Medicaid: Primer on Financing Arrangements

Fast Facts

This report, based on past work, describes ways states pay for their share of Medicaid, a program that finances health care for certain low-income people and others through a federal-state partnership.

The federal government provides matching funds based in part on state estimates of their costs. States can use money from local governments and other sources to pay some costs.

We found that through certain financing arrangements, states can lower their contribution and shift Medicaid costs to the federal and local governments and care providers. This can increase the federal share and poses risks to the program’s sustainability.

Both federal and state governments fund Medicaid

A graphic of federal, Medicaid, and state funding

Highlights

What GAO Found

GAO provides a primer describing the most common types of arrangements used by states to finance the nonfederal share of state's Medicaid expenditures. The primer provides examples of how these arrangements can shift the magnitude or share of expenditures to local governments, providers, and the federal government.

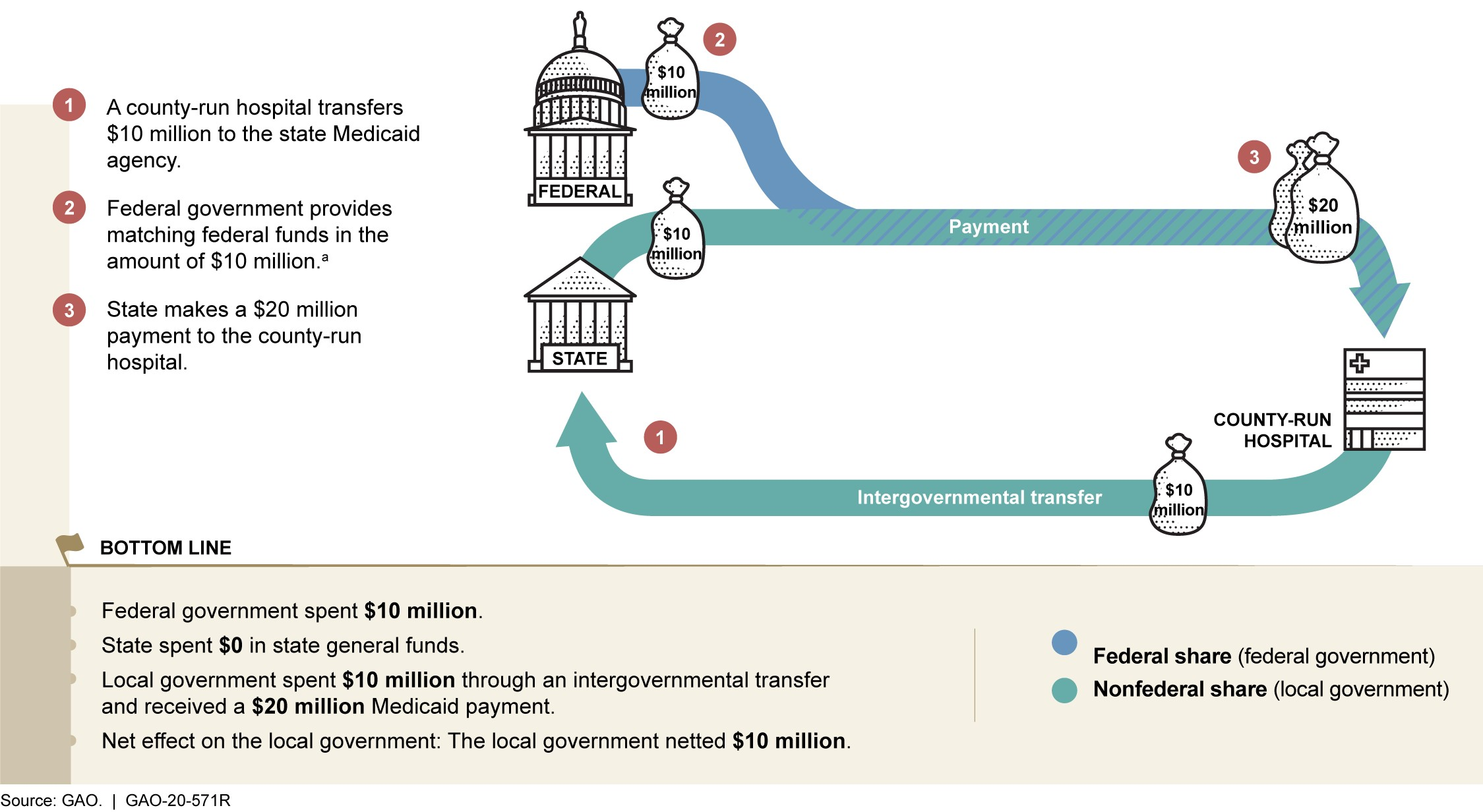

Federal law imposes requirements around the use of provider and local government funds to finance the nonfederal share of a state's Medicaid expenditures, but in some cases, the nonfederal share of a particular Medicaid payment can be financed entirely by local government or by using funding from taxes levied on providers with no contribution from state general funds. In these cases, the arrangement can shift responsibility for financing Medicaid expenditures to local governments, providers, and the federal government. For example, if a state finances the nonfederal share using local government funds (e.g. funds from a county-run hospital) the arrangement shifts the financing to the federal government because the net payment—the payment minus any funds contributed by the provider— the hospital receives consists entirely of federal funds.

Example of a Medicaid Payment Financed by Local Government and Federal Funds

Why GAO Did This Study

The federal government and states share responsibility for financing Medicaid expenditures. The Centers for Medicare & Medicaid Services (CMS), the agency within the Department of Health and Human Services (HHS), which oversees Medicaid, matches each state's Medicaid expenditures for health care services with federal funds according to a statutory formula. These expenditures include payments for care provided to Medicaid beneficiaries, such as base payments directly to providers for services rendered, and supplemental payments, which are not tied to care for individual beneficiaries, but may help offset any remaining costs of care for Medicaid beneficiaries.

Federal law requires that states finance at least 40 percent of their share of total Medicaid expenditures through state funds; within limits, they can use funding from local governments or funding from taxes levied on providers. The arrangements states use to finance the nonfederal share of Medicaid expenditures have implications for federal spending. For example, GAO found in past work that states rely heavily on local government and provider funds to finance supplemental payments, sometimes in ways that lowered their own expenditures by shifting a larger share of the payments to the federal government. GAO was asked to provide information on different arrangements states have used to finance the nonfederal share of Medicaid expenditures. In this report, GAO provides a primer on this topic, describing these financing arrangements, and provides examples of how these arrangements have shifted the magnitude or share of expenditures to local governments, providers, and the federal government.

GAO was asked to provide information on different arrangements states have used to finance the nonfederal share of Medicaid expenditures. In this report, GAO provides a primer on this topic, describing these financing arrangements, and provides examples of how these arrangements have shifted the magnitude or share of expenditures to local governments, providers, and the federal government. To do so, GAO reviewed related GAO reports and other research published since 2012 that examined the arrangements most commonly used by states, as well as relevant federal laws, regulations, and guidance. Using that information, GAO produced illustrations of the financing arrangements and described their implications. GAO provided a draft of this report to HHS for review and comment. HHS provided technical comments, which GAOs incorporated as appropriate.

Recommendations

Since designating Medicaid as a high-risk area in 2003, GAO has made at least 55 recommendations related to the appropriate use of program dollars. Of these recommendations, 15 were not yet implemented as of May 2020.