IRS Return Selection: Improved Planning, Internal Controls, and Data Would Enhance Large Business Division Efforts to Implement New Compliance Approach

Fast Facts

The IRS's Large Business and International division audits large partnerships and corporations (worth at least $10 million) and wealthy individuals—which sometimes poses compliance challenges. For example, the underreported income tax of corporations alone was about $28 million annually between 2008 and 2010.

This division is implementing a new approach to compliance that focuses on specific issues, such as partnerships that underreport certain types of income. We found that the IRS has made progress in implementing this approach but recommended that it fully address all the project planning principles necessary to effectively implement it.

Conceptual Overview of How the Large Business and International Division Selects Tax Returns for Audit

A funnel graphic show five levels, starting at returns filed and ending at audit selection.

Highlights

What GAO Found

The Internal Revenue Service's (IRS) Large Business and International division (LB&I) uses a variety of methods, such as computer models and staff reviews of returns, to identify tax returns for audit consideration. From the returns identified, managers and auditors in LB&I field offices select the returns to be audited. For the eight methods LB&I uses for identifying and selecting tax returns for audit (selection methods) that GAO analyzed, LB&I documentation on its procedures and policies generally reflected 4 of the 10 internal control principles GAO reviewed. For example:

- Related to the internal control principle of demonstrating commitment to integrity and ethical values, LB&I auditors who identify tax returns for audit consideration are prohibited from auditing those returns themselves or assigning them to specific individuals for audit. In addition, all LB&I staff completed a required training on ethics and impartiality in 2015, the latest available data.

- Related to the internal control principle of demonstrating a commitment to competence, LB&I's procedures and manuals generally documented its training to help assure the competence of staff involved in audit selection. This training included courses on basic skills as well as instruction on more specific topics.

However, for the other 6 internal control principles GAO reviewed, there were gaps in documentation that limit LB&I's assurance that its selection methods are being implemented as designed and are supporting its objectives. For example:

- Related to the internal control principle of identifying, analyzing, and responding to risk, LB&I documentation did not specify procedures or a process for how to respond to changing circumstances, such as a change in the law, in selecting returns for audit.

- Related to the internal control principle of reporting on issues and remediating related deficiencies, LB&I documentation indicated that problems identified with selection methods were discussed in meetings, but not that corrective action was taken to address them.

GAO also found that LB&I has monitoring directives, but it does not have a standard process for monitoring field staff's audit selection decisions. Without such a process, LB&I lacks reasonable assurance that decisions are made consistently.

LB&I is in the process of implementing a new approach for addressing taxpayer compliance, including how it identifies tax returns for audit. LB&I plans to implement what officials call “campaigns,” which are projects focused on a specific compliance-related issue, such as partnerships underreporting certain income, rather than projects focused on the characteristics of whole tax returns. According to LB&I officials, campaigns could include conducting audits as well as other efforts, such as reaching out to taxpayers and tax professionals, issuing guidance, and participating in industry events. LB&I officials said certain audit selection methods that existed prior to the development of campaigns will operate while LB&I implements its campaign approach, and campaigns may subsume some of those methods.

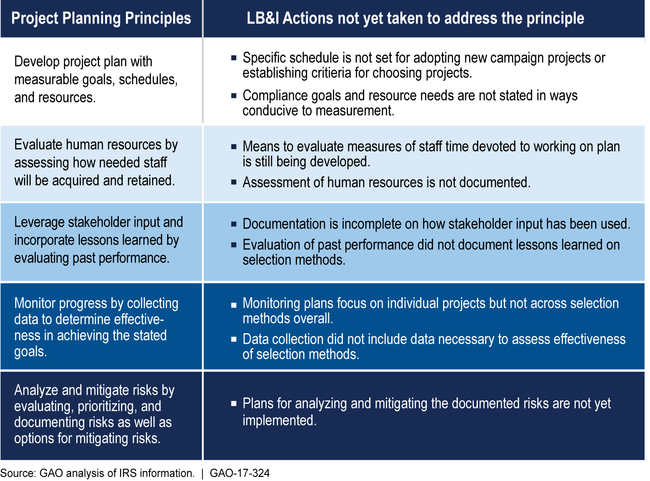

GAO found that LB&I made some progress in implementing its new compliance approach, such as by involving stakeholders in plans and implementing the process for submitting proposals for campaigns. However, LB&I has not fully met five project planning principles set forth in prior GAO work (see table below). Until it fully meets these principles, LB&I management lacks reasonable assurance that its new compliance approach will succeed in accomplishing its overall objectives of encouraging voluntary compliance and fair treatment of taxpayers.

