The Nation's Retirement System: A Comprehensive Re-evaluation Needed to Better Promote Future Retirement Security

Fast Facts

The U.S. retirement system has fundamentally changed since the 1970s, and several challenges have emerged, including:

Baby boomers reaching retirement age, affecting Social Security's finances

Complexity of planning and managing funds in employer-sponsored retirement plans

Growing debt and health care costs hindering individual savings

These challenges increase the risk that people will outlive their retirement savings and put added pressure on government programs.

This testimony from U.S. Comptroller General Gene Dodaro is based on an earlier report that recommended establishing a commission to comprehensively examine the retirement system.

Smashed piggy bank on top of five $100 bills.

Highlights

What GAO Found

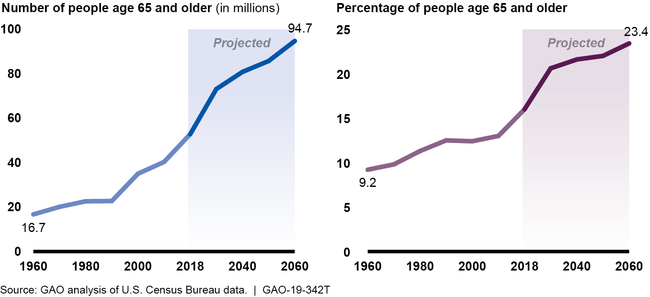

Fundamental changes over the past 40 years have led to various risks and challenges for the three main pillars supporting the U.S. retirement system. For example, current projections indicate that by 2034, the Old-Age and Survivors trust fund for Social Security's retirement program—the first pillar—will only be sufficient to pay 77 percent of scheduled benefits, due in part to the aging of the population (see figure). Other federal government retirement-related programs also face financial uncertainty. For example, the Pension Benefit Guaranty Corporation, which insures the pension benefits of most private sector defined benefit plans, estimates a greater than 90 percent chance the multiemployer program will be insolvent by 2025. Meanwhile, employer-sponsored plans—the second pillar—have experienced a shift from traditional defined benefit (DB) plans that generally provide set monthly payments for life, to defined contribution (DC) account-based plans, like 401(k)s. DC plans provide greater portability of savings that can be better suited to the needs of a more mobile workforce, but also require individuals to assume more responsibility for planning and managing their savings. While DC plans can provide meaningful retirement security for many, especially higher earners, lower earners appear more prone to having little or no savings in their DC accounts. Further, individuals' savings—the third pillar—may be constrained by economic trends such as low real wage growth and growing out-of-pocket health care costs. Combined with increased longevity, these challenges can put individuals at greater risk of outliving their savings and fiscal pressures on government programs will likely grow.

The U.S. Population Is Aging

Congress generally has sought to address retirement-related issues in an incremental fashion. Also, no one agency is responsible for overseeing the U.S. retirement system in its entirety, so there is no obvious federal agency to lead a comprehensive reform effort. It has been nearly 40 years since a federal commission has conducted a comprehensive evaluation of the nation's approach to financing retirement. Without a more comprehensive re-evaluation of the challenges across all three pillars of the system, it may be difficult to identify effective, enduring solutions. Unless timely action is taken, many older Americans risk not having sufficient means for a secure and dignified retirement.

Why GAO Did This Study

Strengthening the U.S. retirement system to be more accessible and financially sound is important to ensuring that all Americans can retire with dignity and security, and to managing the fiscal exposures to the federal government from various retirement-related programs. Currently, the U.S. retirement system, and many of the workers and retirees it was designed to help, face major challenges.

This testimony discusses (1) the fiscal risks and other challenges facing the U.S. retirement system, and (2) the need to re-evaluate our nation's approach to financing retirement. It is based on a 2017 report, GAO-18-111SP , on the nation's retirement system, with updated statistics when more recent estimates from publicly available sources were available.

Recommendations

In the 2017 report, GAO recommended that Congress should consider establishing an independent commission to comprehensively examine the US retirement system and make recommendations to clarify key policy goals for the system and improve how the nation promotes retirement security.