Medicaid: Additional Efforts Needed to Ensure that State Spending is Appropriately Matched with Federal Funds

Highlights

What GAO Found

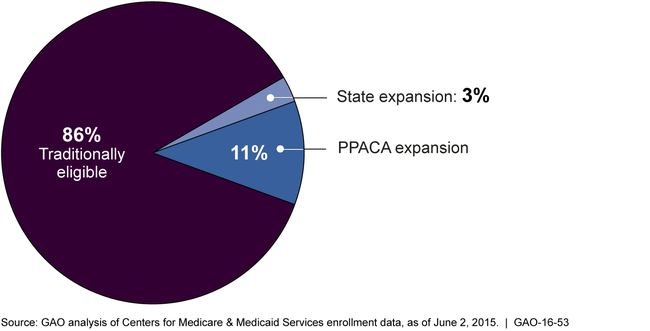

PPACA-expansion and state-expansion enrollees—individuals who were not eligible under historic Medicaid eligibility rules but are eligible under (1) a state option to expand Medicaid under the Patient Protection and Affordable Care Act (PPACA), or (2) a state's qualifying expansion of coverage prior to PPACA's enactment—comprised about 14 percent of Medicaid enrollees and about 10 percent of Medicaid expenditures at the end of 2014. According to GAO's analysis of state reported data, of the approximately 69.8 million individuals recorded as enrolled in Medicaid, about 60.1 million were traditionally eligible enrollees, comprising about 86 percent of the total; about 7.5 million (11 percent of all Medicaid enrollees) were PPACA-expansion enrollees, and 2.3 million (3 percent of all Medicaid enrollees) were state-expansion enrollees. With regard to expenditures, states had reported $481.77 billion in Medicaid expenditures for services in calendar year 2014. Of this total, expenditures for traditionally eligible enrollees were $435.91 billion (about 90 percent of total expenditures), expenditures for PPACA-expansion enrollees were about $35.28 billion (7 percent of total expenditures), and expenditures for state-expansion enrollees were $10.58 billion (2 percent of total expenditures).

Proportion of Medicaid Enrollees by Eligibility Group, Last Quarter of Calendar Year 2014

The Centers for Medicare & Medicaid Services (CMS), which oversees Medicaid, has implemented interim measures to review the accuracy of state eligibility determinations and examine states' expenditures for different eligibility groups, for which states may receive up to three different federal matching rates. However, CMS has excluded from review federal Medicaid eligibility determinations in the states that have delegated authority to the federal government to make Medicaid eligibility determinations through the federally facilitated exchange. This creates a gap in efforts to ensure that only eligible individuals are enrolled into Medicaid and that state expenditures are correctly matched by the federal government. In addition, CMS reviews of states' expenditures do not use information obtained from the reviews of state eligibility determination errors to better target its review of Medicaid expenditures for the different eligibility groups. An accurate determination of these different eligibility groups is critical to ensuring that only eligible individuals are enrolled, that they are enrolled in the correct eligibility group, and that states' expenditures are appropriately matched with federal funds for Medicaid enrollees, consistent with federal internal control standards. Consequently, CMS cannot identify erroneous expenditures due to incorrect eligibility determinations, which also limits its ability to ensure that state expenditures are appropriately matched with federal funds.

Why GAO Did This Study

Historically, Medicaid eligibility has been limited to certain categories of low-income individuals, but PPACA, enacted on March 23, 2010, gave states the option to expand coverage to nearly all adults with incomes at or below 133 percent of the federal poverty level, beginning January 1, 2014. States that do so are eligible for increased federal matching rates for enrollees receiving coverage through the state option to expand Medicaid under PPACA, and where applicable, enrollees in states that expanded coverage prior to PPACA's enactment.

GAO was asked to examine Medicaid enrollment and expenditures, and CMS oversight of the appropriateness of federal matching funds. This report examines (1) Medicaid enrollment and spending in 2014 by different eligibility groups; and (2) how CMS ensures states are accurately determining eligibility, and that expenditures are appropriately matched. GAO analyzed enrollment and expenditure data for enrollee eligibility groups submitted by states to CMS, examined relevant federal laws and regulations, internal control standards, CMS guidance and oversight tools, and interviewed CMS officials.

Recommendations

GAO recommends that CMS (1) review federal determinations of Medicaid eligibility for accuracy, and (2) use the information obtained from the eligibility reviews to inform the expenditure review, and increase assurances that expenditures for the different eligibility groups are correctly reported and appropriately matched. In its response, the agency generally concurred with these recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Centers for Medicare & Medicaid Services | To improve the effectiveness of its oversight of eligibility determinations, the Administrator of CMS should conduct reviews of federal Medicaid eligibility determinations to ascertain the accuracy of these determinations and institute corrective action plans where necessary. |

The Department of Health and Human Services conducts periodic reviews of federal eligibility determinations. In July 2017, HHS issued its final rule on the Payment Error Rate Measurement (PERM) program, and stated that it would include reviews of federal eligibility determinations in states that have delegated that have delegated the authority to determine eligibility to federal health insurance marketplaces. PERM reviewers select a random sample of eligibility determinations for review each cycle. Given this methodology, not every PERM cycle will include a review of federal determinations; however, over time, federal eligibility determinations are subject to review, even if they are not reviewed every year. According to CMS, 31 federal determinations have been reviewed across several states through the last three years of PERM cycles (2020 through 2022), and all were found to have been correctly determined. These results suggest there is no need for a separate review of federal determinations.

|

| Centers for Medicare & Medicaid Services |

Priority Rec.

To increase assurances that states receive an appropriate amount of federal matching funds, the Administrator of CMS should use the information obtained from state and federal eligibility reviews to inform the agency's review of expenditures for different eligibility groups in order to ensure that expenditures are reported correctly and matched appropriately. |

CMS has taken steps to share information between the eligibility review pilots and CMS-64 quarterly expenditure reviews regarding Medicaid expansion enrollees. In February 2019, CMS confirmed that the agency will continue to share information as the Payment Error Rate Program (PERM) eligibility reviews replace the eligibility review pilots, thereby allowing CMS to continue to use information on eligibility errors identified in eligibility reviews to better focus the expenditure reviews.

|