Defense Base Act Insurance: State Department Should Evaluate Its Open Market System and Incorporate Leading Practices into Any Future Single Insurer Solicitation

Highlights

What GAO Found

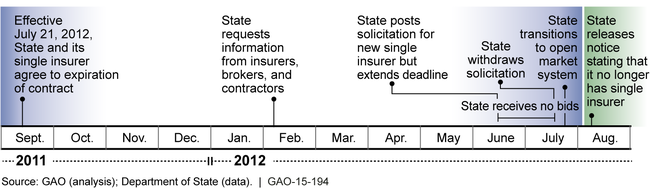

The Department of State (State) did not follow leading acquisition practices in transitioning from a single insurer Defense Base Act (DBA) program to an open market system. Leading practices emphasize adequately documenting market research, allowing enough time to complete a solicitation, and collecting and analyzing data to select among alternatives, but State took limited measures to document the market research it performed and had little time to complete its 2012 solicitation. State included provisions in the solicitation to which insurers strongly objected, received no offers, and had to cancel the solicitation 3 days before its existing single insurer contract was to expire. As a result, State had to quickly transition to an open market system without weighing the relative costs and benefits to determine which insurance system best served its needs. Until State conducts such an evaluation, it cannot be assured that the open market system is the better alternative, and unless State incorporates leading practices into any future single insurer solicitations, it risks a similar outcome.

Timeline of the Department of State's Transition to an Open Market System for Defense Base Act Insurance

GAO found that State contractors' DBA premiums increased following the transition, but the increases were in a range similar to those likely to have occurred if State had continued its single insurer program. For example, median DBA premium rates increased by $1.98 per $100 of payroll. GAO analysis also shows that the increase in DBA premium rates after the transition was in a range comparable to the increase in DBA premium rates requested by State's single DBA insurer, which said it had lost money under the prior contract.

Existing data do not show a clear effect on small businesses resulting from State's transition to an open market system, but insurers and contractors have expressed concern that the change has had or could have an adverse effect. GAO analysis of federal procurement data from fiscal years 2009 through 2013 found a decrease in the percentage of contracts awarded to small businesses, but GAO could not link this to State's transition. Information GAO gathered from insurance industry officials and contractors shows that there is a potential for adverse effects, for example, denial of coverage and higher effective premium rates. State's policy is to maximize opportunities for small businesses, but it has not assessed whether its transition to an open market DBA system is affecting those opportunities. Without such an assessment, State cannot be assured that it is meeting its policy goal of maximizing opportunities for small businesses.

Why GAO Did This Study

DBA requires U.S. government contractors to buy workers' compensation insurance for most employees working overseas. The cost of this insurance, if allowable under federal regulations, is generally reimbursable under government contracts. From 1992 until 2012, State had a contract with a single insurer to supply all State's contractors working overseas with DBA insurance. In July 2012, State's single insurer program ended after State unsuccessfully sought to solicit a new DBA single insurer agreement and State transitioned to a system requiring its contractors to obtain DBA insurance on the open market. However, concerns were raised about the transition and its impact on State's costs and on small businesses' competitiveness. To address these objectives, GAO was asked to review State's transition.

This report assesses (1) State's management of the transition to an open market system, (2) the change's effect on contractors' premium rates, and (3) the change's effect on small businesses. GAO analyzed State documents; reviewed federal and State contracting regulations; analyzed premium rate data and federal contracting data; and interviewed officials from State, the insurance industry, and contracting firms.

Recommendations

State should (1) determine whether an open market system best suits its needs, (2) incorporate leading practices into any future single insurer solicitation, and (3) assess the effects of its transition on small businesses. State concurred with GAO's recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of State | The Secretary of State should direct State's Office of the Procurement Executive to conduct an assessment to determine how State's transition to an open market DBA system is affecting small businesses. |

State concurred with the recommendation. In response, between December 2014 and January 2015, State's Office of the Procurement Executive (OPE) conducted market research to assess the impact of an open market system on small businesses. Among other things, OPE contacted the five major insurance providers to discuss how rates differ under a single provider system compared to an open market system; met with the Department of Labor, the U.S. Army Corps of Engineers, and the U.S. Agency for International Development to discuss these agencies experiences with open market and single provider systems; and obtained input from State's Office of Small and Disadvantaged Business Utilization to learn more about concerns that small businesses had raised during events sponsored by that office. Based on the evidence obtained through its market research, OPE determined that the effects of an open market system on small contractors are minimal.

|

| Department of State | The Secretary of State should direct State's Office of the Procurement Executive to incorporate leading practices into any future single insurer solicitations by determining whether existing guidance could be used, or by developing guidance based on leading practices in federal and State Department acquisition regulations and State internal control standards. |

The Department of State agreed to incorporate leading practices into any future single Defense Base Act (DBA) insurance solicitation if State makes a determination to transition back to a single DBA insurer program. However, as of March 2019 the Department had not experienced any issues with the current open market DBA system and did not intend to transition back to a single insurer program. A Procurement Information Bulletin was issued in 2017 to provide additional guidance to the Department's contracting officers and contracting officer representatives.

|

| Department of State | The Secretary of State should direct State's Office of the Procurement Executive to evaluate whether a single insurer program or an open market system best serves its needs. |

State concurred with the recommendation. In response, between December 2014 and January 2015, State's Office of the Procurement Executive (OPE) conducted market research to determine whether a single insurer or open market program best serves State's needs. Among other things, OPE contacted the five major insurance providers to discuss how rates differ under a single provider system compared to an open market system and met with the Department of Labor, the U.S. Army Corps of Engineers, and the U.S. Agency for International Development to discuss these agencies experiences with open market and single provider systems. OPE also obtained input from State's Office of Small and Disadvantaged Business Utilization, Office of the Legal Advisor, and State contracting officers. Based on the evidence obtained through its market research, OPE determined that an open market system best fits State's needs because, among other things, neither approach held an inherent cost advantage and an open market program is easier for State to administer.

|