Foreign Investments in U.S. Agricultural Land: Enhancing Efforts to Collect, Track, and Share Key Information Could Better Identify National Security Risks

Fast Facts

Foreign investment in U.S. agricultural land grew to about 40 million acres in 2021, per USDA estimates. This can pose national security risks—such as when foreign interests buy land near U.S. military installations.

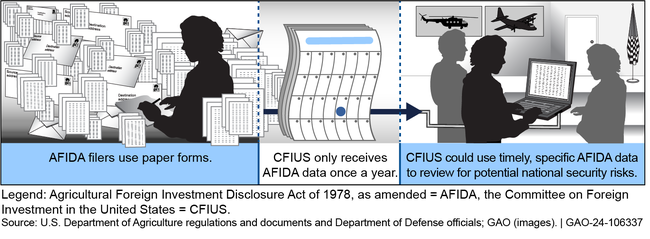

USDA annually publishes data on agricultural land investments, which DOD, Treasury, and other agencies may review for risks. DOD noted that it needs more specific and timely data.

USDA needs to collect, track, and share the data better, and developing a real-time data system would help. For example, USDA annually compiles its data from paper forms filed with headquarters or county offices. Our recommendations address this and more.

Highlights

What GAO Found

The United States Department of Agriculture (USDA) does not share timely data on foreign investments in agricultural land collected under the Agricultural Foreign Investment Disclosure Act of 1978, as amended (AFIDA). Committee on Foreign Investment in the United States (CFIUS) agencies, including the Department of Defense (DOD) and the Department of the Treasury, identify and review transactions that may pose national security risks, such as the proximity of agricultural land to a sensitive military base. USDA annually publishes selected AFIDA information online that CFIUS agencies may use when considering potential national security risks associated with agricultural land. In addition, USDA officials said they respond promptly when they receive requests for information. However, DOD officials noted they need AFIDA information that is more up-to-date and more specific, and they need to receive this information more than once a year. USDA has requested funding to develop a real-time data system that can be accessed by other U.S. government agencies and the public. Meanwhile, sharing current data could help increase visibility into potential national security risks related to foreign investments in U.S. agricultural land.

AFIDA Data Are Not Regularly Part of CFIUS Reviews

USDA implements AFIDA across field offices and headquarters, but its processes to collect, track, and report key information are flawed. USDA collects the required data on paper forms with county or federal offices and reviews them for accuracy, according to USDA officials. However, its processes to do so are unclear and challenging to implement. For example, USDA's AFIDA handbook provides limited instructions on how to collect reliable AFIDA information. In addition, although Congress required USDA to create an online submission process and public database for AFIDA data by the end of 2025, USDA does not have plans and timelines to do so, in part because USDA has not received funding. USDA also does not sufficiently verify and conduct quality reviews to track the accuracy and completeness of its collected AFIDA data. GAO's review of AFIDA data current through calendar year 2021 found errors, such as the largest land holding associated with the People's Republic of China being counted twice. USDA has begun efforts to identify AFIDA non-compliance through data mining, according to officials, and has opportunities to expand this practice. But without improving its internal processes, USDA cannot report reliable information to Congress or the public about where and how much U.S. agricultural land is held by foreign persons.

Why GAO Did This Study

USDA estimated that foreign investment in U.S. agricultural land grew to approximately 40 million acres in 2021. These investments may have consequences for U.S. national security. For example, there may be foreign ownership of U.S. agricultural land close to sensitive military installations.

CFIUS is an interagency committee that reviews certain foreign transactions to determine potential effects on U.S. national security. These include foreign investments in U.S. agricultural land. In addition, USDA's AFIDA statute, enacted in 1978, requires foreign persons acquiring or transferring agricultural land to file a disclosure form with USDA.

GAO was asked to review foreign investments in U.S. agricultural land. This report examines the extent to which (1) USDA shares information related to foreign investments in U.S. agricultural land with CFIUS for its national security reviews, and (2) USDA's processes enable it to collect, track, and report reliable data on foreign investments in U.S. agricultural land. GAO reviewed laws, regulations, and agency guidance; analyzed USDA data; and interviewed agency officials.

