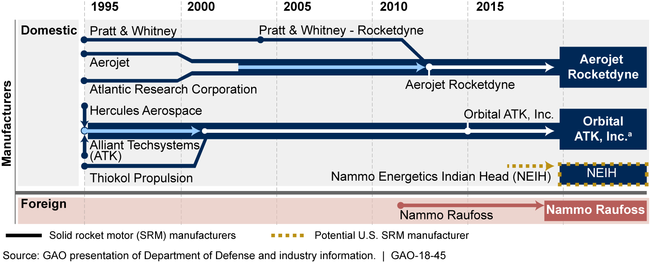

Over the past two decades, the solid rocket motor (SRM) industrial base has undergone various changes including consolidation and recent expansion. Specifically, since 1995, the industry has consolidated from six U.S. manufacturers to two U.S. manufacturers. With regard to expansion, a foreign supplier entered the market in 2012, and in 2017, a U.S. firm, which is ultimately foreign-owned, was also established. According to the Department of Defense (DOD) while it supports competition, its current demand for SRMs can only sustain two manufacturers. Although at this stage it is too early to know how, or if, these new entrants will impact the economic viability of the more long-standing U.S. manufacturers.

Industry Trends of Solid Rocket Motor Manufacturers since 1995

aIn September 2017, Northrup Grumman announced plans to acquire Orbital ATK, Inc.

The consolidation in the SRM industrial base has also been accompanied by a decrease of suppliers throughout the supply chain. For example, one SRM manufacturer estimated a decrease in suppliers, from approximately 5,000 to 1,000, over the last 20 years. This increases the risk of production delays and disruptions in the event that key components and materials available from a single source become unavailable from that source. GAO found that DOD and industry are taking steps to identify and mitigate these risks, such as by establishing alternative sources and requiring advance notice when suppliers are considering exiting the market.

In its annual industrial capabilities reports to Congress, DOD has consistently stated that the limited number of new missile development programs inhibits its ability to provide opportunities to help SRM manufacturers maintain their workforce capabilities. Specifically, with few new missile programs being initiated, engineers have had fewer opportunities to develop their engineering skills related to SRM concept designs, system development, and production, which are critical if SRM performance issues arise. However, in 2016, DOD funded a 4-year project to enhance engineering design skills for less experienced engineers working for the two U.S. manufacturers and help them develop advanced SRM technologies.

Why GAO Did This Study

DOD relies on a multi-tiered supply chain to provide SRMs, the propulsion systems behind the various missile systems that provide defense capabilities to meet U.S. national security objectives. The SRM industrial base includes manufacturers that turn to an extensive network of suppliers that provide the raw materials, components, and subsystems needed to build SRMs. DOD is responsible for developing a strategy for the national industrial base that ensures that defense contractors and their suppliers are capable of providing the goods and services needed to achieve national security objectives.

GAO was asked to review the state of the U.S. industrial base for SRMs. This report addresses (1) SRM industry trends, (2) single source supplier risks, and (3) opportunities for SRM manufacturers' engineering workforce development. GAO analyzed DOD's annual industrial capabilities reports to Congress for fiscal years 2009 through 2016, which reflect DOD's most current information on SRM risks, and reviewed DOD budget data and information from missile prime contractors and SRM manufacturers. GAO also interviewed missile prime contractors, SRM manufacturer representatives, and officials from DOD and the military departments.

Recommendations

GAO is not making recommendations at this time.