Defense-Wide Working Capital Fund: Action Needed to Maintain Cash Balances within Required Levels

Highlights

What GAO Found

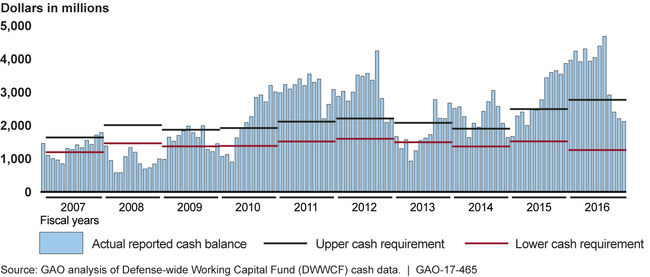

The Defense-wide Working Capital Fund's (DWWCF) reported monthly cash balances were outside the upper and lower cash requirements as defined by the Department of Defense's (DOD) Financial Management Regulation (FMR) for 87 of 120 months, and more than 12 consecutive months on three separate occasions during fiscal years 2007 through 2016. Reasons why the balances were outside the requirements at selected periods of time include the following:

The Defense Logistics Agency (DLA) disbursed about $1.3 billion more in fiscal year 2008 for, among other things, the purchase of fuel than it collected from the sale of fuel because of higher fuel costs.

DOD transferred $1.4 billion to the DWWCF in fiscal year 2013 because of cash shortfalls that resulted from DLA paying higher costs for fuel.

DLA collected about $3.7 billion more from the sale of fuel than it disbursed for fuel in fiscal year 2015 because of lower fuel costs.

Although the DOD FMR contains guidance on tools DOD managers can use to help ensure that the monthly cash balances are within the requirements, the regulation does not provide guidance on when to use the tools. Without this guidance, DOD risks not taking prompt action to bring the monthly cash balances within requirements. When monthly cash balances are outside requirements for long periods of time, the DWWCF is at further risk of not paying its bills on time or holding funds that could be used for other higher priorities.

The DWWCF's Reported Monthly Cash Balances Compared to DOD Upper and Lower Cash Requirements

Initially, the DWWCF's cash plan that supports the fiscal year 2017 President's Budget, dated February 2016, showed the monthly balances were projected to be above the upper cash requirement for most of fiscal year 2017. However, its October 2016 revised plan showed that the monthly cash balances were projected to be within the requirements for all 12 months. The plan changed because (1) DOD made unplanned cash transfers out of the DWWCF in the second half of fiscal year 2016 and (2) DOD reduced the standard fuel price in September 2016, leading to lower projected cash balances for fiscal year 2017.

Why GAO Did This Study

The Defense Finance and Accounting Service, the Defense Information Systems Agency, and DLA use the DWWCF to charge for goods and services provided to the military services and other customers. The DWWCF relies primarily on sales revenue rather than annual appropriations to finance its continuing operations. The DWWCF reported total revenue of $45.7 billion in fiscal year 2016 from (1) providing finance, accounting, information technology, and energy solution services to the military services and (2) managing inventory items for the military services.

GAO was asked to review issues related to DWWCF cash management. GAO's objectives were to determine to what extent (1) the DWWCF's reported monthly cash balances were within DOD's upper and lower cash requirements from fiscal years 2007 through 2016 and (2) the DWWCF's projected monthly cash balances were within the upper and lower cash requirements for fiscal year 2017. To address these objectives, GAO reviewed relevant DOD cash management guidance, analyzed DWWCF actual reported and projected cash balances and related data, and interviewed DWWCF officials.

Recommendations

GAO recommends that DOD update the FMR to include guidance on the timing of when DOD managers should use available tools to help ensure that monthly cash balances are within the upper and lower cash requirements. DOD concurred with GAO's recommendation and cited related actions planned.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Defense | The Secretary of Defense should direct the Office of the Under Secretary of Defense (Comptroller) to provide guidance in the DOD Financial Management Regulation on the timing of when DOD managers should use available tools to help ensure that monthly cash balances are within the upper and lower cash requirements. |

In response to our recommendation, DOD revised its cash management policy in July 2021 to include guidance instructing Working Capital Fund components to leverage cash management tools when cash execution is trending above or below planned levels for three consecutive months. If implemented effectively, these revised procedures should reduce the risk of Working Capital Fund components (1) not paying its bills on time, (2) making a disbursement in excess of available cash, or (3) restricting funds that could be used for other higher priority requirements.

|