Remittances to Fragile Countries: Treasury Should Assess Risks from Shifts to Non-Banking Channels

Fast Facts

People who send money from the United States to their families—especially to those in poor countries—see these "remittances" as a lifeline. However, remittances and other global payments can be used to hide money laundering and other financial crimes.

Money transfer companies have used banks to transfer money worldwide. But some banks want to limit their exposure to the risk of financial crimes, and refuse or restrict transfer companies' accounts.

Now, some transfer companies are bypassing the bank by taking cash over borders. We recommended that Treasury assess the risks of these transfers, which are harder to monitor for criminal activity.

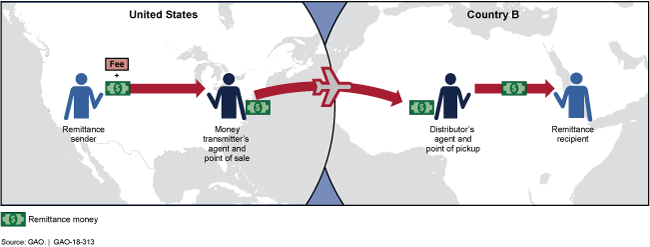

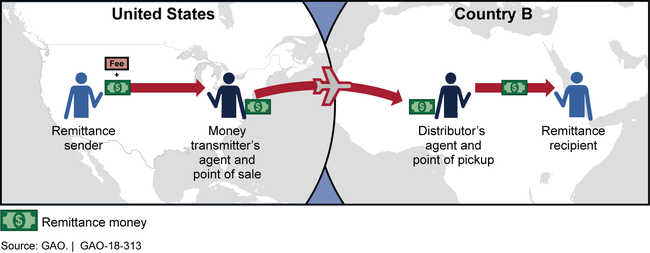

Example of Remittance Transfer Using a Cash Courier

Diagram of a cash-to-cash transfer, showing the money's path across borders to the recipient.

Highlights

What GAO Found

Stakeholders, including money transmitters, banks, and U.S. Department of the Treasury (Treasury) officials, reported a loss of banking access for money transmitters as a key challenge, although remittances continue to flow to selected fragile countries. All 12 of the money transmitters GAO interviewed, which served Haiti, Liberia, Nepal, and particularly Somalia, reported losing some banking relationships during the last 10 years. As a result, 9 of the 12 money transmitters reported using channels outside the banking system (hereafter referred to as non-banking channels), such as cash couriers, to move funds domestically or, in the case of Somalia, for cross-border transfer of remittances (see figure). Several banks reported that they had closed the accounts of money transmitters because of the high cost of due diligence actions they considered necessary to minimize the risk of fines under Bank Secrecy Act regulations. Treasury officials noted that despite some money transmitters losing bank accounts, they see no evidence that the volume of remittances is falling.

Example of a Cash-to-Cash Remittance Transfer Using a Cash Courier

U.S. agencies have taken steps that may mitigate money transmitters' loss of banking access. For example, several agencies have issued guidance to clarify expectations for providing banking services to money transmitters. In addition, Treasury is implementing projects to strengthen financial institutions in some fragile countries. However, U.S. agencies disagreed with other suggestions, such as immunity from enforcement actions for banks serving money transmitters, since those actions could adversely affect goals related to preventing money laundering and terrorism financing.

Treasury cannot assess the effects of money transmitters' loss of banking access on remittance flows because existing data do not allow Treasury to identify remittances transferred through banking and non-banking channels. Remittance data that U.S. agencies collect from banks do not include transfers that banks make on behalf of money transmitters. Additionally, the information Treasury collects on transportation of cash from U.S. ports of exit does not identify remittances sent as cash. Therefore, Treasury cannot assess the extent to which money transmitters are shifting from banking to non-banking channels to transfer funds due to loss of banking access. Non-banking channels are generally less transparent than banking channels and thus more susceptible to the risk of money laundering and terrorism financing.

Why GAO Did This Study

The United States is the largest source of remittances, with an estimated $67 billion sent globally in 2016, according to the World Bank. Many individuals send remittances through money transmitters, a type of business that facilitates global money transfers. Recent reports found that some money transmitters have lost access to banking services due to derisking—the practice of banks restricting services to customers to, in part, avoid perceived regulatory concerns about facilitating criminal activity.

GAO was asked to review the possible effects of derisking on remittances to fragile countries. This report examines (1) what stakeholders believe are the challenges facing money transmitters in remitting funds from the United States to selected fragile countries, (2) actions U.S. agencies have taken to address identified challenges, and (3) U.S. efforts to assess the effects of such challenges on remittance flows to fragile countries. GAO selected four case-study countries—Haiti, Liberia, Nepal, and Somalia—based on factors including the large size of U.S. remittance flows to them. GAO interviewed U.S.-based money transmitters, banks, U.S. agencies, and individuals remitting to these countries and also surveyed banks.

Recommendations

Treasury should assess the extent to which shifts in remittance flows to non-banking channels for fragile countries may affect Treasury's ability to monitor for financial crimes and, if necessary, should identify corrective actions. GAO requested comments from Treasury on the recommendation, but none were provided.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Treasury | The Secretary of Treasury should assess the extent to which shifts in remittance flows from banking to non-banking channels for fragile countries may affect Treasury's ability to monitor for money laundering and terrorist financing and, if necessary, should identify corrective actions. |

Although Treasury did not comment on the report or recommendation, Treasury reported that the use of non-banking channels, such as bulk transfers via courier, raises a number of concerns. Treasury conducted a study that found remittances moving to Somalia through non-banking channels were still subject to Bank Secrecy Act and USA PATRIOT Act requirements, because money transmitters transferring these funds are required to register with Treasury's Financial Crimes Enforcement Network, implement an anti-money laundering program, and comply with various record-keeping and reporting requirements. Treasury officials noted that they lose visibility over transfers through both non-banking channels and banking channels upon arrival at foreign exchange houses. In addition, U.S. officials have engaged Somali government officials to facilitate the exchange of information, including on suspected terrorist organization accounts, in order to help monitor for possible illicit financial activity. In August 2018, as a result of this analysis, Treasury concluded that it had access to data that enabled it to monitor remittance flows through non-banking channels to detect possible illicit activity to approximately the same extent as through banking channels. Therefore, Treasury concluded no corrective action was necessary.

|