Bank Secrecy Act: Derisking along the Southwest Border Highlights Need for Regulators to Enhance Retrospective Reviews

Highlights

What GAO Found

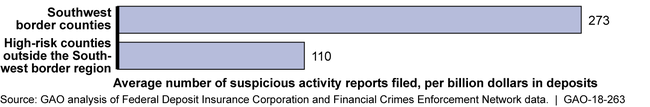

“Derisking” is the practice of banks limiting certain services or ending their relationships with customers to, among other things, avoid perceived regulatory concerns about facilitating money laundering. The Southwest border region is a high-risk area for money laundering activity, in part, because of a high volume of cash and cross-border transactions, according to bank representatives and others. These types of transactions may create challenges for Southwest border banks in complying with Bank Secrecy Act/anti-money laundering (BSA/AML) requirements because they can lead to more intensive account monitoring and investigation of suspicious activity. GAO found that, in 2016, bank branches in the Southwest border region filed 2-1/2 times as many reports identifying potential money laundering or other suspicious activity (Suspicious Activity Reports), on average, as bank branches in other high-risk counties outside the region (see figure).

Average Number of Suspicious Activity Reports Filed, 2016.

According to GAO's survey, an estimated 80 percent (+/- 11 percent margin of error) of Southwest border banks terminated accounts for BSA/AML risk reasons. Further, according to the survey, an estimated 80 percent (+/- 11) limited or did not offer accounts to customers that are considered high risk for money laundering because the customers drew heightened regulatory oversight—behavior that could indicate derisking. Counties in the Southwest border region have been losing bank branches since 2012, similar to national and regional trends. Nationally, GAO's econometric analysis generally found that counties that were urban, younger, had higher income or had higher money laundering-related risk were more likely to lose branches. Money laundering-related risks were likely to have been relatively more important drivers of branch closures in the Southwest border region.

Regulators have not fully assessed the BSA/AML factors influencing banks to derisk. Executive orders and legislation task the Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) and the federal banking regulators with reviewing existing regulations through retrospective reviews to determine whether they should be retained or amended, among other things. FinCEN and federal banking regulators have conducted retrospective reviews of parts of BSA/AML regulations. The reviews, however, have not evaluated how banks' BSA/AML regulatory concerns may influence them to derisk or close branches. GAO's findings indicate that banks do consider BSA/AML regulatory concerns in providing services. Without assessing the full range of BSA/AML factors that may be influencing banks to derisk or close branches, FinCEN, the federal banking regulators, and Congress do not have the information needed to determine if BSA/AML regulations and their implementation can be made more effective or less burdensome.

Why GAO Did This Study

Some Southwest border residents and businesses have reported difficulties accessing banking services in the region. GAO was asked to review if Southwest border residents and businesses were losing access to banking services because of derisking and branch closures.

This report (1) describes the types of heightened BSA/AML compliance risks that Southwest border banks may face and the BSA/AML compliance challenges they may experience; (2) determines the extent to which banks have terminated accounts and closed branches in the region and the reasons for any terminations and closures; and (3) evaluates how regulators have assessed and responded to concerns about derisking in the region and elsewhere, and how effective their efforts have been; among other objectives. GAO surveyed a nationally representative sample of 406 banks, which included the 115 banks that operate in the Southwest border region; analyzed Suspicious Activity Report filings; developed an econometric model on the drivers of branch closures; and interviewed banks that operate in the region.

Recommendations

GAO recommends that FinCEN and the federal banking regulators conduct a retrospective review of BSA regulations and their implementation for banks. The review should focus on how banks' regulatory concerns may be influencing their willingness to provide services. The federal banking regulators agreed to the recommendation. FinCEN did not provide written comments.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Financial Crimes Enforcement Network |

Priority Rec.

The Director of FinCEN should jointly conduct a retrospective review of BSA/AML regulations and their implementation for banks with Federal Deposit Insurance Corporation (FDIC), the Federal Reserve, and Office of the Comptroller of the Currency (OCC). This review should focus on how banks' regulatory concerns may be influencing their willingness to provide services. In conducting the review, the FDIC, the Federal Reserve, OCC, and FinCEN should take steps, as appropriate, to revise the BSA regulations or the way they are being implemented to help ensure that BSA/AML regulatory objectives are being met in the most effective and least burdensome way. (Recommendation 1) |

