2017 Filing Season: New Wage Verification Process Holds Promise but IRS Faced Implementation Challenges

Fast Facts

The IRS has faced the ongoing problem of identity theft refund fraud and improper payments. For the 2017 tax filing season, IRS implemented W-2 systemic verification—which compares W-2 wage data to taxpayers' returns before paying refunds. This could help identify discrepancies and fraudulent refunds.

In this testimony, we reported that these W-2 data helped identify $863 million in refunds as potentially fraudulent. However, wage data were not available in time for all tax returns due to older computer systems and paper W-2s (which had to be manually processed).

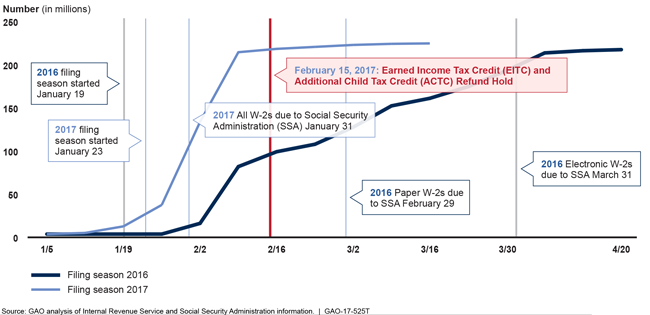

Number of W-2s the IRS received for the 2016 and 2017 Filing Seasons

Graph of numbers of W-2s the IRS received during the filing seasons for 2016 and 2017.

Highlights

What GAO Found

To help combat identify theft refund fraud and improper payments, in 2017 the Internal Revenue Service (IRS) implemented provisions of the Protecting Americans from Tax Hikes Act of 2015 (the Act). Consistent with GAO's prior reporting, the Act advanced the deadline for employers filing Form W-2, Wage and Tax Statement (W-2) with the Social Security Administration to January 31, allowing IRS to verify information reported on tax returns (such as wages and withholding) before issuing refunds, a process IRS calls W-2 systemic verification. As of February 17, 2017, IRS received over 214 million W-2 forms (a 125 percent increase over the same time last year). The Act also required IRS to hold refunds until February 15 for taxpayers claiming the Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC) to provide time to use W-2 data to verify returns. Although IRS applied the verification process to all returns, preliminary data suggest the following:

For returns where the taxpayer claimed the EITC or ACTC, IRS verified the wage information for over 35 percent of these returns before February 15. Moreover, the refund hold allowed IRS time to verify returns when it received more W-2 data, resulting in approximately $863 million in additional refunds being identified as potentially fraudulent. However, since not all W-2 data were available before February 15, IRS was unable to verify wage information for over 58 percent (7.7 million) of tax returns with refunds claiming the EITC or ACTC for a total of $38.1 billion.

IRS did not hold returns that did not claim the EITC or ACTC because it was not required to do so, although those returns were subject to systemic verification and other checks. Preliminary data show that IRS verified wages reported on 8.6 million (41 percent) returns that did not claim the EITC or ACTC before February 15. However, IRS was unable to verify wage information reported on over 58 percent (12.3 million) of tax returns claiming $28.1 billion in refunds, because not all W-2 data were available.

Several issues contributed to delays in availability of W-2 information. IRS processes W-2 electronic data weekly rather than when received due to the age of its computer system, resulting in a lag between when IRS has the data and can use it. In addition, some employers can request and be granted 30-day filing extensions and some file paper W-2s, which take longer to process. IRS continues to analyze the W-2 systemic verification process and its outcomes.

IRS's telephone wait times and level of service—those seeking live assistance and receiving it—improved in the 2017 filing season compared to prior years. Average wait time decreased from 9.7 to 6.8 minutes compared to last year, and telephone level of service was more than 77 percent compared to 74 percent. Further, IRS reduced the number of written correspondence that is late, or “overage,” compared to prior years. IRS also experienced minor disruptions during return processing with two brief electronic filing system interruptions. Finally, IRS launched a new online service, but others were unavailable or discontinued due to security concerns.

Why GAO Did This Study

IRS processes over 100 million tax returns during the filing season. In the past several years, IRS has been confronted with the ongoing problem of identity theft refund fraud and improper payments. Wage information that employers report on Form W-2 had not been available to IRS until after it issued most refunds. As GAO previously reported, earlier access to W-2 wage data—as now provided in recent legislation—could allow IRS to more timely match this information to taxpayers' returns and identify discrepancies before issuing billions of dollars of fraudulent refunds.

GAO was asked to review the 2017 filing season to-date (January through late March to mid-April). This testimony describes IRS's (1) implementation of W-2 systemic verification, and (2) performance in providing telephone and other customer service and processing individual income tax returns during the 2017 filing season.

GAO reviewed IRS systemic verification data and documents and interviewed IRS officials. To evaluate IRS's performance during the 2017 filing season, GAO compared data and documents to IRS's prior years' performance and interviewed IRS officials.

Recommendations

GAO is not making new recommendations but provides a status update on previously recommended actions that IRS could take to further improve service and operations.