Private Deposit Insurance: Credit Unions Largely Complied with Disclosure Rules, but Rules Should Be Clarified

Highlights

What GAO Found

About 2 percent of credit unions (125) have private deposit insurance, which is provided by one company—American Share Insurance (ASI). Regulatory and other assessments have suggested that ASI's reserves have been adequate and that the company has had a strong ability to cover present and future losses for the credit unions it insures. The most recent examination of ASI by its primary regulator (Ohio Department of Insurance) determined that ASI's reserves for losses were adequate and appropriate and consistent with legal requirements. An independent actuarial firm hired by ASI reported that it had a strong ability to cover losses under different economic scenarios. The Ohio regulator and the actuarial firm both noted risk factors that could affect ASI's financial condition, including changes in macroeconomic conditions or major losses by the largest credit unions it insures. In the event of financial difficulties, Ohio law allows ASI to tap into additional sources of funding, including lines of credit and special assessments from its insured credit unions.

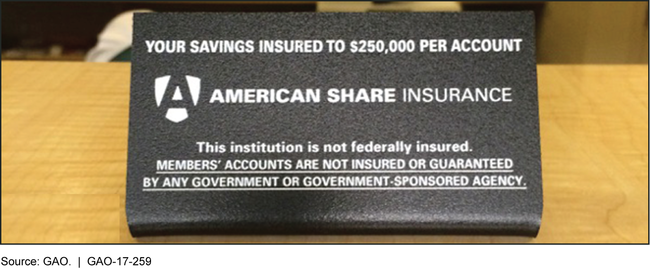

Privately insured credit unions largely complied with the Bureau of Consumer Financial Protection (CFPB) requirements to disclose that they do not have federal deposit insurance. For instance, 45 of 47 credit unions GAO visited displayed required disclosures at teller windows (see fig.), and 99 of 102 websites GAO reviewed included the disclosure on their main Internet page, as required. However, 7 of 17 credit unions with drive-through windows that GAO visited did not have disclosure signs at these windows. Additionally, printed materials (such as brochures and flyers) GAO reviewed from 8 of 36 credit unions did not include disclosures. The regulations require all advertising to include a disclosure, but do not define what constitutes advertising. In some cases, disclosure signs or text size were too small to be easily read, or were not placed conspicuously. CFPB's regulations on disclosures for privately insured credit unions do not specify signage dimensions or font size. Without clear disclosure requirements, state credit union supervisors and credit unions may not be consistent in how they interpret disclosure requirements and some consumers may not be informed that their deposits are not federally insured.

Figure: Example of Disclosure at a Privately Insured Credit Union

Why GAO Did This Study

The Federal Deposit Insurance Act requires privately insured credit unions to disclose to consumers that they do not have federal deposit insurance and CFPB has implemented regulations on these requirements. The Fixing America's Surface Transportation Act includes a provision for GAO to review private deposit insurers and privately insured credit unions' compliance with disclosures. This report (1) discusses regulatory and other assessments of ASI, the sole private insurer, and (2) examines the level of compliance with disclosure requirements for privately insured credit unions. GAO reviewed documentation from and interviewed federal and state regulators, ASI management, and ASI's third-party actuarial firm. GAO reviewed certain key methods and assumptions used by the actuarial firm. GAO also analyzed regulatory ratings (2006–2015) and selected financial data (2011–2015) on privately and federally insured credit unions. In addition, GAO reviewed 102 websites for all privately insured credit unions that had websites, conducted unannounced site visits at 47 credit unions (selected based largely on asset size and geography), and reviewed printed materials from 36 of the credit unions it visited that had materials readily available.

Recommendations

GAO recommends that CFPB issue guidance for privately insured credit unions to clarify whether drive-through windows require disclosure, describe what constitutes clear and conspicuous disclosure, including minimum signage dimensions and font size, and explain and provide examples of which communications are advertising. CFPB agreed with these recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Consumer Financial Protection Bureau | To help state credit union supervisors and privately insured credit unions better interpret Regulation I and inform consumers when an institution is not federally insured, CFPB should issue guidance to clarify whether drive-through windows require disclosures. |

CFPB agreed with this recommendation. CFPB said it had explored options for addressing the recommendation and determined it would require notice-and-comment rulemaking. As of August 2024, CFPB had not added this item to its rulemaking program because the issues identified did not appear to CFPB to present significant risk of consumer harm and CFPB had seen no indication of consumer or industry concerns related to this issue.

|

| Consumer Financial Protection Bureau | To help state credit union supervisors and privately insured credit unions better interpret Regulation I and inform consumers when an institution is not federally insured, CFPB should issue guidance to describe what constitutes clear and conspicuous disclosure, including minimum signage dimensions and font size for disclosures. |

CFPB agreed with this recommendation. CFPB said it had explored options for addressing the recommendation and determined it would require notice-and-comment rulemaking. As of August 2024, CFPB had not added this item to its rulemaking program because the issues identified did not appear to CFPB to present significant risk of consumer harm and CFPB had seen no indication of consumer or industry concerns related to this issue.

|

| Consumer Financial Protection Bureau | To help state credit union supervisors and privately insured credit unions better interpret Regulation I and inform consumers when an institution is not federally insured, CFPB should issue guidance to explain and provide examples of which communications are advertising. |

CFPB agreed with this recommendation. CFPB said it had explored options for addressing the recommendation and determined it would require notice-and-comment rulemaking. As of August 2024, CFPB had not added this item to its rulemaking program because the issues identified did not appear to CFPB to present significant risk of consumer harm and CFPB had seen no indication of consumer or industry concerns related to this issue.

|