FinCEN identified several actions it took that it believes are responsive to our recommendation. In 2018, FinCEN convened a working group with the Federal Reserve, OCC, FDIC, the National Credit Union Administration, and the Office of Terrorism and Financial Intelligence to identify ways to improve the efficiency and effectiveness of BSA/AML regulations, supervision, and examinations. FinCEN staff cited several recent interagency joint statements that resulted from the activities of the working group as examples of the working group's outcomes. The first, issued in October 2018, clarified the permissibility of sharing BSA resources among institutions with lower risk profiles to increase efficiency and reduce burden. The second, issued in December 2018, encouraged innovative industry approaches by banks to enhance the efficiency and effectiveness of their BSA/AML compliance programs. The third, issued in July 2019, highlighted that the extent of examination activities necessary to evaluate a bank's BSA/AML compliance program generally depends on the risk profile of the bank and the quality of processes implemented by the bank to identify, measure, monitor, and control risk and to report potential money laundering, terrorist financing, and other illicit financial activity. In April 2020, the Federal Financial Institutions Examination Council, of which FinCEN is a member, issued revisions to the BSA/AML examination manual to enhance the risk-focused approach to BSA/AML supervision. Finally, FinCEN conducted the BSA Value Project. A key objective of the project is to provide a comprehensive and quantitative understanding of the broad value of BSA reporting and other BSA information. The results will be used to make use of BSA data more effective and its collection of BSA data more efficient and to assess how potential regulatory and compliance changes being considered with its government partners will affect BSA reporting. Taken together, these actions meet the intent of our recommendation that FinCEN jointly conduct a retrospective review of BSA/AML regulations and their implementation for banks with OCC, the Federal Reserve, and FDIC, including how banks' regulatory concerns may be influencing their willingness to provide services. Further, we believe the outcomes of these actions are consistent with our recommendation that the results of this review be used to revise the BSA regulations or the way they are being implemented to help ensure that BSA/AML regulatory objectives are being met in the most effective and least burdensome way.

|

| Federal Deposit Insurance Corporation |

Priority Rec.

The Chairman of FDIC should jointly conduct a retrospective review of BSA/AML regulations and their implementation for banks with the Federal Reserve, OCC, and FinCEN. This review should focus on how banks' regulatory concerns may be influencing their willingness to provide services. In conducting the review, FDIC, the Federal Reserve, OCC, and FinCEN should take steps, as appropriate, to revise the BSA regulations or the way they are being implemented to help ensure that BSA/AML regulatory objectives are being met in the most effective and least burdensome way. (Recommendation 2) |

FDIC identified several actions it took that it believes are responsive to our recommendation. In 2018, FDIC convened a working group with the Federal Reserve, OCC, FinCEN, the National Credit Union Administration, and the Office of Terrorism and Financial Intelligence to identify ways to improve the efficiency and effectiveness of BSA/AML regulations, supervision, and examinations. FDIC staff cited several recent interagency joint statements that resulted from the activities of the working group as examples of the working group's outcomes. The first, issued in October 2018, clarified the permissibility of sharing BSA resources among institutions with lower risk profiles to increase efficiency and reduce burden. The second, issued in December 2018, encouraged innovative industry approaches by banks to enhance the efficiency and effectiveness of their BSA/AML compliance programs. The third, issued in July 2019, highlighted that the extent of examination activities necessary to evaluate a bank's BSA/AML compliance program generally depends on the risk profile of the bank and the quality of processes implemented by the bank to identify, measure, monitor, and control risk and to report potential money laundering, terrorist financing, and other illicit financial activity. Additionally, in February 2019, FDIC implemented a new examination tool intended to better define complexity within depository institutions for more efficient staffing assignments, and to improve the examination process. In April 2020, the Federal Financial Institutions Examination Council, of which FDIC is a member, issued revisions to the BSA/AML examination manual to enhance the risk-focused approach to BSA/AML supervision. Finally, FDIC participated in FinCEN's BSA Value Project as a regulatory stakeholder. A key objective is to provide a comprehensive and quantitative understanding of the broad value of BSA reporting and other BSA information. The results will be used to make use of BSA data more effective and its collection of BSA data more efficient and to assess how potential regulatory and compliance changes being considered with its government partners will affect BSA reporting. Taken together, these actions meet the intent of our recommendation that FDIC jointly conduct a retrospective review of BSA/AML regulations and their implementation for banks with OCC, the Federal Reserve, and FinCEN, including how banks' regulatory concerns may be influencing their willingness to provide services. Further, we believe the outcomes of these actions are consistent with our recommendation that the results of this review be used to revise the BSA regulations or the way they are being implemented to help ensure that BSA/AML regulatory objectives are being met in the most effective and least burdensome way.

|

| Federal Reserve System |

Priority Rec.

