Homeownership: Information on Mortgage Options and Effects on Accelerating Home Equity Building

Highlights

What GAO Found

Federal homeownership assistance programs generally are not designed to accelerate equity building (home equity is the difference between the value of a home and the amount owed on a mortgage). For example, programs that offer grants for down-payment assistance can provide a one-time boost to home equity. However, these programs are not specifically designed to accelerate equity building—that is, increasing the pace of paying off principal more quickly than would be the case with a 30-year fixed-rate mortgage. Instead, the focus of federal programs is on providing affordable access to homeownership, including through grants, loans, and mortgage insurance or guarantees. For instance, federal mortgage insurance programs help provide market liquidity by protecting lenders from losses, in turn increasing access to credit and homeownership, and ultimately, the opportunity for equity building for home buyers.

Borrowers have options to accelerate equity building that include obtaining shorter-term mortgages, making more frequent or additional payments, or choosing a mortgage product designed to accelerate equity building. For example, a mortgage product introduced by private lenders in 2014—the Wealth Building Home Loan (WBHL)—has features designed to accelerate equity building, including shorter terms (15 or 20 years) and the option to buy down the interest rate. The product also allows for no down payment. However, these products have trade-offs, including the following:

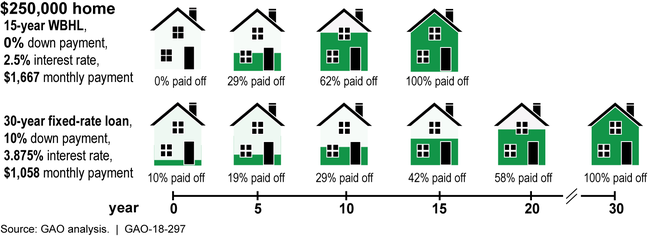

- Shorter-term loans build home equity (in terms of principal reduction) at a faster rate, but require higher monthly payments (see fig.). Payments for a 15-year fixed-rate mortgage can be more than 40 percent higher than for a 30-year fixed-rate mortgage.

- Higher payments may make mortgages less affordable or limit access for lower-income borrowers. For example, higher payments may result in a higher debt-to-income ratio for some home buyers, which may prevent them from qualifying for a mortgage unless they buy a less expensive home.

- In contrast, all else equal, loans with a shorter term generally have reduced credit risk—the likelihood of a home buyer defaulting on a mortgage—for lenders.

Principal Reduction Pace: 15-Year Fixed-Rate Wealth Building Home Loan (WBHL) versus 30-Year Fixed-Rate Loan

Note: Monthly mortgage payments do not include property tax or any type of insurance. Interest rates used are generally consistent with market rates in September and October 2017.

Why GAO Did This Study

The federal government has a number of programs to help increase access to affordable homeownership for first-time buyers and lower-income households, including programs that provide guarantees for certain types of mortgages and funding that can be used for down-payment assistance. Generally, homeowners can build home equity by making payments on a mortgage to reduce the outstanding principal (assuming home value does not depreciate). Recently, there has been interest in mortgage products that accelerate home equity building.

GAO was asked to explore options for building equity through homeownership. This report discusses (1) how federal homeownership assistance programs affect home equity building; and (2) options, including private-sector mortgage products, through which borrowers can accelerate home equity building and the trade-offs of these options for both borrowers and lenders.

GAO analyzed relevant laws and program guidance of federal homeownership assistance programs. GAO attended housing conferences and interviewed relevant federal and state agency officials, academics, and industry stakeholders, including mortgage insurers and lenders, to identify existing and proposed accelerated equity-building products and mechanisms and to better understand the benefits and trade-offs of accelerated equity building. GAO also developed examples of mortgage scenarios to illustrate the trade-offs of accelerated equity building. Federal agencies provided technical comments, which were incorporated where appropriate.

For more information, contact Daniel Garcia-Diaz, 202-512-8678 or GarciaDiazD@gao.gov.