Stimulus Checks: Direct Payments to Individuals during the COVID-19 Pandemic

Fast Facts

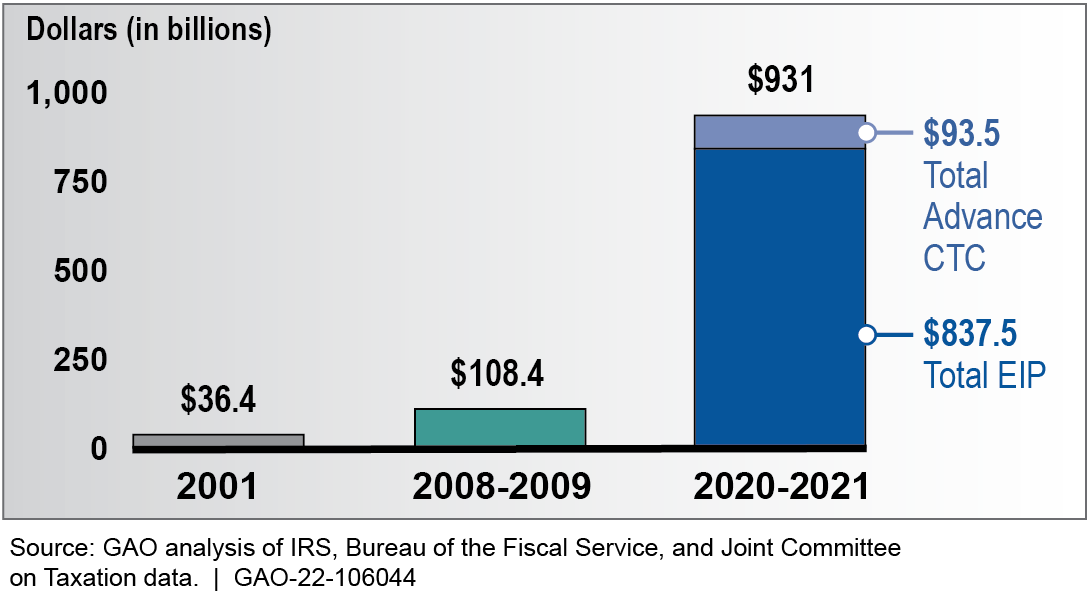

The federal government made direct payments to individuals totaling $931 billion to help with COVID-19. However, it was challenging for the IRS and Treasury to get payments to some people.

We found that nonfilers (i.e., people who are not required to file tax returns), first-time filers, mixed immigrant status families, and those experiencing homelessness were among those likely to have trouble receiving these payments in a timely manner.

We recommended that Treasury and the IRS tailor their outreach efforts to educate such people about their eligibility for these payments.

Highlights

In 2020 and 2021, IRS and Treasury issued $931 billion in direct payments to individuals to ease financial stress due to the COVID-19 pandemic. However, some eligible Americans never received payments. We made recommendations to strengthen Treasury and IRS’s outreach and communications efforts for the billions of dollars in similar tax credits IRS administers, such as the Earned Income Tax Credit.

