Temporary Assistance for Needy Families: Update on States Counting Third-Party Expenditures toward Maintenance of Effort Requirements

Highlights

What GAO Found

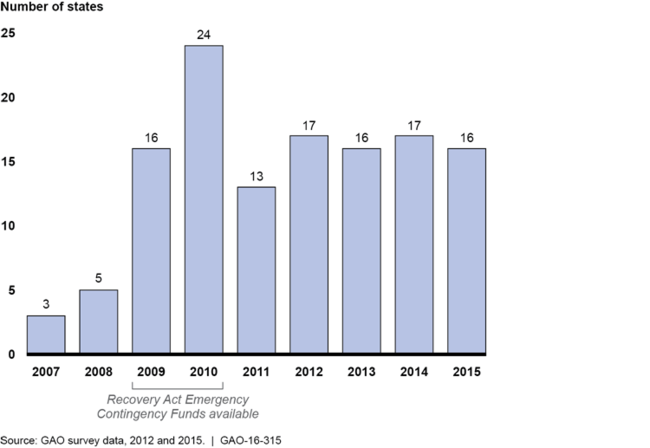

Nearly one-third of states (16 of 51) reported counting nongovernmental third-party expenditures toward their states' required spending level under the Temporary Assistance for Needy Family (TANF) block grant in fiscal year 2015, according to GAO's survey of all state TANF directors. TANF requires states to maintain a significant portion of their own historic financial commitment, called maintenance of effort (MOE), to welfare-related programs. In addition to its own spending, a state may count toward its MOE requirement certain in-kind or cash expenditures by nongovernmental third parties—such as food banks—as long as these services are allowable under TANF, are provided to needy families, and the state meets other requirements. The number of states counting such expenditures as MOE spending increased substantially between fiscal years 2009 and 2010, perhaps in part due to requirements necessary to obtain additional funding under the American Recovery and Reinvestment Act of 2009 (Recovery Act). After fiscal year 2010, the number of states counting nongovernmental third-party expenditures toward their TANF MOE requirements fell, but remained higher than pre-Recovery Act levels for other reasons. States that reported such expenditures as TANF MOE spending cited reasons such as developing public-private partnerships and meeting state MOE requirements.

Number of States That Reported Counting Nongovernmental Third-Party Expenditures as Temporary Assistance for Needy Families (TANF) Maintenance of Effort (MOE) Spending, Fiscal Years 2007-2015

Of the 16 states that reported counting nongovernmental third-party expenditures as TANF MOE spending in fiscal year 2015, most said the types of services they counted involved food assistance and programs serving youth, according to GAO's survey. For example, one state reported working with a food bank to count the value of the food the bank provided to families deemed needy under state TANF rules.

Why GAO Did This Study

Each year, TANF block grants, which are overseen by the U.S. Department of Health and Human Services (HHS), provide $16.5 billion in federal funds to states to assist low-income families. States are also required to spend a significant amount of their own funds under TANF, but they can include certain expenditures made by nongovernmental third parties toward their MOE requirement. Some stakeholders support this option because it helps states meet MOE requirements, but others question whether this approach is consistent with program goals. GAO was asked to update the information presented in its 2012 report on this topic (GAO-12-929R).

This report updates information on, among other things, (1) the extent to which states count nongovernmental third-party expenditures for services as TANF MOE spending, and (2) the types of nongovernmental third-party services provided that states counted as TANF MOE spending.

To obtain this information, GAO surveyed state TANF directors in all 50 states and the District of Columbia and reached a 100-percent response rate. GAO also reviewed relevant federal laws and regulations, reviewed HHS expenditure data, and interviewed HHS officials. Lastly, GAO interviewed TANF officials in three states selected to reflect geographic diversity and variety among other factors.

Recommendations

GAO is not making recommendations in this report. HHS agreed with the findings, and provided written comments on the report.