Unemployment Insurance: Estimated Amount of Fraud During Pandemic Likely Between $100 Billion and $135 Billion

Fast Facts

We estimate that fraud accounted for 11-15% of the total amount of unemployment insurance benefits paid during the pandemic.

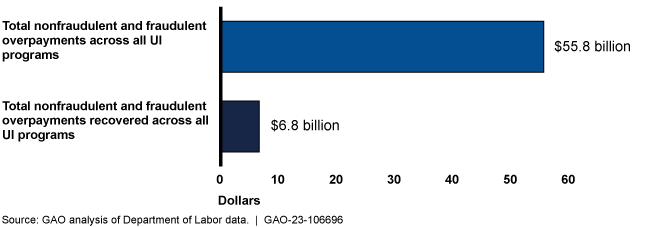

In that time frame, the Department of Labor provided funding to states to help prevent, detect, and investigate fraud and recover fraudulent payments. States reported finding about $55.8 billion in total overpayments—$5.3 billion of which were fraudulent.

States reported recovering about $6.8 billion total, including $1.2 billion in fraudulent payments.

Since 2018, we've made 26 related recommendations to DOL. Of those, 16 haven't yet been fully implemented.

The unemployment insurance system is on our High Risk List.

Total unemployment insurance overpayments and recoveries, March 2020 – March 2023 (as of May 1, 2023)

Highlights

What GAO Found

Based on statistical sampling and imputation techniques, GAO estimates that the amount of fraud in unemployment insurance (UI) programs during the COVID-19 pandemic was likely between $100 billion and $135 billion. This is about 11 percent and 15 percent, respectively, of the total amount of UI benefits paid during the pandemic. GAO's estimate is for the period from April 2020 (first full month of payments from all UI programs) to May 2023 (end of the public health emergency). This estimate covers all 53 states that participated in the regular and temporary UI programs. The full extent of UI fraud during the pandemic will likely never be known with certainty. In commenting on a draft of this report, the Department of Labor (DOL) expressed concerns about GAO's fraud estimation methodology and stated that the resulting estimate was likely overstated. GAO disagrees and explains in the report the steps taken to estimate the range of fraud. These steps include using (1) a 95-percent confidence interval to account for sample design and size, and (2) multiple data sources and validity checks to account for uncertainty associated with identifying potential fraud in its sample.

During the pandemic, DOL provided states with assistance to improve UI systems and processes. As of July 2023, DOL reported allocating grants totaling about $1.4 billion to states for initiatives including fraud prevention, detection, investigation, and recovery. Officials from selected states confirmed that they used this assistance for fraud detection and prevention, including verification software and improvements in payment timeliness.

Coronavirus Aid, Relief, and Economic Security (CARES) Act and American Rescue Plan Act (ARPA) Unemployment Insurance (UI) Financial Assistance

As of May 1, 2023, states reported identifying about $55.8 billion in fraudulent and nonfraudulent UI overpayments and recoveries of about $6.8 billion from March 2020 through March 2023. During this period, states reported identifying fraudulent UI overpayments totaling $5.3 billion and recoveries of $1.2 billion. States use several tools to recover overpayments, including direct repayment and offsets. States can also write off overpayments as uncollectible. Further, states may waive their legal right to collect nonfraudulent overpayments. DOL rules do not allow states to waive fraudulent overpayments.

Why GAO Did This Study

The UI system has faced long-standing challenges with program integrity, which worsened during the COVID-19 pandemic. In response to historic pandemic job losses, Congress created new temporary UI programs to provide relief for the unemployed. The unprecedented demand for benefits and need to quickly implement the new programs increased the risk of fraud. Due to this and other challenges, GAO added the UI system to its High Risk List in June 2022.

This report (1) provides an estimate of fraud within UI programs during the pandemic; (2) identifies the assistance DOL provided to states; and (3) presents amounts that states reported in UI overpayment recoveries and waivers, among other amounts. GAO used data from multiple sources to produce an estimated range of the extent of fraud during the pandemic. In determining the estimate, GAO reviewed DOL data, selected and reviewed a sample of payments, matched samples to other federal data bases, developed an econometric model on claims and economic conditions, and performed numerous other analyses. GAO also reviewed data on state-reported overpayments, recoveries, and waivers. GAO interviewed officials from 14 states, selected based on fraud risk and other factors.

Recommendations

Since 2018, GAO has made 26 recommendations to DOL to improve the UI system. However, DOL has not yet fully implemented 16 of these; doing so can reduce UI's fraud vulnerabilities.