Large Business and International (LB&I) Division's Plans for New Compliance Approach Assessed against Project Planning Principles as of December 2016

Why GAO Did This Study

LB&I audits large partnerships and corporations with $10 million or more in assets and high wealth individuals. These entities pose compliance challenges. For example, IRS reported that the gross underreported income tax of large corporations alone averaged an estimated $28 billion annually between 2008 and 2010, the most recent data. It is important for LB&I to have adequate controls for its audit procedures and to properly plan and implement its new approach to address noncompliance.

GAO was asked to evaluate how IRS selects returns and is implementing its new compliance approach. Among other objectives, this report (1) assesses the extent that LB&I's documented procedures and policies for its audit selection methods generally reflected relevant internal control principles, (2) assesses the extent that LB&I has a standard process to monitor audit selection decisions, and (3) assesses the extent that LB&I has planned and implemented its new approach to address compliance.

GAO reviewed LB&I procedures and policies for eight selection methods that involved the use of discretion and its plans for implementing a new compliance approach. Given the status of LB&I's plans for and implementation of its new approach, GAO did not assess LB&I's decision to create the approach. GAO held focus groups with LB&I staff responsible for selecting audits, and interviewed IRS official

Recommendations

GAO recommends that IRS address documentation gaps in its selection method procedures and policies related to six internal control principles, develop a standard process to monitor field staff's audit selection decisions, and take seven actions to fully address planning principles in its efforts to implement its new compliance approach. In commenting a draft of this report, IRS agreed with all of the recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | As LB&I finishes implementing its new approach and decides which selection methods will be used with the campaigns, the Commissioner of Internal Revenue should ensure that the documentation gaps in policies and procedures are addressed for six internal control principles for the selection methods that will be used, including defining objectives to identify risk and defining risk tolerances. |

In our 2017 report, IRS Return Selection: Improved Planning, Internal Controls, and Data Would Enhance Large Business Division Efforts to Implement New Compliance Approach, we found that the Internal Revenue Service (IRS) Large Business and International Division (LB&I) did not define objectives or risk tolerances for its audit selection processes that could be used with its campaign audit selection program. We recommended that the Commissioner of Internal Revenue have IRS document the definition of its objective to identify risks and define risk tolerances. In response, IRS confirmed in March 2020 that it documented objectives and risk tolerances for its audit selection processes. The objective for its campaign selection process, according to IRS's Internal Revenue Manual (IRM), is identifying "the highest potential compliance risks among LB&I taxpayers and to assign resources to address these potential risks." IRS officials said the risks associated with this objective also have been documented in the IRM, including potential treatment streams, deployment of resources, identification and delivery of training, mentoring, networking, and audit tools. By adding objectives linked to risk tolerances to its campaign selection processes, IRS has helped reduce the appearance of subjectivity on which tax returns have the highest risk of noncompliance.

|

| Internal Revenue Service | As LB&I finishes implementing its new approach and decides which selection methods will be used with the campaigns, the Commissioner of Internal Revenue should ensure that the documentation gaps in policies and procedures are addressed for six internal control principles for the selection methods that will be used, including identifying, analyzing, and responding to risks to achieving the objectives. |

In our 2017 report, IRS Return Selection: Improved Planning, Internal Controls, and Data Would Enhance Large Business Division Efforts to Implement New Compliance Approach, we found that the Internal Revenue Service (IRS) Large Business and International Division (LB&I) did not clearly state how LB&I would respond to changing circumstances that could affect its ability to select returns with the highest compliance risks. We recommended that the Commissioner of Internal Revenue have IRS identify, analyze, and respond to risks to achieving its objectives. By fiscal year 2018, IRS first said that one of the workload selection methods that we addressed in our report on offshore compliance is now handled by another selection method called campaigns. IRS also said that it had created a process to identify and respond to risks for its campaign selection process and for the process focused on international individual compliance. To address campaign risk assessments, the Compliance Integration Council, the governing body over the campaign selection process, now has a scoring process for analyzing risk and procedures for responding to the risk. Examples of the metrics used include returns closed, dollars per hour, recommended dollars and hours per return, among others. For the international individual compliance selection method, IRS said it developed guide papers for examiners and technical specialists that cover how to mitigate risks. Having processes to identify, analyze, and respond to changes that affect risks will help ensure LB&I is fulfilling its responsibility to apply the tax law with integrity and fairness to all.