Recommendations

GAO is making six recommendations, including that USDA share detailed and timely AFIDA data with CFIUS agencies, improve the reliability of AFIDA data, and assess its ability to adopt an online submission system and public database. USDA generally agreed with our recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Agriculture | The Secretary of Agriculture should ensure that the Chief Operating Officer of FPAC-BC, in coordination with relevant CFIUS member agencies, establish a process to provide detailed and timely AFIDA transaction data relevant to foreign investments in agricultural land to CFIUS member agencies, including DOD and Treasury. Such information could include whether a party has filed a disclosure, who filed it, and when it was filed. (Recommendation 1) |

USDA concurred with this recommendation. In December 2024, USDA officials reported that they were developing a memorandum of understanding to create a mutually-agreed mechanism for officials from USDA's Office of Homeland Security to share AFIDA filings more widely with officials from DOD and Treasury on a timely basis. In May 2025, in accordance with Section 787 of the Consolidated Appropriations Act, 2024, USDA and Treasury signed a memorandum of understanding for USDA to share AFIDA forms filed by foreign persons from countries of concern-the People's Republic of China, Russia, North Korea, and Iran-and other transactions that USDA has reason to believe may post a national security risk. As of August 2025, USDA officials said that DOD has not yet signed an agreement with USDA. In addition, USDA officials stated that if sufficient funding becomes available for a filing portal, FPAC-BC will work to ensure that relevant CFIUS member agencies have access to detailed and timely AFIDA transaction data, either directly through the portal or through weekly or monthly FSA-153 filing summaries. We will continue to monitor the implementation of this recommendation.

|

| Department of Agriculture | The Secretary of Agriculture should direct the Administrator of FSA, as FPAC-BC updates the AFIDA handbook, to clarify and provide specific instructions to headquarters and county employees for completing AFIDA responsibilities, including reviewing the accuracy of forms and identifying missing information. (Recommendation 2) |

USDA concurred with this recommendation. In December 2024, USDA officials told us they were developing a revision of the handbook to clarify instructions and emphasize the importance of reviewing FSA-153 filings for accuracy. In August 2025, USDA officials said that revisions to the handbook were delayed but that a significantly revised handbook would be completed by the end of 2025. In addition, officials are emphasizing the need for consistent and regular outreach regarding FSA-153 requirements and have updated the AFIDA brochure and poster that FSA county offices distribute to potential filers. We will continue to monitor the implementation of this recommendation.

|

| Department of Agriculture |

Priority Rec.

The Secretary of Agriculture should direct the Chief Operating Officer of FPAC-BC and the Administrator of FSA to jointly complete an analysis to determine the extent to which the agency can satisfy the requirements of the Consolidated Appropriations Act, 2023 to create an AFIDA online submission system and public database within its expected budget. If the analysis shows that the agency would be unable to meet the requirements of the Consolidated Appropriations Act, 2023, USDA should report the results to Congress and recommend appropriate legislative changes. (Recommendation 3) |

USDA concurred with this recommendation. USDA officials stated that it has not received sufficient funding to modernize AFIDA information technology and that there is no timeline for the creation of the new AFIDA online submission process. USDA put forward a request for $1 million for AFIDA, which was included in the agency's final budget for fiscal year 2024. USDA officials said they then let a contract for $1.4 million to start work on the online filing portal and began development of the portal using a revised FSA-153 form. The revised form was developed to improve the accuracy of the data USDA captures, such as on leaseholds and the impacts of foreign investment. USDA reported that the new FSA-153 form was being finalized. However, FPAC-BC projected that creating the online filing portal and a public database would cost $36.7 million and therefore require additional funds. In July 2024, the Secretary of Agriculture reported the results of this analysis to the Senate appropriations subcommittee that oversees USDA expressing the gap in funding to meet the Consolidated Appropriations Act, 2023 requirements. Having received information about USDA's ability to meet AFIDA requirements from the Consolidated Appropriations Act, 2023, Congress can now consider if additional legislative action is needed. Based on USDA's actions to provide this information, we are closing this recommendation as implemented.

