Federal Housing Administration: Opportunities Exist to Improve Defaulted Single-Family Loan Sales

Fast Facts

The Federal Housing Administration helps increase homeownership by insuring mortgage loans that have less strict standards and lower down payments than conventional loans. The housing crisis of 2007-2011 led to historic rates of mortgage defaults, many of which were insured by FHA.

FHA can sell these loans in order to limit its losses from defaults. We found that the defaulted loans FHA sold were more likely to go into foreclosure than the defaulted loans FHA kept. In addition, about 3% of the loans FHA sold were not actually eligible for sale.

We made 9 recommendations, including that FHA establish a schedule for its eligibility checks.

[Map updated to correct the legend.]

Percentage of FHA defaulted loans sold, by state, 2010-2016

Map showing range of loans sold per 1,000 loans in default by state

Highlights

What GAO Found

The Department of Housing and Urban Development's (HUD) Federal Housing Administration (FHA) uses multiple entities to check loan eligibility for the Distressed Asset Stabilization Program (DASP)—in which FHA accepts assignment of eligible, defaulted single-family loans from servicers in exchange for claim payments and sells the loans in competitive auctions. After servicers submit loans for sale, FHA and its contractors concurrently check loan data for completeness, validity, and eligibility. FHA relies on servicers to check eligibility a few weeks before and again after the bid date. The status of delinquent loans can be fluid, and a change in eligibility status close to this date may not be detected. GAO's analysis of fiscal year 2016 default data indicates about 2.67 percent of loans that FHA sold were ineligible based on length of delinquency or loss mitigation status. Without checking loan eligibility closer to bidding, FHA risks selling ineligible loans, and borrowers could lose access to benefits.

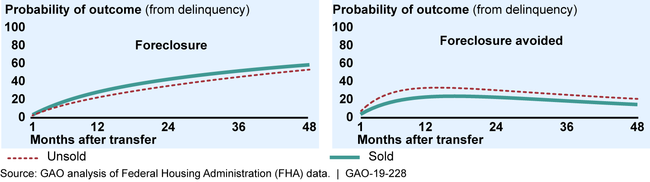

FHA does not evaluate outcomes for sold loans against similar unsold loans. GAO found that, in aggregate, sold defaulted loans were more likely to experience foreclosure than comparable unsold defaulted loans (see figure). However, GAO's analysis identified varying outcomes by purchasers and sales. For example, some purchasers' loans had higher probabilities of avoiding foreclosure, with borrowers making regular payments again by 24 months after the transfer of loans. Also, loans sold in 2016 sales were less likely to experience foreclosure compared to unsold loans. HUD policy states that the agency's evaluations isolate program effects from other influences. Evaluating outcomes for sold loans against similar unsold loans could help FHA determine whether DASP is meeting its objective of maximizing recoveries to the Mutual Mortgage Insurance Fund (MMI Fund) and understand the extent to which DASP helps borrowers.

Foreclosure and Foreclosure Avoidance Outcomes for Loans Sold through the Distressed Asset Stabilization Program and Similar, Unsold Loans, Fiscal Years 2013–2016

Note: Graphs do not include loans that were unresolved, paid-in-full, and in some other statuses.

Changing some of FHA's auction processes may help the MMI Fund. FHA could increase participation and MMI Fund recoveries in its auctions by communicating upcoming sales earlier. One purchaser said that additional notice would allow it time to plan for the capital needed to bid. Also, FHA set reserve prices (minimum acceptable price) based on the amount it expected to recover after loans completed foreclosure—yet GAO estimates that some of these loans will avoid foreclosure (see figure). As a result, FHA risks recovering less for the MMI Fund in loan sales than if the loans had not been sold.

Why GAO Did This Study

HUD insures single-family mortgage loans and is authorized to sell defaulted loans under the National Housing Act. In fiscal years 2010–2016, FHA auctioned off approximately 111,000 loans to private purchasers under DASP. DASP helped reduce a backlog of federally insured defaulted loans stemming from the 2007–2011 financial crisis and was intended to protect the MMI Fund by paying insurance claims before the costly foreclosure process.

GAO was asked to evaluate DASP. This report examines, among other things, certain DASP procedures, including verifying loan eligibility criteria, and documentation; FHA's evaluation of the identified outcomes of sold loans and how these compare with similar, unsold loans; and the potential effects that changes to DASP might have on the MMI Fund. GAO reviewed FHA policies, contracts, and reports, and interviewed FHA officials, selected servicers and purchasers based on sales participation, and other stakeholders. GAO also conducted a statistical analysis comparing outcome data for sold loans and similar loans that remained FHA-insured and analyzed the effect of loan pool characteristics on bidder participation.

Recommendations

GAO is making nine recommendations to FHA, including establishing specific time frames to check loan eligibility, evaluating loan outcome data, and changing auction processes to help protect the MMI Fund. FHA generally agreed with seven recommendations, and neither agreed nor disagreed with two. GAO maintains that all the recommendations are valid.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Federal Housing Administration | The Commissioner of FHA should ensure that its eligibility checks are conducted throughout the DASP sale process, such as by establishing a schedule to check for eligibility at certain milestones. (Recommendation 1) |

HUD developed Standard Operating Procedures for these sales and issued the procedures on October 17, 2019. Although we maintain that an eligibility check closer to the bid day would help prevent the sale of ineligible loans, these procedures outline the different parties involved in checking loan eligibility and note the timeframes throughout the sale process for which these checks should occur.

|

| Federal Housing Administration | In formalizing procedures for DASP, the Commissioner of FHA should document processes for timely consideration and review of program changes. (Recommendation 2) |