|

| Internal Revenue Service | As LB&I finishes implementing its new approach and decides which selection methods will be used with the campaigns, the Commissioner of Internal Revenue should ensure that the documentation gaps in policies and procedures are addressed for six internal control principles for the selection methods that will be used, including designing control activities to achieve objectives and responding to risks. |

In our 2017 report, IRS Return Selection: Improved Planning, Internal Controls, and Data Would Enhance Large Business Division Efforts to Implement New Compliance Approach, we found that the Internal Revenue Service (IRS) Large Business and International Division (LB&I) did not clearly state how it determines whether its selection methods are working in responding to risks. IRS provided no evidence that the results from auditing returns selected due to offshore issues are monitored or that the results are provided to management to ensure that the selection method is working given the related risks. We recommended that the Commissioner of Internal Revenue have IRS design control activities to achieve objectives and respond to risks. In May 2020, IRS confirmed that the agency has established objectives and control activities to respond to risks. These controls generally are documented in IRS's Internal Revenue Manual (IRM) and include policies, procedures, techniques and assignment of responsibilities. For example, for the campaign selection process, the IRM says that part of LB&I's objective "is to identify the highest potential compliance risks among LB&I taxpayers and to assign resources to address these potential risks." LB&I now monitors various metrics that it uses to assess risks and determine whether its selection methods are achieving its objective. Additionally, for fiscal year 2019, IRS ran reports for risk assessment that included such measures as closures rates, year-to-date cases closed and percentage of pro-rata plan closed. Having control activities in place is important for IRS to achieve its objective of applying the tax law with integrity and fairness.

|

| Internal Revenue Service | As LB&I finishes implementing its new approach and decides which selection methods will be used with the campaigns, the Commissioner of Internal Revenue should ensure that the documentation gaps in policies and procedures are addressed for six internal control principles for the selection methods that will be used, including using quality information to achieve objectives. |

In our 2017 report, IRS Return Selection: Improved Planning, Internal Controls, and Data Would Enhance Large Business Division Efforts to Implement New Compliance Approach, we found that the Internal Revenue Service (IRS) Large Business and International Division (LB&I) management did not receive reports developed from relevant, reliable, and timely information about whether a selection method was working. We recommended that IRS use quality information to achieve objectives. In an official response, IRS first said that one of the workload selection methods that we addressed in our report on offshore compliance is now handled by another selection method called campaigns. In 2020, IRS provided documentation showing data reliability controls for the data underlying the reports it uses to determine whether the audit selection methods are working. Better assuring the use of quality data from a reliable source will better position LB&I to make the best choices in achieving its audit selection objectives.

|

| Internal Revenue Service | As LB&I finishes implementing its new approach and decides which selection methods will be used with the campaigns, the Commissioner of Internal Revenue should ensure that the documentation gaps in policies and procedures are addressed for six internal control principles for the selection methods that will be used, including communicating internally the necessary quality information about the objectives. |

In our 2017 report, IRS Return Selection: Improved Planning, Internal Controls, and Data Would Enhance Large Business Division Efforts to Implement New Compliance Approach, we found that the Internal Revenue Service (IRS) Large Business and International Division (LB&I) did not meet internal control standards for communicating internally the necessary quality information about audit selection objectives. We recommended that IRS communicate internally the necessary such quality information about their objectives. In March 2020, IRS sent us documentation that it communicated the objectives to LB&I employees about the objectives for its campaign selection process, one of the selection methods we discussed in our report. IRS also sent us documentation in October 2019 that it has established communication and training sessions on the campaign selection process. By communicating objectives and establishing more communication, LB&I will better enable management to make adjustments to achieve the audit selection objectives and address potential risks.

|

| Internal Revenue Service | As LB&I finishes implementing its new approach and decides which selection methods will be used with the campaigns, the Commissioner of Internal Revenue should ensure that the documentation gaps in policies and procedures are addressed for six internal control principles for the selection methods that will be used, including evaluating issues and remediating identified internal control deficiencies on a timely basis. |

