Corporate Boards: Strategies to Address Representation of Women Include Federal Disclosure Requirements

Highlights

What GAO Found

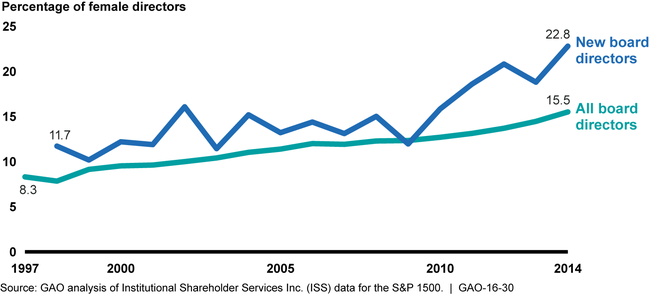

Representation of women on the boards of U.S. publicly-traded companies has been increasing, but greater gender balance could take many years. In 2014, women comprised about 16 percent of board seats in the S&P 1500, up from 8 percent in 1997. This increase was partly driven by a rise in women's representation among new board directors. However, even if equal proportions of women and men joined boards each year beginning in 2015, GAO estimated that it could take more than four decades for women's representation on boards to be on par with that of men's.

Percentage of Women on Corporate Boards and among New Directors, 1997-2014

Based on an analysis of interviews with stakeholders, board director data, and relevant literature, GAO identified various factors that may hinder women's increased representation among board directors. These include boards not prioritizing recruiting diverse candidates; few women in the traditional pipeline to board service—with Chief Executive Officer (CEO) or board experience; and low turnover of board seats.

Stakeholders GAO interviewed generally preferred voluntary strategies for increasing gender diversity on corporate boards, yet several large investors and most stakeholders interviewed (15 of 19) supported improving Securities and Exchange Commission (SEC) disclosure requirements on board diversity. SEC currently requires companies to disclose information on board diversity to help investors make investment and voting decisions. As stated in its strategic plan, one of SEC's objectives is to ensure that investors have access to high-quality disclosure materials to inform investment decisions. A group of large public pension fund investors and many stakeholders GAO interviewed questioned the usefulness of information companies provide in response to SEC's board diversity disclosure requirements. Consequently, these investors petitioned SEC to require specific disclosure on board directors' gender, race, and ethnicity. Without this information, some investors may not be fully informed in making decisions. SEC officials said they plan to consider the petition as part of an ongoing effort to review all disclosure requirements.

Why GAO Did This Study

Women make up almost half of the nation's workforce, yet research shows that they continue to hold a lower percentage of corporate board seats compared to men. Research highlights advantages to gender diverse boards, and some countries have taken steps to increase board gender diversity. The SEC requires companies to disclose certain information on board diversity. GAO was asked to review the representation of women on U.S. corporate boards.

This report examines (1) the representation of women on boards of U.S. publicly-traded companies and factors that may affect it and (2) selected stakeholders' views on strategies for increasing representation of women on corporate boards. GAO analyzed a dataset of board directors at companies in the S&P 1500 from 1997 through 2014; and conducted interviews with a nongeneralizable sample of 19 stakeholders including CEOs, board directors, and investors. GAO selected stakeholders to reflect a range of experiences, among various factors. GAO also reviewed existing literature and relevant federal laws and regulations.

GAO is not making recommendations in this report. SEC provided technical comments that were incorporated, as appropriate. The Equal Employment Opportunity Commission had no comments.

For more information, contact Andrew Sherrill at (202) 512-7215 or sherrilla@gao.gov.