HUD developed Standard Operating Procedures for these sales that were published on October 17, 2019 that include a process for considering program changes. The procedures describe that HUD stakeholders (designees from the Office of Finance and Budget, Office of Asset Sales, Office of Risk Management, Office of General Counsel, and the FHA Commissioner's Office) will hold a policy decisions meeting at least 100 days prior to the bid day for an upcoming sale and continue to meet monthly. During this meeting, the stakeholders will (1) review the prior sale and proposed or implemented changes to determine whether the sale maximized recoveries, and (2) set policy objectives for the next sale. The Office of Asset Sales will create a Loan Sale Policy Memo following each meeting to capture discussions, decisions, or recommendations related to loan sale policy.

|

| Federal Housing Administration | The Commissioner of FHA should clearly define DASP objectives and develop measurable targets for all program objectives. (Recommendation 3) |

HUD issued Standard Operating Procedures for single-family loan sales on October 17, 2019. The document notes that these sales have been implemented to reduce losses or improve recoveries for FHA's Mutual Mortgage Insurance Fund. HUD's measurement of its primary goal is through the reserve pricing model which establishes the lowest acceptable price HUD will accept to yield the desired recoveries. HUD officials said that they will compare loan sale recoveries against other disposition types to measure results. HUD provided support on March 2, 2021 that it had updated the Office of Asset Sales website to be consistent with the Standard Operating Procedures. In addition to these primary goals, HUD pointed out that each sale may also have mission-driven goals, such as increasing sales to and participation of nonprofit/local government bidders. In November 2022, HUD provided information showing that its mission driven goal was for 50 percent of sales to go to nonprofit/local government bidders and that 55.4 percent of three sales held in 2022 were to nonprofit bidders.

|

| Federal Housing Administration | The Commissioner of FHA should use performance data to develop criteria for when to hold DASP sales. (Recommendation 4) |

HUD created a quarterly Single Family Loan Sale Performance Metrics Report to help determine when to hold a sale of defaulted single-family forward mortgages. The metrics will be compared quarterly to the metrics from the two most recent quarters. These metrics include volume of seriously delinquent cases (90+ days past due) in the FHA-insured mortgage portfolio; conveyance claim costs; HUD foreclosure timelines; the market environment and nonprofit interest, among others. A committee of internal HUD stakeholders will review these performance metrics regularly and discuss the merits of conducting a sale.

|

| Federal Housing Administration | The Commissioner of FHA should evaluate loan outcomes under DASP compared to outcomes for similar, unsold loans. (Recommendation 5) |

HUD's contractor performed a baseline analysis of the characteristics of loans that purchasers had reported as modified in the post-sale period, including a comparison to outcomes of similar, unsold loans. The contractor's analysis of the FHA portfolio compared the performance of loans sold through DASP with the overall FHA portfolio by determining the rate at which modifications failed and loans returned to delinquent status.

|

| Federal Housing Administration | The Commissioner of FHA should monitor individual purchasers' compliance with FHA's modification requirements and ensure the purchasers submit the data needed to evaluate the sustainability of modifications. (Recommendation 6) |

HUD issued a notice to purchasers of additional data the purchasers should provide to HUD during post-sale reporting that was effective in April 2020. HUD also provided an updated data dictionary to describe the new data fields. The new data fields include: current interest rate, maximum interest rate during the last 12 months, minimum interest rate during the last 12 months, time modified interest rate fixed, and reason modification not executed. These data fields will help HUD evaluate the sustainability of loan modifications made by purchasers.

|

| Federal Housing Administration | The Commissioner of FHA should communicate long-range notice to prospective bidders of upcoming DASP sales. (Recommendation 7) |

HUD issued a Standard Operating Procedure for these sales on October, 17, 2019, which states that the Office of Asset Sales will document decisions about long-range sale planning timelines in a Loan Sale Policy Memo, including an annual sale schedule that may be released to the public.

|

| Federal Housing Administration | The Commissioner of FHA should develop a methodology to assess the range of possible outcomes for loans when setting DASP reserve prices. (Recommendation 8) |

HUD issued an internal memo on March 25, 2023 updating and documenting its procedures for setting reserve pricing methodology for disposing of single-family residential loans. The memo proposes methodologies for three disposition methods, Claims without Conveyance of Title (CWCOT) for single family forward loans, note sales for single-family forward loans, and notes sales for Home Equity Conversion Mortgage (HECM) loans. HUD reviewed its recent sales and reserve price methodologies and identified enhancements that will make the reserve pricing methodologies for each method consistent and result in higher valuations of some loans. While our recommendation primarily was related to the reserve pricing methodology for single-family forward note sales, HUD has not conducted a sale on these assets since FY2016. However, the enhancements include considering variations across ranges of loan sizes and disposition methods, which is consistent with our recommendation. The memo also documents standardized processes for the single-family forward note sale as well as the other two types of loan sales HUD currently is conducting and, therefore, meets the intent of the recommendation given current conditions.

|

| Federal Housing Administration | The Commissioner of FHA should analyze FHA's loan portfolio and market information before setting loan eligibility criteria. (Recommendation 9) |

HUD issued Standard Operating Procedures for these sales on October 17, 2019. The procedures contain examples of loan eligibility criteria used in prior sales. The SOP further stated that sale discussions and deliberations would be held monthly prior to initiating a loan sale, that market conditions would be discussed in these meetings, and that past sales results would be considered when determining whether FHA should conduct a sale. Further, the SOP stated that loan eligibility criteria would continue to evolve over time based on policy objectives, the current FHA defaulted portfolio, and market conditions.

|