The Chair of the Federal Reserve should jointly conduct a retrospective review of BSA/AML regulations and their implementation for banks with FDIC, OCC, and FinCEN. This review should focus on how banks' regulatory concerns may be influencing their willingness to provide services. In conducting the review, FDIC, the Federal Reserve, OCC, and FinCEN should take steps, as appropriate, to revise the BSA regulations or the way they are being implemented to help ensure that BSA/AML regulatory objectives are being met in the most effective and least burdensome way. (Recommendation 3) |

The Federal Reserve identified several actions it took that it believes are responsive to our recommendation. In 2018, the Federal Reserve convened a working group with FDIC, OCC, FinCEN, the National Credit Union Administration, and the Office of Terrorism and Financial Intelligence to identify ways to improve the efficiency and effectiveness of BSA/AML regulations, supervision, and examinations. Federal Reserve staff cited several recent interagency joint statements that resulted from the activities of the working group as examples of the working group's outcomes. The first, issued in October 2018, clarified the permissibility of sharing BSA resources among institutions with lower risk profiles to increase efficiency and reduce burden. The second, issued in December 2018, encouraged innovative industry approaches by banks to enhance the efficiency and effectiveness of their BSA/AML compliance programs. The third, issued in July 2019, highlighted that the extent of examination activities necessary to evaluate a bank's BSA/AML compliance program generally depends on the risk profile of the bank and the quality of processes implemented by the bank to identify, measure, monitor, and control risk and to report potential money laundering, terrorist financing, and other illicit financial activity. Additionally, in April 2020, the Federal Financial Institutions Examination Council, of which the Federal Reserve is a member, issued revisions to the BSA/AML examination manual to enhance the risk-focused approach to BSA/AML supervision. Finally, the Federal Reserve participated in FinCEN's BSA Value Project as a regulatory stakeholder. A key objective is to provide a comprehensive and quantitative understanding of the broad value of BSA reporting and other BSA information. The results will be used to make use of BSA data more effective and its collection of BSA data more efficient and to assess how potential regulatory and compliance changes being considered with its government partners will affect BSA reporting. Taken together, these actions meet the intent of our recommendation that the Federal Reserve jointly conduct a retrospective review of BSA/AML regulations and their implementation for banks with FDIC, OCC and FinCEN, including how banks' regulatory concerns may be influencing their willingness to provide services. Further, we believe the outcomes of these actions are consistent with our recommendation that the results of this review be used to revise the BSA regulations or the way they are being implemented to help ensure that BSA/AML regulatory objectives are being met in the most effective and least burdensome way.

|

| Office of the Comptroller of the Currency | The Comptroller of the Currency should jointly conduct a retrospective review of BSA/AML regulations and their implementation for banks with FDIC, the Federal Reserve, and FinCEN. This review should focus on how banks' regulatory concerns may be influencing their willingness to provide services. In conducting the review, FDIC, the Federal Reserve, OCC and FinCEN should take steps, as appropriate, to revise the BSA regulations or the way they are being implemented to help ensure that BSA/AML regulatory objectives are being met in the most effective and least burdensome way. (Recommendation 4) |

OCC identified several actions it took that it believes are responsive to our recommendation. In 2018, OCC convened a working group with the Federal Reserve, FDIC, FinCEN, the National Credit Union Administration, and the Office of Terrorism and Financial Intelligence to identify ways to improve the efficiency and effectiveness of BSA/AML regulations, supervision, and examinations. OCC staff cited several recent interagency joint statements that resulted from the activities of the working group as examples of the working group's outcomes. The first, issued in October 2018, clarified the permissibility of sharing BSA resources among institutions with lower risk profiles to increase efficiency and reduce burden. The second, issued in December 2018, encouraged innovative industry approaches by banks to enhance the efficiency and effectiveness of their BSA/AML compliance programs. The third, issued in July 2019, highlighted that the extent of examination activities necessary to evaluate a bank's BSA/AML compliance program generally depends on the risk profile of the bank and the quality of processes implemented by the bank to identify, measure, monitor, and control risk and to report potential money laundering, terrorist financing, and other illicit financial activity. Additionally, in April 2020, the Federal Financial Institutions Examination Council, of which OCC is a member, issued revisions to the BSA/AML examination manual to enhance the risk-focused approach to BSA/AML supervision. Finally, OCC participated in FinCEN's BSA Value Project as a regulatory stakeholder. A key objective is to provide a comprehensive and quantitative understanding of the broad value of BSA reporting and other BSA information. The results will be used to make use of BSA data more effective and its collection of BSA data more efficient and to assess how potential regulatory and compliance changes being considered with its government partners will affect BSA reporting. Taken together, these actions meet the intent of our recommendation that OCC jointly conduct a retrospective review of BSA/AML regulations and their implementation for banks with FDIC, the Federal Reserve, and FinCEN, including how banks' regulatory concerns may be influencing their willingness to provide services. Further, we believe the outcomes of these actions are consistent with our recommendation that the results of this review be used to revise the BSA regulations or the way they are being implemented to help ensure that BSA/AML regulatory objectives are being met in the most effective and least burdensome way.

|