Medicare Part B: Data on Coupon Discounts Needed to Evaluate Methodology for Setting Drug Payment Rates

Highlights

What GAO Found

In 2015, manufacturers of 29 of the 50 high-expenditure Medicare Part B drugs GAO analyzed offered coupon programs, which reduce the costs patients incur for specific drugs. Part B drugs are typically administered by a physician. Coupon programs are prohibited in the Medicare program but are generally available to privately insured patients. GAO obtained data on coupon discounts for 18 drugs. GAO estimated that 19 percent of privately insured patients who received these drugs used coupons in 2013, but coupon use varied widely depending on the drug—from 1 percent to over 90 percent.

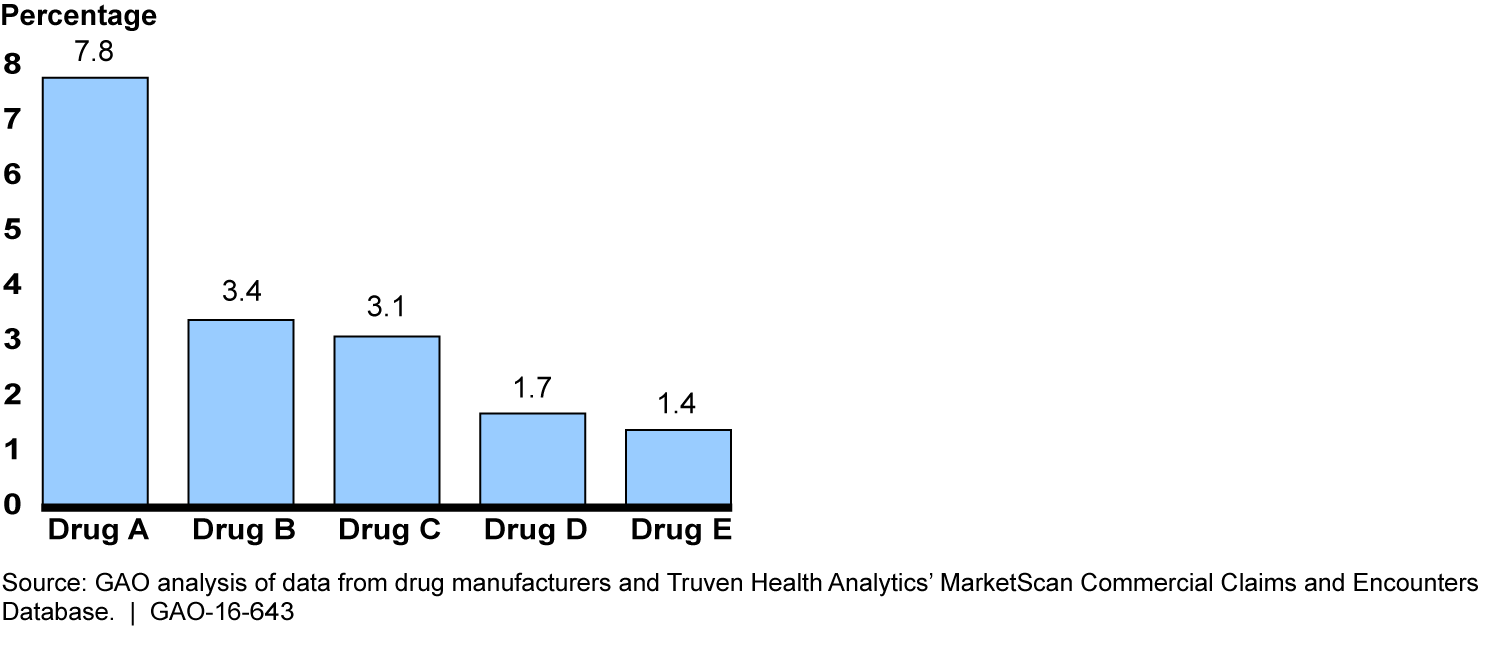

Medicare's methodology for setting Part B payment rates to providers may be less suitable for drugs with coupon programs than for drugs without them. The methodology for most Part B drugs is based on the average sales price (ASP), which is defined by law as the amount physicians and other purchasers pay manufacturers for the drug, net of discounts and rebates to those purchasers. Medicare and its beneficiaries spent $20 billion on Part B drugs paid based on ASP in 2013. As ASP does not account for coupon discounts to patients, the discounts reduce the effective market price that manufacturers receive for drugs with coupon programs. GAO estimated that, for the 18 drugs for which it obtained coupon discount data, the ASP exceeded the effective market price by an estimated 0.7 percent in 2013. Part B spending for these drugs could have been an estimated $69 million lower if ASP equaled the effective market price. ASP exceeded the effective market price by more than 1.0 percent for 5 of the 18 drugs, suggesting that the ASP-based methodology may be even less suitable for these drugs.

Estimated Percentage by which Average Sales Price Exceeded Effective Market Price, Selected Drugs with Coupon Programs, 2013

Notes: The remaining 13 drugs out of the 18 drugs for which GAO obtained coupon discount data had average sales prices that exceeded the effective market price by less than 1.0 percent.

Upward trends in coupon program use and drug prices suggest that these programs could cause the methodology for setting Part B drug payment rates to become less suitable over time for drugs with coupon programs. However, the Centers for Medicare & Medicaid Services (CMS) lacks the authority to collect coupon discount data from manufacturers and thus lacks important information that could inform its ongoing efforts to evaluate alternatives to this methodology.

Why GAO Did This Study

Use of drug coupons in the private sector has increased in recent years. GAO was asked to study coupon programs for drugs covered by Medicare Part B, including any implications for Part B spending.

This report (1) identifies coupon programs associated with high-expenditure Part B drugs and describes the extent to which privately insured patients use coupons and (2) examines, for drugs with coupon programs, the suitability of the Part B drug payment rate methodology. GAO identified high-expenditure Part B drugs using 2013 Medicare claims data—the latest available at the time of the analysis—and collected information from manufacturers on coupon program characteristics in 2015. GAO also analyzed coupon use and patient costs for drugs using 2013 data from manufacturers and private insurers; estimated how Part B spending could have differed if ASP had accounted for coupon discounts in 2013; reviewed federal laws and regulations; and interviewed CMS officials.

Recommendations

To determine the suitability of the Part B drug payment rate methodology for drugs with coupon programs, Congress should consider (1) granting CMS authority to collect data from drug manufacturers on coupon discounts for Part B drugs paid based on ASP; and (2) requiring CMS to periodically collect these data and report on the implications of coupon programs for this methodology. The Department of Health and Human Services provided technical comments on a draft of this report, which GAO incorporated as appropriate.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| To determine the suitability of Medicare's Part B drug payment rate methodology for drugs with coupon programs, Congress should consider (1) granting CMS the authority to collect data from drug manufacturers on coupon discounts for Part B drugs paid based on ASP, and (2) requiring the agency to periodically collect these data and report on the implications that coupon programs may have for this methodology. | As of February 2025, Congress had not introduced or passed legislation to address this Matter for Congressional Consideration. We will update the status of this Matter if such action occurs. |