The Nation's Retirement System: A Comprehensive Re-evaluation Is Needed to Better Promote Future Retirement Security

Highlights

Section 1: Landscape of U.S. Retirement System Has Shifted

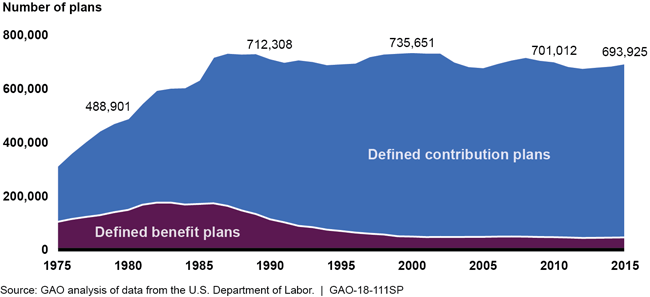

Fundamental changes have occurred over the past 40 years to the nation’s current retirement system, made up of three main pillars: Social Security, employer-sponsored pensions or retirement savings plans, and individual savings. These changes have made it increasingly difficult for individuals to plan for and effectively manage retirement. In particular, there has been a marked shift away from employers offering traditional defined benefit (DB) pension plans to defined contribution (DC) plans, such as 401(k)s, as the primary type of retirement plan. This shift to DC plans has increased the risks and responsibilities for individuals in planning and managing their retirement. In addition, economic and societal trends—such as increases in debt and health care costs—can impede individuals’ ability to save for retirement.

Trends in Private Sector Retirement Plans since 1975

Section 2: Individuals Face Three Key Challenges in Planning and Managing Their Retirement

GAO’s prior work has found that many individuals face the following challenges in their efforts to provide for a financially secure retirement at a time when increases in longevity further raise the risk of outliving their savings:

-

Access: Accessing retirement plans through their employers.

-

Saving: Accumulating sufficient retirement savings.

-

Retirement: Ensuring accrued savings and benefits last through retirement.

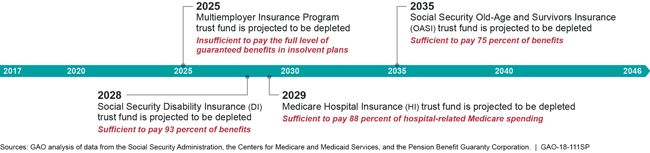

Section 3: U.S. Retirement System Is Threatened by Fiscal Risks and Benefit Adequacy Concerns

The three pillars of the current retirement system in the United States are anticipated to be unable to ensure adequate benefits for a growing number of Americans due, in part, to the financial risks associated with certain federal programs.

-

Social Security’s retirement program (Old-Age and Survivors Insurance):

Beginning in 2035, this program is projected to be unable to pay full benefits. Long-term fiscal projections show that, absent fiscal policy changes, the federal government is on an unsustainable path, largely due to spending increases driven by the growing gap between federal revenues and health care programs, demographic changes, and net interest on the public debt. -

Private employer-sponsored plans:

DB plans: On the decline; also, the Pension Benefit Guaranty Corporation (PBGC) which insures most DB plans, is at risk due to substantial liabilities, especially in its multiemployer program.

DC plans: On the rise, but with more risk and responsibility for individuals; many individuals are not saving enough in these plans to provide an adequate retirement.

-

Individual savings: Outside of employer-sponsored plans, individuals’ retirement savings are often low or nonexistent, which may increase their reliance on various federal and state safety net programs.

Timeline of Projected Fiscal Risks for Certain Federal Programs

Section 4: The Need to Re-evaluate the Nation’s Approach to Financing Retirement

Over the past 40 years, the nation has sought to address the issues facing the U.S. retirement system in a piecemeal fashion. This approach may not be able to effectively address the interrelated nature of the challenges facing the system today. Fundamental economic changes have occurred, as well as the shift from DB to DC plans, with important consequences for the system. Further, it has been nearly 40 years since a federal commission has conducted a comprehensive evaluation of the nation’s approach to financing retirement. A panel of retirement experts convened by GAO in November 2016 agreed that there is a need for a new comprehensive evaluation. The experiences of other countries can also provide useful insights for ways to improve the system.

Matter for Congressional Consideration

Congress should consider establishing an independent commission to comprehensively examine the U.S. retirement system and make recommendations to clarify key policy goals for the system and improve how the nation promotes retirement security.

For more information, contact Charles A Jeszeck at (202) 512-7215 or jeszeckc@gao.gov.

Recommendations

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider establishing an independent commission to comprehensively examine the U.S. retirement system and make recommendations to clarify key policy goals for the system and improve how the nation can promote more stable retirement security. We suggest that such a commission include representatives from government agencies, employers, the financial services industry, unions, participant advocates, and researchers, among others, to help inform policymakers on changes needed to improve the current U.S. retirement system. | On April 25, 2018, the Senate introduced the "Commission on Retirement Security Act of 2018" (S.2753). On May 14, 2019, the Senate re-introduced this legislation (S.1435). This bipartisan legislation would establish a comprehensive retirement Commission that would be responsible for developing findings, conclusions, and recommendations for how to improve or replace existing private retirement programs. Commission members would be appointed using a bipartisan process and would include representatives from government agencies; current or former members of Congress; economic experts; and practitioners with expertise or experience engaging with employers, labor unions, and consumers designing and administering retirement plans. As of January 2025, no additional action has been taken. |