Private Health Insurance: Enrollment Remains Concentrated among Few Issuers, including in Exchanges

Fast Facts

There may be several companies selling health insurance in a given market, but we've previously found that most people generally enroll with one of a few companies. When that happens, it can mean less competition and higher premiums for that area.

We updated our work with more recent private insurance data. The overall story is similar: The 3 largest companies held 80% or more of the market in at least 37 states.

Available data on the Affordable Care Act insurance exchanges had similar trends. Three or fewer companies held 80% or more of the market in at least:

46 of 49 exchanges for individuals

42 of 46 exchanges for small employers

This is a photo of a stethoscope and calculator resting on a medical bill.

Highlights

What GAO Found

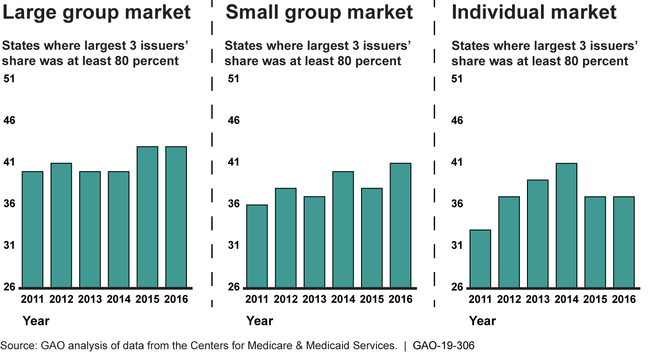

Enrollment in private health insurance plans continued to be concentrated among a small number of issuers in 2015 and 2016. In the overall large group market (coverage offered by large employers), small group market (coverage offered by small employers), and individual market (coverage sold directly to individuals), the three largest issuers held 80 percent of the market or more in at least 37 of 51 states. This is similar to what GAO previously reported for 2011 through 2014.

Number of States Where the Three Largest Issuers Had at Least 80 Percent of Enrollment, by Market, 2011-2016

GAO also found that within the overall individual and small group markets in each state, the health insurance exchanges established by the Patient Protection and Affordable Care Act (PPACA) were also concentrated from 2015 to 2017.

- For the individual market exchanges, in each year, three or fewer issuers held 80 percent or more of the market, on average, in at least 46 of the 49 state exchanges for which GAO had data. Further, the largest issuers increased their market share in about two-thirds of exchanges. The number of issuers participating in a market and their market shares can affect concentration, and many individual exchanges generally had a decreasing number of participating issuers over time.

- For the small group market exchanges, in each year, three or fewer issuers held 80 percent or more of the market in at least 42 of the 46 state exchanges for which GAO had data. The small group exchanges also had slight changes in issuer participation and market share over this time period.

GAO received technical comments on a draft of this report from the Department of Health and Human Services and incorporated them as appropriate.

Why GAO Did This Study

A highly concentrated health insurance market may indicate less competition and could affect consumers' choice of issuers and the premiums they pay. In 2014, PPACA required the establishment of health insurance exchanges—a new type of marketplace where individuals and small groups can compare and select among insurance plans sold by participating issuers—and the introduction of other reforms that could affect market concentration and competition among issuers. GAO previously reported that enrollment through these newly established exchanges was also generally concentrated.

PPACA included a provision for GAO to study market concentration. This report describes changes in the concentration of enrollment among issuers in (1) overall individual, small group, and large group markets, and (2) individual and small group exchanges.

GAO determined market share in the overall markets using enrollment data from 2015 and 2016 that issuers are required to report annually to the Centers for Medicare & Medicaid Services (CMS) and compared that data to 2011 through 2014 enrollment data GAO analyzed in previous reports. GAO determined market share in the exchanges from 2015 through 2017 using other sources of enrollment data from CMS and states. For all data sets, GAO used the most recent data available.

For more information, contact John Dicken at (202) 512-7114 or dickenj@gao.gov.