Large Bank Holding Companies: Expectations of Government Support

Highlights

What GAO Found

While views varied among market participants with whom GAO spoke, many believed that recent regulatory reforms have reduced but not eliminated the likelihood the federal government would prevent the failure of one of the largest bank holding companies. Recent reforms provide regulators with new authority to resolve a large failing bank holding company in an orderly process and require the largest bank holding companies to meet stricter capital and other standards, increasing costs and reducing risks for these firms. In response to reforms, two of three major rating agencies reduced or removed the assumed government support they incorporated into some large bank holding companies' overall credit ratings. Credit rating agencies and large investors cited the new Orderly Liquidation Authority as a key factor influencing their views. While several large investors viewed the resolution process as credible, others cited potential challenges, such as the risk that multiple failures of large firms could destabilize markets. Remaining market expectations of government support can benefit large bank holding companies if they affect investors' and customers' decisions.

GAO analyzed the relationship between a bank holding company's size and its funding costs, taking into account a broad set of other factors that can influence funding costs. To inform this analysis and to understand the breadth of methodological approaches and results, GAO reviewed selected studies that estimated funding cost differences between large and small financial institutions that could be associated with the perception that some institutions are too big to fail. Studies GAO reviewed generally found that the largest financial institutions had lower funding costs during the 2007-2009 financial crisis but that the difference between the funding costs of the largest and smaller institutions has since declined. However, these empirical analyses contain a number of limitations that could reduce their validity or applicability to U.S. bank holding companies. For example, some studies used credit ratings which provide only an indirect measure of funding costs.

GAO's analysis, which addresses some limitations of these studies, suggests that large bank holding companies had lower funding costs than smaller ones during the financial crisis but provides mixed evidence of such advantages in recent years. However, most models suggest that such advantages may have declined or reversed. GAO developed a series of statistical models that estimate the relationship between bank holding companies' bond funding costs and their size or systemic importance, controlling for other drivers of bond funding costs, such as bank holding company credit risk. Key features of GAO's approach include the following:

- U.S. Bank Holding Companies: The models focused on U.S. bank holding companies to better understand the relationship between funding costs and size in the context of the U.S. economic and regulatory environment.

- Bond Funding Costs: The models used bond yield spreads—the difference between the yield or rate of return on a bond and the yield on a Treasury bond of comparable maturity—to measure funding costs because they are a risk-sensitive measure of what investors charge bank holding companies to borrow.

- Extensive Controls : The models controlled for credit risk, bond liquidity, and other variables to account for factors other than size that could affect funding costs.

- Multiple Models : GAO used 42 models for each year from 2006 through 2013 to assess the impact of using alternative measures of credit risk, bond liquidity, and size and to allow the relationship between size and bond funding costs to vary over time with changes in the economic and regulatory environment.

- Credit Risk Levels : GAO compared bond funding costs for bank holding companies of different sizes at the average level of credit risk for each year, at low and high levels of credit risk for each year, and at the average level of credit risk during the financial crisis.

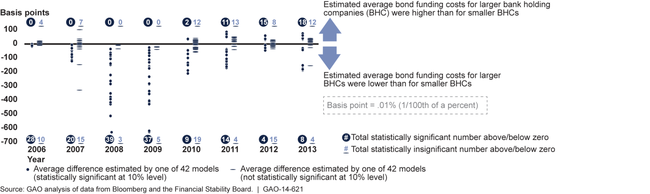

The figure below shows the differences between model-estimated bond funding costs for bank holding companies with $1 trillion in assets and bank holding companies with $10 billion in assets, with average levels of credit risk in each year. Circles represent statistically significant model-estimated differences.

Estimates from 42 Models of Average Bond Funding Cost Differences between Bank Holding Companies with $1 Trillion and $10 Billion in Assets, 2006-2013

Notes: GAO estimated econometric models of the relationship between BHC size and funding costs using data for U.S. BHCs and their outstanding senior unsecured bonds for the first quarter of 2006 through the fourth quarter of 2013. The models used bond yield spreads to measure funding costs and controlled for credit risk factors such as capital adequacy, asset quality, earnings, maturity mismatch, and volatility, as well as bond liquidity and other characteristics of bonds and BHCs that can affect funding costs. GAO estimated 42 models for each year from 2006 through 2013 to assess the sensitivity of estimated funding cost differences to using alternative measures of capital adequacy, volatility, bond liquidity, and size or systemic importance. GAO used the models to compare bond funding costs for BHCs of different sizes but the same levels of credit risk, bond liquidity, and other characteristics. This figure compares bond funding costs for BHCs with $1 trillion and $10 billion in assets, for each model and for each year, with average levels of credit risk. Each circle and dash shows the comparison for a different model, where circles and dashes below zero suggest BHCs with $1 trillion in assets have lower bond funding costs than BHCs with $10 billion in assets, and vice versa.

All 42 models found that larger bank holding companies had lower bond funding costs than smaller ones in 2008 and 2009, while more than half of the models found that larger bank holding companies had higher bond funding costs than smaller ones in 2011 through 2013, given the average level of credit risk each year (see figure). However, the models' comparisons of bond funding costs for bank holding companies of different sizes varied depending on the level of credit risk. For example, in hypothetical scenarios where levels of credit risk in every year from 2010 to 2013 are assumed to be as high as they were during the financial crisis, GAO's analysis suggests that large bank holding companies might have had lower funding costs than smaller ones in recent years. However, reforms in the Dodd-Frank Wall Street Reform and Consumer Protection Act, such as enhanced standards for capital and liquidity, could enhance the stability of the financial system and make such a credit risk scenario less likely.

This analysis builds on certain aspects of prior studies, but important limitations remain and these results should be interpreted with caution. GAO's estimates of differences in funding costs reflect a combination of several factors, including investors' beliefs about the likelihood a bank holding company will fail and the likelihood it will be rescued by the government if it fails, and cannot precisely identify the influence of each factor. In addition, these estimates may reflect factors other than investors' beliefs about the likelihood of government support and may also reflect differences in the characteristics of bank holding companies that do and do not issue bonds. Finally, GAO's estimates, like all past estimates, are not indicative of future trends.

Why GAO Did This Study

“Too big to fail” is a market notion that the federal government would intervene to prevent the failure of a large, complex financial institution to avoid destabilizing the financial sector and the economy. Expectations of government rescues can distort investor incentives to properly price the risks of firms they view as too big to fail, potentially giving rise to funding and other advantages for these firms.

GAO was asked to review the benefits that the largest bank holding companies (those with more than $500 billion in assets) have received from perceived government support. This is the second of two GAO reports on government support for bank holding companies. The first study focused on actual government support during the 2007-2009 financial crisis and recent statutory and regulatory changes related to government support for these firms. This report examines how financial reforms have altered market expectations of government rescues and the existence or size of funding advantages the largest bank holding companies may have received due to perceived government support.

GAO reviewed relevant statutes and rules and interviewed regulators, rating agencies, investment firms, and corporate customers of banks. GAO also reviewed relevant studies and interviewed authors of these studies. Finally, GAO conducted quantitative analyses to assess potential “too-big-to-fail” funding cost advantages.

In its comments, the Department of the Treasury generally agreed with GAO's analysis. GAO incorporated technical comments from the financial regulators, as appropriate.

For more information, contact Lawrance Evans, Jr. at (202) 512-4802 or EvansL@gao.gov.