In our 2017 report, IRS Return Selection: Improved Planning, Internal Controls, and Data Would Enhance Large Business Division Efforts to Implement New Compliance Approach, we found that the Internal Revenue Service (IRS) Large Business and International Division (LB&I) did not show that it promptly evaluated and identified deficiencies with selection methods and took appropriate action. We recommended that IRS evaluate issues and remediate identified internal control deficiencies on a timely basis. In 2020, IRS sent us documentation showing it had implemented several changes to procedures to remediate control deficiencies. For its Global High Wealth selection method, it implemented a feedback loop in fiscal year 2018 that supplies executives and senior management with data twice per year. For the international individual-miscellaneous method, LB&I conducts a monthly call to discuss feedback and possible deficiencies. For its campaign selection method, IRS also has documented a feedback loop to raise possible deficiencies in the process. Finally, IRS in an official response said that one of the workload selection methods that we addressed in our report on offshore compliance is now handled by the campaign selection method, which now has the feedback loop. By documenting actions taken, LB&I will have better assurance that problems with selection methods will be corrected.

|

| Internal Revenue Service | Also in accordance with federal internal control standards, the Commissioner should direct LB&I to adopt a standard process for monitoring audit selection decisions in the field, such as by modifying the existing quality control system. |

In our 2017 report, IRS Return Selection: Improved Planning, Internal Controls, and Data Would Enhance Large Business Division Efforts to Implement New Compliance Approach, we found that the Internal Revenue Service (IRS) Large Business and International Division (LB&I) did not have a standard process for monitoring decisions about which tax returns would be audited. In particular, we found that although LB&I staff indicated that some of the audit selection decisions may be reviewed at the discretion of managers, LB&I's procedures do not document a systematic, standard process to regularly monitor field audit decisions. This was inconsistent with internal controls for management to establish and operate activities to monitor the internal control system and evaluate the results. By not monitoring the processes used in the field offices to select specific tax returns for audit, LB&I management raises risks such as potentially inconsistent selection decisions and potential perceptions that selection processes are not supporting LB&I's mission to apply the tax law with integrity and fairness to all taxpayers. We recommended that LB&I adopt a standard process for monitoring audit selection decisions in the field. In response, IRS sent us documentation in March 2020 showing that it had implemented a standard process with improved quality controls to monitor and review audit selection and survey decisions in the field. In an official response, IRS said the standard process is used to improve identification of issues of strategic important and is used across all LB&I to determine audit potential of LB&I returns. IRS also said that LB&I conducted training for these procedures for auditors and managers. By establishing a process to monitor field selection with improved quality controls, LB&I management has greater assurance that it will make consistent selection decisions, avoid hindrances to identifying and evaluating remediation to deficiencies in selection processes, and reduce perceptions that selection processes are not supporting LB&I's mission to apply the tax law with integrity and fairness to all taxpayers.

|

| Internal Revenue Service | To further ensure that the new campaigns under LB&I's new approach for addressing tax compliance are implemented successfully, the Commissioner should create a timetable with specific dates for implementing its new compliance approach. |

IRS officials in October 2018 provided documentation that LB&I has fully implemented the campaign program and has effectively documented each step of the campaign process. This process specifically shows a timeline of a campaign from inception to CIC approval and execution. By having documented a schedule for standing up the campaign program, IRS will be better assured that the program will operate as intended.

|

| Internal Revenue Service | To further ensure that the new campaigns under LB&I's new approach for addressing tax compliance are implemented successfully, the Commissioner should establish metrics to help determine whether the campaign effort overall meets LB&I's goals. |

In our 2017 report, IRS Return Selection: Improved Planning, Internal Controls, and Data Would Enhance Large Business Division Efforts to Implement New Compliance Approach, we found that the Internal Revenue Service (IRS) Large Business and International Division (LB&I) did not establish metrics for measuring progress toward goals for its new compliance approach called campaigns. This was inconsistent with project planning principles. Without metrics to track progress across campaigns, LB&I was limited in its ability to determine whether its new approach was meeting stated goals. We recommended that IRS establish metrics to help determine whether the campaign efforts overall meets LB&I's goals. In a 2018 response, IRS said that it has identified metrics across all of its selection methods and that the evaluation of the metrics will be continuous. IRS also said it would make improvements based on those evaluations. The metrics include returns closed, dollar per hour, hours per return, no-change closures, among others. In May 2020, IRS provided documentation showing how it compiles these metrics in a report. Having metrics will permit LB&I to better determine whether campaigns are meeting stated goals .

|

| Internal Revenue Service | To further ensure that the new campaigns under LB&I's new approach for addressing tax compliance are implemented successfully, the Commissioner should finalize and document plans to evaluate the human resources expended on campaign activities. |

