Private Health Insurance: Markets Remained Concentrated through 2018, with Increases in the Individual and Small Group Markets

Fast Facts

Several companies may be selling health insurance in a given market, but, as we previously reported, most people usually enroll with one of a small number of insurers. Known as market concentration, this can result in higher premiums due to less competition in the market.

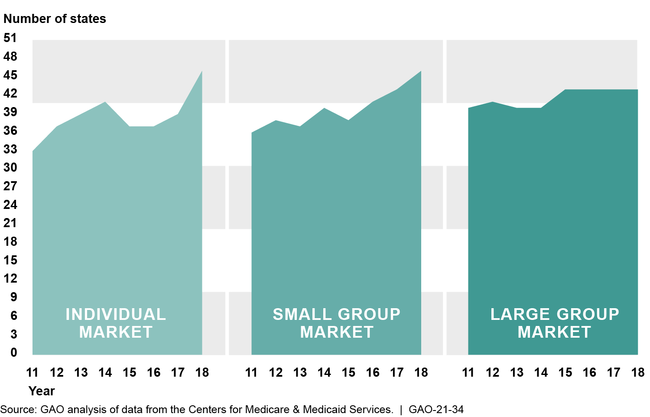

We found this pattern continued through 2018, with the markets for individuals and for small employers seeing an increase in concentration over the last 2 years. Specifically, three or fewer health insurers held at least 80% of the market in 46 states for both of these markets—marking an increase of market concentration in at least 10 states since 2011.

Highlights

What GAO Found

Enrollment in private health insurance plans in the individual (coverage sold directly to individuals), small group (coverage offered by small employers), and large group (coverage offered by large employers) markets has historically been highly concentrated among a small number of issuers. GAO found that this pattern continued in 2017 and 2018. For example:

- For each market in 2018, at least 43 states (including the District of Columbia) were highly concentrated.

- Overall individual and small group markets have become more concentrated in recent years. The national median market share of the top three issuers increased by approximately 8 and 5 percentage points, respectively, from 2015 through 2018. With these increases, the median concentration was at least 94 percent in both markets in 2018.

Number of States and District of Columbia Where the Three Largest Issuers Had at Least 80 Percent of Enrollment, by Market, 2011-2018

GAO found similar patterns of high concentration across the 39 states in 2018 that used federal infrastructure to operate individual market exchanges— marketplaces where consumers can compare and select among insurance plans sold by participating issuers—established in 2014 by the Patient Protection and Affordable Care Act (PPACA) and known as federally facilitated exchanges. From 2015 through 2018, states that were already highly concentrated became even more concentrated, often because the number of issuers decreased or the existing issuers accrued the entirety of the market share within a state. In 2017 and 2018 all 39 states were highly concentrated.

GAO received technical comments on a draft of this report from the Department of Health and Human Services and incorporated them as appropriate.

Why GAO Did This Study

GAO previously reported that, from 2011 through 2016, enrollment in the individual, small group, and large group health insurance markets was concentrated among a few issuers in most states (GAO-19-306). GAO considered states' markets or exchanges to be highly concentrated if three or fewer issuers held at least 80 percent of the market share. GAO also found similar concentration on the health insurance exchanges established in 2014 by PPACA. A highly concentrated health insurance market may indicate less issuer competition and could affect consumers' choice of issuers and the premiums they pay for coverage.

PPACA included a provision for GAO to periodically study market concentration. This report describes changes in the concentration of enrollment among issuers in the overall individual, small group, and large group markets; and individual market federally facilitated exchanges.

GAO determined market share in the overall markets using enrollment data from 2017 and 2018 that issuers are required to report annually to the Centers for Medicare & Medicaid Services (CMS). GAO determined market share in the individual market federally facilitated exchanges in 2018 using enrollment data from CMS. For all analyses, GAO used the latest data available.

For more information, contact John Dicken at (202) 512-7114 or dickenj@gao.gov.