Budget Issues: Budget Uncertainty and Disruptions Affect Timing of Agency Spending

Fast Facts

When Congress funds federal agencies, it includes certain conditions for when and how agencies can use this money. As funds approach the end of their period of availability (usually at the end of the fiscal year), a "use-it or lose-it" mentality can set in among agencies, creating an incentive to rush to obligate.

However, higher obligations at the end of a year do not necessarily indicate a problem with wasteful spending. GAO testified that agency officials limit their spending early in the fiscal year because funding may be less than anticipated due to budget uncertainties like continuing resolutions and sequestration.

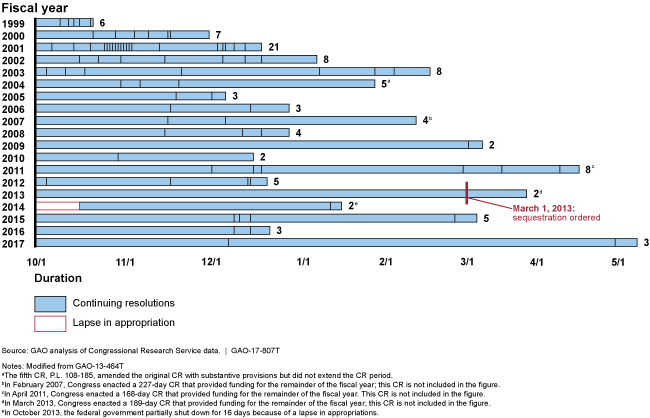

Duration and Number of Continuing Resolutions (Fiscal Years 1999-2017)

Graphic showing 2 to 21 continuing resolutions in different fiscal years.

Highlights

What GAO Found

Agency responses to budget uncertainties affect timing of spending. Due to uncertainties about the total funding ultimately available in a given year, prior GAO work has found that agency officials limit their spending early in the fiscal year because final funding decisions may be less than anticipated. GAO's prior work has identified three key sources of budget uncertainty and disruption.

Continuing resolutions. In all but 4 of the last 40 years, Congress has passed continuing resolutions (CR) to enable agencies to continue operating if all regular appropriation bills have not been enacted on time. In 2009, GAO reported that challenges caused by CRs continued at the selected agencies reviewed even after they had received their full year appropriations. Officials from selected agencies reported that they delayed hiring or contracts during the CR period, potentially reducing the level of services these agencies provided and increasing costs. Agency officials reported taking varied actions to manage inefficiencies resulting from CRs, including shifting contract and grant cycles to later in the fiscal year to avoid repetitive work.

Sequestration. In 2014, GAO reported that agencies that historically obligated most of their funding in the latter half of the fiscal year had more flexibility to implement sequestration.

Lapse in appropriations. In 2014, GAO reported on the effects of a 2013 lapse in appropriations (or government shutdown) on agencies' ability to manage their resources. In managing the implementation of the shutdown, the agencies GAO reviewed experienced budget and programmatic delays.

GAO has also previously reported that while agency managers leverage flexibilities available to them as they execute their budgets, Congress has established controls that agencies must follow throughout the year to ensure accountability and fiscal control. Legal constraints regarding the purpose, amount, and time of the funds available affect how the funds can be spent throughout the year. These include:

- The fiscal characteristics of the funding, including the period of availability of the funds, influence how agencies manage their resources.

- An agency may not obligate current appropriations for the needs of future fiscal years. Commonly referred to as the bona fide needs rule, an agency must point to a genuine need for the expenditure, not a mere need to use up remaining dollars before the end of the fiscal year.

- Two laws in particular require agencies to walk a fine line throughout the fiscal year, avoiding both over-obligating and under-obligating funds. The Antideficiency Act prohibits an agency from incurring obligations or expenditures in advance of or in excess of an appropriation. Conversely, the Impoundment Control Act generally bars agencies from refusing to obligate the amounts that Congress has appropriated for their use. Sometimes obligation delays are due to legitimate programmatic reasons or the result of outside forces not under the agency's control.

Why GAO Did This Study

Given the fiscal pressures facing the nation, the need to identify opportunities for savings, better leverage resources, and increase accountability has become even more critical to the success of federal agencies and the programs they administer. At the same time, federal decision makers must effectively and efficiently manage resources in an era of considerable budget uncertainty.

Congress exercises its constitutional power of the purse by appropriating funds and prescribing conditions governing their use. As funds approach the end of their period of availability for obligation, a “use-it or lose-it” mentality can set in, creating an incentive to rush to obligate. However, higher obligations in the fourth quarter of a fiscal year do not necessarily indicate a problem with wasteful spending—such spending may be the result of planned spending intended by Congress and the agencies.

This statement is primarily based on GAO's prior reports and testimonies on agency budgeting issued between 2009 and 2016. It addresses (1) strategies federal managers have used to execute their budgets in response to various budget uncertainties and disruptions, and (2) the legal constraints and other considerations agency managers must balance when executing their budgets.

For more information, contact Heather Krause at (202) 512-6806 or kraush@gao.gov.