2023 Annual Report: Additional Opportunities to Reduce Fragmentation, Overlap, and Duplication and Achieve Billions of Dollars in Financial Benefits

Fast Facts

Each year, GAO reports on federal programs with fragmented, overlapping, or duplicative goals or actions, and we have suggested hundreds of ways to address those problems, reduce costs, or boost revenue. In our 13th annual report, we identified 100 new matters for congressional consideration and recommendations to agencies to help address these findings.

Congressional and agency action in these areas has yielded about $600 billion in cost savings and revenue increases. Addressing remaining matters and recommendations could save tens of billions more dollars and improve government services.

Highlights

What GAO Found

GAO identified 100 new matters and recommendations in 35 new topic areas for Congress or federal agencies to improve the efficiency and effectiveness of government. For example:

- Congress should reauthorize the First Responder Network Authority by 2027 to ensure the continuity of the public-safety broadband network and collection of potential revenues of billions of dollars over 15 years.

- The Office of Personnel Management could save hundreds of millions of dollars or more annually by implementing a monitoring mechanism to identify and remove ineligible family members from the Federal Employees Health Benefits program.

- Responsible federal offices need a national broadband internet access strategy and should address any key statutory limitations to better manage fragmented efforts across 15 federal agencies and more than 130 programs, and to address overlap and potential duplication.

- The Department of Health and Human Services’ Administration for Community Living should identify a mechanism for nine federal programs across four federal agencies to continue sharing falls prevention information with one another and with disability organizations and providers in order to better manage fragmentation and potentially save tens of millions of dollars annually by reducing medical expenses related to falls.

- The Internal Revenue Service should document processes used to address certain compliance risks for COVID-19 employer tax credits, and implement additional compliance activities to potentially recapture tens of millions of dollars or more of ineligible claims.

- The General Services Administration could generate or save millions of dollars in property sales or space reduction opportunities by leveraging lessons learned to help with decision-making processes.

- The Small Business Administration could recover millions of dollars by taking additional steps to identify and respond to potentially fraudulent or ineligible Restaurant Revitalization Fund recipients.

- Congress and federal agencies could better manage fragmentation across the more than 30 federal entities involved in disaster recovery to improve service delivery to disaster survivors and improve the effectiveness of recovery efforts.

Congress and agencies have addressed many of the 1,885 matters and recommendations that GAO identified from 2011 to 2023 to reduce costs, increase revenues, and improve agencies’ operating effectiveness, although work remains to fully address them. To achieve these benefits, as of April 2023, Congress and agencies had fully addressed 1,239 (about 66 percent) of the 1,885 matters and recommendations and partially addressed 144 (about eight percent).

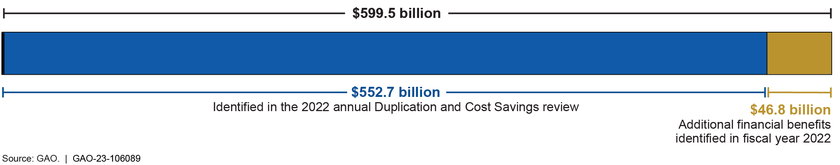

As shown in the figure below, these efforts have cumulatively resulted in about $600 billion in financial benefits, an increase of $46.8 billion from GAO’s last report on this topic. These are rough estimates based on a variety of sources that considered different time periods and used different data sources, assumptions, and methodologies.

Financial Benefits of $599.5 Billion, GAO’s 2011-2023 Duplication and Cost Savings Reports

Further steps are needed to fully address the matters and recommendations GAO identified from 2011 to 2023. While GAO is no longer tracking 119 matters and recommendations due to changing circumstances, GAO estimates that fully addressing the remaining 527 open matters and recommendations could result in savings of tens of billions of dollars and improved government services, among other benefits. For example:

|

Topic area and description |

Mission |

Potential benefits |

|---|---|---|

|

*Medicare Payments by Place of Service: Congress should consider directing the Secretary of Health and Human Services to equalize payment rates between settings for evaluation and management office visits and other services that the Secretary deems appropriate. (GAO-16-189) |

Health |

$141 billion over 10 years (Congressional Budget Office) |

|

*Nuclear Waste Disposal: The Department of Energy may be able to reduce certain risks by adopting alternative approaches to treating a portion of its low-activity radioactive waste. (GAO-22-104365) |

Energy |

Tens of billions of dollars (GAO) |

|

Navy Shipbuilding: The U.S. Navy could improve its acquisition practices and take steps to ensure ships can be efficiently sustained. (GAO-20-2) |

Defense |

Billions of dollars (GAO) |

|

Medicare Advantage: The Centers for Medicare & Medicaid Services could better adjust payments for differences between Medicare Advantage plans and traditional Medicare providers in the reporting of beneficiary diagnoses. (GAO-12-51) |

Health |

Billions of dollars (MedPAC) |

|

*Internal Revenue Service Enforcement Efforts:Enhancing the Internal Revenue Service enforcement and service capabilities can help reduce the gap between taxes owed and paid by collecting tax revenue and facilitating voluntary compliance. This could include expanding third-party information reporting. For example, reporting could be required for certain payments that rental real estate owners make to service providers, such as contractors who perform repairs on their rental properties, and for payments that businesses make to corporations for services. (GAO-09-238, GAO-08-956) |

General Government |

Billions of dollars (Joint Committee on Taxation) |

|

*Foreign Military Sales Administrative Account: Congress should consider redefining what can be considered an allowable expense to be charged from the administrative account. (GAO-18-401) |

Defense |

Tens of millions of dollars annually (GAO) |

Why GAO Did This Study

GAO issues annual reports on federal programs, agencies, offices, and initiatives—either within departments or government-wide—that have duplicative goals or activities. As part of this work, GAO also identifies additional opportunities for greater efficiency and effectiveness that result in cost savings or enhanced revenue collection.

This report discusses new opportunities for achieving billions of dollars in financial savings and improving the efficiency and effectiveness of a wide range of federal programs. It also evaluates the status of matters for congressional consideration and recommendations for federal agencies related to the Duplication and Cost Savings body of work.

In addition, this report provides examples of open matters to Congress and recommendations to federal agencies where further implementation steps could yield significant financial and other (non-financial) benefits.

For more information, contact Jessica Lucas-Judy at (202) 512-6806 or lucasjudyj@gao.gov, or Michelle Sager at (202) 512-6806 or sagerm@gao.gov.