Troubled Asset Relief Program: Few Participants Remain as Treasury Continues to Wind Down Capital Purchase Program

Highlights

What GAO Found

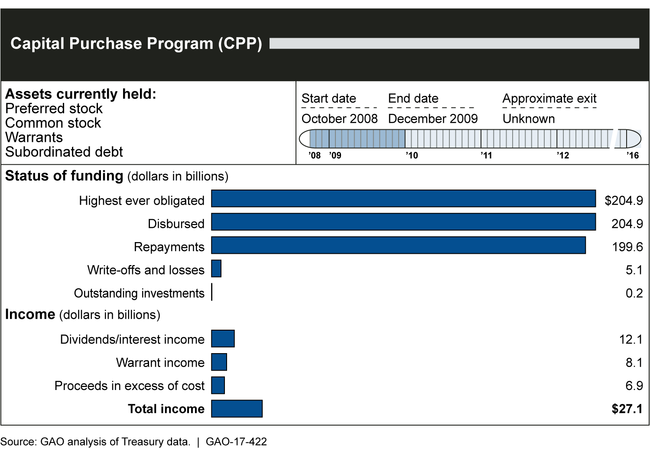

The Department of the Treasury (Treasury) continues to make progress winding down the Capital Purchase Program (CPP). As of December 31, 2016, investments outstanding stood at almost $0.2 billion (see figure), which represents about 0.1 percent of the original amount disbursed. Treasury had received almost $200 billion in repayments, including about $25 million in 2016. Further, Treasury's returns for the program, including repayments and income, totaled about $227 billion, exceeding the amount originally disbursed by almost $22 billion. Of the 707 institutions that originally participated in CPP, 696 had exited the program, including 6 institutions in 2016.

Status of the Capital Purchase Program, as of December 31, 2016

Treasury officials expect that the majority of the remaining institutions will require a restructuring to exit the program. Restructurings allow institutions to negotiate terms for their CPP investments. With this option, Treasury requires institutions to raise new capital or merge with another institution and Treasury agrees to receive cash or other securities, typically at less than par value. Treasury officials expect to rely primarily on restructurings because the overall weaker financial condition of the remaining institutions makes full repayment unlikely.

The financial condition of the institutions remaining in CPP as of December 31, 2016, appears to have improved since the end of 2011, but some institutions show signs of financial weakness. For example, 5 institutions had negative returns on average assets (a common measure of profitability) for the third quarter of 2016.

Why GAO Did This Study

CPP was established as the primary means of restoring stability to the financial system under the Troubled Asset Relief Program (TARP). Under CPP, Treasury invested almost $205 billion in 707 eligible financial institutions between October 2008 and December 2009. CPP recipients have made dividend and interest payments to Treasury on the investments. The Emergency Economic Stabilization Act of 2008, as amended, includes a provision that GAO report at least annually on TARP activities and performance. This report examines (1) the status of CPP, including repayments, investments outstanding, and number of remaining institutions; and (2) the financial condition of institutions remaining in CPP.

To assess the program's status, GAO reviewed Treasury reports on the status of CPP. In addition, GAO reviewed information from Treasury officials to identify the agency's current efforts to wind down the program. Finally, GAO used financial and regulatory data to assess the financial condition of institutions remaining in CPP.

GAO provided a draft of this report to Treasury for its review and comment. Treasury provided technical comments that GAO incorporated as appropriate.

For more information, contact Daniel Garcia-Diaz at (202) 512-8678 or garciadiazd@gao.gov.