Federal Budget: Government-Wide Inventory of Accounts with Spending Authority and Permanent Appropriations, Fiscal Years 1995 to 2015

Fast Facts

Not all federal funding is reviewed each year as part of the annual appropriations process. For example, Congress can make a law that allows an agency to collect fees for services, such as copyright registration fees, and use that money without further congressional action.

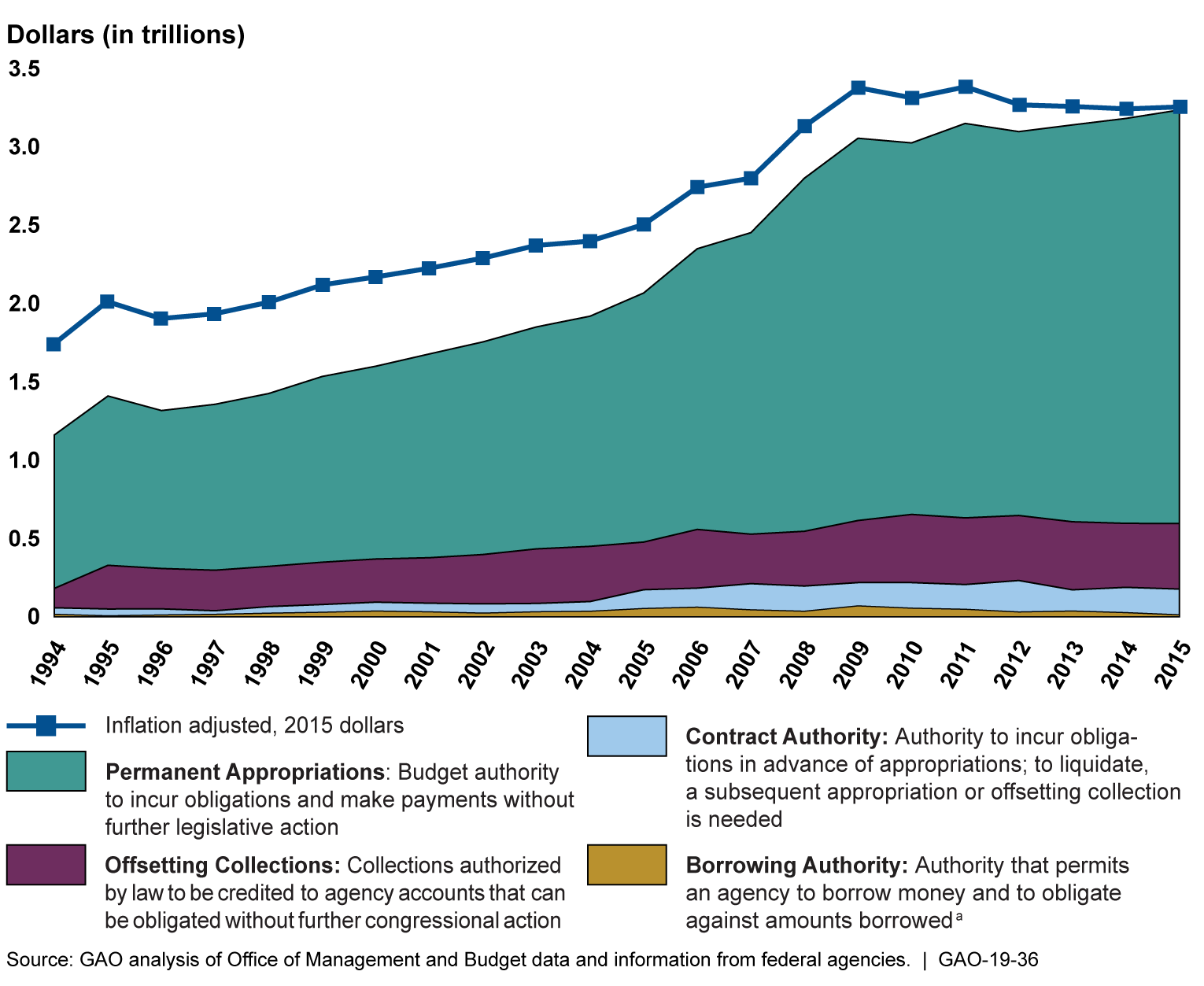

This report updates our inventory of this type of federal funding and helps provide visibility into spending authority that is not from the annual appropriations process. We found $3.2 trillion in such funding from fiscal year 1995 through fiscal year 2015 (the most recent data at the start of our work). This is an increase of 88% from fiscal year 1994 (our last update).