|

| Department of Agriculture | The Secretary of Agriculture should direct the Chief Operating Officer of FPAC-BC to improve its verification and monitoring of collected AFIDA data, such as reviewing and validating information throughout the AFIDA data collection process. (Recommendation 4) |

USDA concurred with this recommendation. In June 2025, USDA officials provided us with a new set of standard operating procedures for how headquarters and county offices should process FSA-153 forms. Officials told us these procedures will help ensure that each paper form is carefully reviewed and that the data are properly captured in the AFIDA spreadsheet. However, these new procedures were not communicated to county offices and do not align with their current procedures. Officials said they cannot implement these new county office procedures until USDA regulations are updated, which officials did not provide a timeline for. In addition, FPAC-BC updated the checklist that state offices use to conduct annual compliance checks of county offices' efforts under AFIDA and moved the process for completing that checklist to an internal Microsoft SharePoint site. USDA officials also provided evidence to demonstrate that they undertook a process to correct all data issues identified by a review conducted by FPAC-BC's Performance, Accountability, and Risk division of a sample of AFIDA forms. We will continue to monitor the implementation of this recommendation.

|

| Department of Agriculture | The Secretary of Agriculture should direct the Chief Operating Officer of FPAC-BC, in coordination with the Administrator of FSA, to continue data mining activities that compare AFIDA data to FSA program data to identify suspected non-filers. (Recommendation 5) |

USDA concurred with this recommendation. In fall 2023, USDA officials reported performing a nationwide data matching exercise between FSA program data and AFIDA data to identify foreign persons that should have filed an AFIDA disclosure. The exercise identified 655 foreign landowners that, according to officials, are likely non-filers and need to complete an AFIDA filing. As a result, they identified nine parties that should have filed and owe a penalty. They identified 44 filers that were no longer required to file because they had become U.S. citizens or permanent residents, no longer own the land, or the land is now zoned as residential or less than 10 acres. In addition, USDA identified 35 entities who had already filed with AFIDA and again provided their FSA-153 filings. USDA officials told us that as of February 2024 they were requesting agricultural land transaction data from states with new laws requiring disclosure of such transactions and from other U.S. government agencies that may have such data. In December 2024, USDA officials told us that they heard back from some of these states. For example, officials said state-level officials in Iowa provided evidence of six filings totaling 453 acres, which is fewer than the filings included for Iowa in the AFIDA database. Also as of December 2024, USDA officials conducted research on and sent more than 200 letters to property taxpayers and names listed on the original FSA-153 for records they believed to be outdated that were associated with investors from the People's Republic of China, Russia, Iran, and Cuba. As a result, USDA officials said they removed 116 of these records (totaling 21,029 acres) from the AFIDA database, because USDA's research revealed that these records were no longer foreign-held despite USDA not having received a disposition filing. By conducting data-mining of AFIDA data against FSA program data and taking additional actions to identify non-filers, USDA is better equipped to oversee compliance with AFIDA. As a result of USDA's actions and plan to conduct additional data-mining periodically, we are closing this recommendation as implemented.

|

| Department of Agriculture | The Secretary of Agriculture should direct the Chief Operating Officer of FPAC-BC to ensure its AFIDA reporting is complete, such as incorporating country information from additional foreign persons beyond the primary investor when available. (Recommendation 6) |

USDA generally concurred with this recommendation. In July 2024, USDA officials told us that for new filings starting in 2023 and beyond, the department will provide data on secondary and higher interests associated with investments from the People's Republic of China, Russia, Iran, and North Korea. Officials stated that this information will be included in the Foreign Holdings of U.S. Agricultural Report through December 31, 2023. In October 2024, USDA officials reported that they were manually tracking secondary interests associated with investments from these countries. However, USDA officials noted that to accurately capture secondary and higher interests for all countries, they would need an online filing portal with the burden placed on the filer to accurately provide the information. As of August 2025, USDA officials told us the online filing portal was still under development. We will continue to monitor the implementation of this recommendation.

|