IRS officials in July 2018 provided documentation that they had developed a standard governance process for each case selection program. Campaigns will be run as projects to include scope and scheduled resources. The officials said they have completed an initial skills assessment. They will use the feedback loop to make adjustments to resources to ensure subsequent campaigns are resourced appropriately. By establishing plans to evaluate human resources use by campaigns, IRS will be better able to use its existing resources for case selection with campaigns.

|

| Internal Revenue Service | To further ensure that the new campaigns under LB&I's new approach for addressing tax compliance are implemented successfully, the Commissioner should document lessons learned from stakeholder input and past performance. |

As of January 2021, IRS officials said LB&I has developed and deployed the Campaign Development Form and the LB&I Taxpayer Registry to capture stakeholder input and feedback. This new process will help IRS document lessons learned moving forward with its compliance campaigns. For example, IRS documented feedback from auditors on whether the campaign materials provided sufficient information for IRS examiners to scope their work. By documenting lessons learned, IRS will be in a better position to improve its performance on its campaign compliance programs.

|

| Internal Revenue Service | To further ensure that the new campaigns under LB&I's new approach for addressing tax compliance are implemented successfully, the Commissioner should monitor overall performance across future campaigns, not just individual compliance projects, and in doing so ensure that the data used for monitoring accounts for the costs beyond the auditor's time can clearly be linked with specific selection methods, including the Discriminant Analysis System method, to the extent that the selection methods continue to operate. |

In our 2017 report, IRS Return Selection: Improved Planning, Internal Controls, and Data Would Enhance Large Business Division Efforts to Implement New Compliance Approach, we found that the Internal Revenue Service (IRS) Large Business and International Division (LB&I) did not have plans to evaluate the performance of selection methods across campaigns, a new compliance approach LB&I was rolling out at the time of our report. Without analyzing and monitoring results by selection methods across campaigns, LB&I faces a greater risk of not using the most effective selection method within its campaigns. We recommended that IRS monitor overall performance across future campaigns, not just individual compliance projects, and in doing so ensure that the data used for monitoring accounts for the costs beyond the auditor's time can clearly be linked with specific selection methods, including the Discriminant Analysis System method, to the extent that the selection methods continue to operate. By January 2020, IRS provided documentation that it had established procedures for monitoring campaigns. For example, IRS showed it had defined the range of LB&I resources used in compliance activities for all compliance programs; identified methodologies and developing business processes to request, allocate, and monitor resources for compliance programs, including campaigns; and created an action plan to implement the resource management across the compliance programs, updated for all completed actions taken. By taking actions to monitor and analyze the results of all selection methods across future campaigns, IRS is more likely to choose the method that best addresses noncompliance in future campaigns.

|

| Internal Revenue Service | To further ensure that the new campaigns under LB&I's new approach for addressing tax compliance are implemented successfully, the Commissioner should develop and document criteria to use in choosing selection methods for campaigns using audits. |

In our 2017 report, IRS Return Selection: Improved Planning, Internal Controls, and Data Would Enhance Large Business Division Efforts to Implement New Compliance Approach, we found that the Internal Revenue Service (IRS) Large Business and International Division (LB&I) did not develop criteria for choosing the most effective audit selection methods for its then new compliance approach called campaigns. Without criteria to choose audit selection methods for campaigns using audits, LB&I lacked reasonable assurance the campaigns would meet LB&I's audit objectives. We recommended that IRS develop and document criteria to use in choosing selection methods for campaigns using audits. In an official response sent to us in 2018, IRS said that its Campaign Development Form allows LB&I to prioritize decisions for the highest compliance impact. According to IRS, criteria that LB&I considers include the cost/benefits, the ease of implementation, the expected effectiveness of the treatment stream, taxpayer burden, among other factors. In May 2020, IRS sent documentation attesting to the implementation of these criteria. Using criteria such as these will increase LB&I's assurance that the audit selection methods applied in a given campaign will address LB&I's audit objectives.

|

| Internal Revenue Service | To further ensure that the new campaigns under LB&I's new approach for addressing tax compliance are implemented successfully, the Commissioner should set a timetable to analyze and mitigate risks and document specific metrics for assessing mitigation of identified risks. |

In December 2017, IRS provided documentation showing they had created a timetable to mitigate risks, prioritize selections, and document metrics for assessing whether progress is being made toward goals for its approach to compliance called campaigns. The timetable includes the following: standardize a process to analyze and mitigate risk for campaign selection and implementation and create a standard process for tracking mitigation measures on the risks. By adopting a timetable with metrics, LB&I is better assured that its campaign method will address audit risks.

|