Over time, more federal funding was not reviewed each year as part of the annual appropriations process

A line graph and area chart showing growth in inflation-adjusted and actual dollars

Highlights

What GAO Found

A total of $3.2 trillion in spending authority and permanent appropriations was reported in fiscal year 2015; an increase of 88 percent from fiscal year 1994 adjusted for inflation in fiscal year 2015 dollars. Fiscal year 1994 was the last year included in GAO's prior work. For the purposes of this report, spending authority and permanent appropriations is budget authority provided to agencies through laws other than annual appropriations acts or available permanently by law without further legislation. These authorities include permanent appropriations, contract authority, borrowing authority, offsetting collections, and monetary credits or bartering. Permanent appropriations were the primary driver of the increase in spending authority and permanent appropriations. Offsetting collections authority--which includes certain fees, fines, and penalties--also grew. Agencies reported no use of monetary credits or bartering.

Figure 1 : Growth of Spending Authority and Permanent Appropriations Government-Wide by Budget Authority Type, Fiscal Years 1994 through 2015

Note: Federal agencies reported no use of any monetary credits or bartering—the authority to make purchases with seller credits or something other than dollar amounts, such as land or services.

aFor purposes of this report, borrowing authority does not include the Department of the Treasury’s authority to borrow from the public or other sources under chapter 31, of title 31 of the U.S. Code.

Permanent appropriations fund federal entitlement programs, such as Medicare, administered by the Department of Health and Human Services (HHS), and the Social Security Administration's (SSA) Old-Age, Survivors, and Disability Insurance program. These programs are a significant proportion of reported budget authority in GAO's inventory of accounts in fiscal year 2015. These programs continue to show spending increases largely as a result of the aging population and rising health care costs and are projected to continue to increase in the future. In fiscal year 2015, 7 of the 10 accounts reporting the largest dollar amounts of spending authority and permanent appropriations funded entitlement programs.

Three agencies comprised three quarters of the total government-wide spending authority and permanent appropriations in fiscal year 2015.

- HHS reported the largest amount of spending authority and permanent appropriations with $979 billion, or about 30 percent--mainly from Medicare. HHS overtook SSA and reported the highest dollar amounts of permanent appropriations for the first time in fiscal year 2006.

- SSA reported $920 billion, or about 28 percent of total spending authority and permanent appropriations--mainly from its Old-Age and Survivor's Insurance program and the Disability Insurance program.

- The Department of the Treasury reported the third largest amount--$542 billion, or about 17 percent--the majority of which is for interest on debt held by the public and intragovernmental debt. This interest dropped as a percentage of permanent appropriations since fiscal year 1994, due to lower interest rates that allow the government to borrow money more cheaply. However, interest rates are predicted to rise in the long term, which would increase the net interest costs on the debt.

Figure 2: Agencies Reporting the Largest Percentage of Total Spending Authority and Permanent Appropriations Used, Fiscal Year 2015

Note: The “Other” category combines agencies with a much smaller percentage of spending authority and permanent appropriations use.

The second largest reported budget authority type was offsetting collections--a total of $421 billion in fiscal year 2015, more than double the fiscal year 1994 amount, adjusted for inflation. The Postal Service reported the largest use of offsetting collections authority in fiscal year 2015 in its Postal Service Fund, which includes revenue from mail services.

Sequestration--cancellation of budgetary resources under a presidential order--is a process established in statute which helps to enforce spending limits and thereby control the deficit. In fiscal year 2015, 57 percent of spending authority and permanent appropriations authorities were exempt from sequestration, up from 37 percent in fiscal year 1994. This means that fewer of these authorities were subject to this budgetary enforcement mechanism in fiscal year 2015.

Why GAO Did This Study

Congress can provide budget authority to federal agencies and programs through the annual appropriations process. It can also provide budget authority through laws other than annual appropriations acts, or through permanent appropriations that permit the agency to obligate budget authority without further congressional action. Analysis of these authorities helps provide Congress with visibility into spending authority that is not considered during the annual appropriations process.

GAO was asked to update its 1996 report that had provided an inventory of accounts with spending authority and permanent appropriations for fiscal years 1985 through 1994. This report discusses (1) federal budget accounts with spending authority and permanent appropriations, including the statutory references for the authorities, changes in the number of accounts and dollar amounts since fiscal year 1994, and other relevant information; and (2) whether the identified accounts are subject to or exempt from sequestration, or subject to any special sequestration rules or limitations. GAO also is providing an online dataset of the inventory of accounts with spending authority and permanent appropriations on GAO's public website at https://www.gao.gov/products/GAO-19-36.

GAO analyzed Office of Management and Budget (OMB) budget data to identify accounts with spending authority and permanent appropriations. GAO reviewed data through fiscal year 2015 because that was the most recent data available when GAO began its work. GAO reviewed agency information to confirm data and statutory authority. Agencies also reviewed and verified the final data for their accounts. For the sequestration designation, GAO analyzed OMB data for fiscal years 2013 and 2015--the most recently completed years for which sequestration occurred and OMB identified designations when GAO began its work.

GAO provided a draft of this report and the online dataset to the Director of OMB for review and comment. OMB staff provided technical comments, which GAO incorporated as appropriate.

For more information, contact Tranchau (Kris) T. Nguyen at (202) 512-6806 or nguyentt@gao.gov; Julia C. Matta at (202) 512-4023 or mattaj@gao.gov.