Big Picture

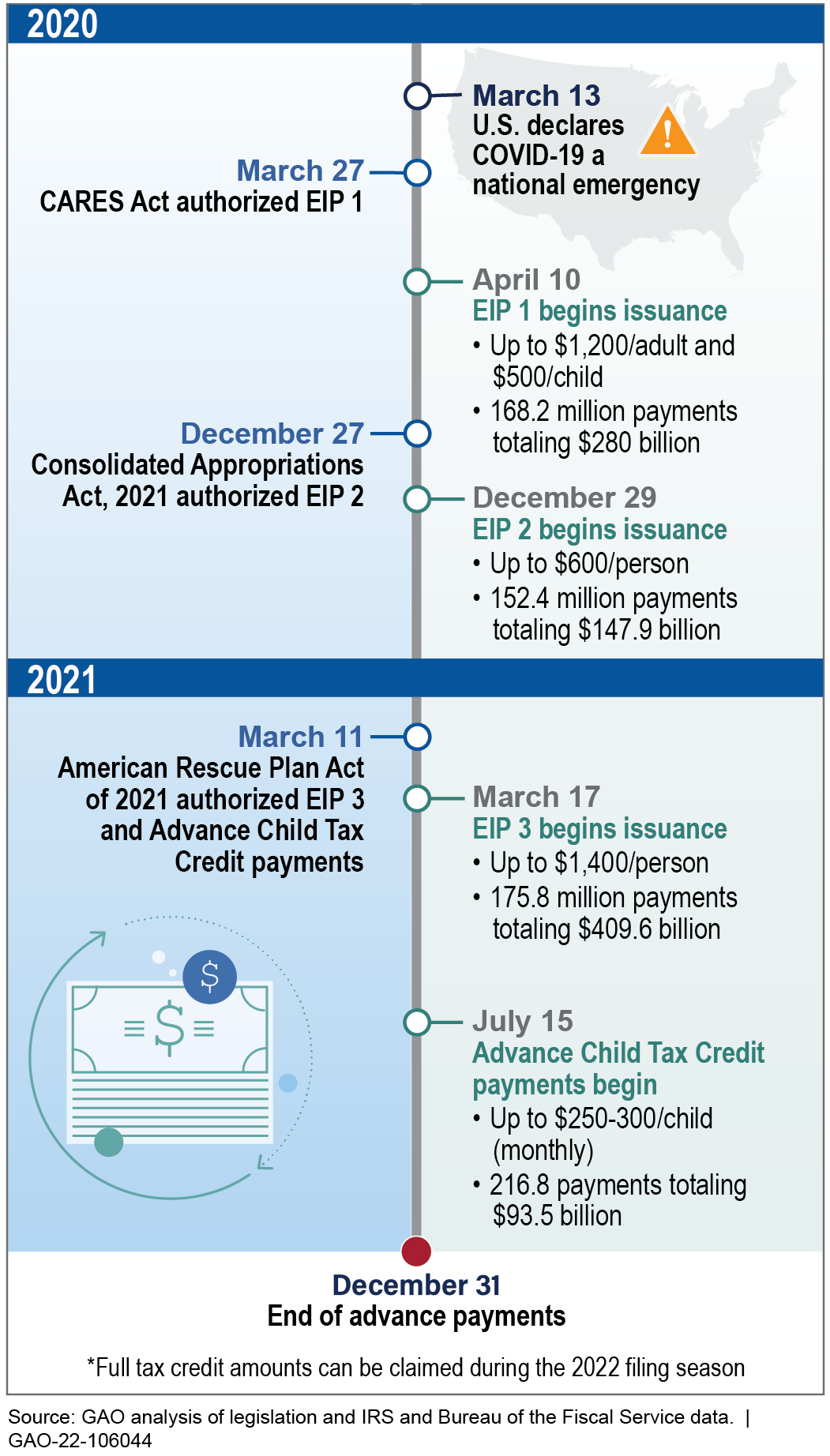

From April 2020 to December 2021, the federal government made direct payments to individuals totaling $931 billion to address pandemic-related financial stress. The CARES Act, the Consolidated Appropriations Act, 2021, and the American Rescue Plan Act of 2021 (Public Laws 116-136, 116-260, and 117-2, respectively) authorized three rounds of Economic Impact Payments (EIPs) that went to around 165 million Americans.

The American Rescue Plan Act of 2021 also temporarily expanded the eligibility of the Child Tax Credit (CTC) to more families and increased the credit amounts. From July to December 2021, eligible families received advance monthly payments of half their total expected CTC, benefiting about 84% of children in the US.

According to Census Bureau and Federal Reserve assessments of survey data, the EIPs and advance CTC payments reduced financial hardship and food insufficiency among recipients. These pandemic-related payments to individuals far exceeded other stimulus payments made to individuals in recent history.

Stimulus payments in 2001, 2008-2009, and 2020-2021

Refundable tax credits sometimes have issues with improper payments (payments made in the wrong amount or to the wrong person). In September 2020, we reported that the EIP improper payment rate was around 2% and IRS took some actions to recover those payments. More recently, Treasury’s Inspector General for Tax Administration (TIGTA) reported on additional steps IRS should take to recover improper payments.

Timeline of Stimulus Payments to Individuals, 2020-2021

What GAO’s Work Shows

1. IRS can use data to tailor outreach efforts.

It was challenging for IRS and Treasury to get payments to some people—especially nonfilers, or those who are not required to file tax returns. These people were eligible for the payments for a couple of reasons:

- first, there was no earned income requirement, so Americans with no or very little income could receive economic relief; and

- second, the payments were refundable tax credits, so eligible individuals can claim the full amount even if it exceeds what they owe in taxes.

In 2020, Treasury and IRS used other data to identify and reach out to around 9 million potentially eligible nonfilers. In May 2021, TIGTA identified potentially 10 million individuals eligible for payments, but IRS has no further plans to reach out to these individuals.

► We recommended that Treasury and IRS use available data to develop an updated estimate of total eligible individuals which they could use to better tailor and redirect their ongoing outreach and communications efforts for similar tax credits.

2. Improved collaboration will also help outreach to underserved communities.

Treasury and IRS undertook sweeping communications and outreach efforts to publicize the EIPs and the advance CTC. For example, they expanded their partnerships to educate more people about the stimulus payments. However, they can do more to measure the effectiveness of their outreach. We found that underserved communities such as nonfilers, first-time filers, unbanked/underbanked, mixed immigrant status families, those with limited internet access, and those experiencing homelessness were likely to experience difficulties with receiving their payments in a timely manner.

► We recommended that Treasury and IRS focus on improving interagency collaboration and use data to assess the effectiveness of their efforts to educate more people about refundable tax credits and eligibility requirements.

Conclusions

- Eligible individuals can still claim their payments through October 17. Individuals who think they may be eligible but did not receive the third EIP or CTC can request an extension and file a simplified return at ChildTaxCredit.gov.

- Lessons learned can help IRS administer refundable tax credits. Although no new EIP and advance CTC payments are underway, Treasury and IRS continue to administer billions of dollars in refundable tax credits annually. Lessons learned from the EIP and advance CTC outreach efforts can help Treasury and IRS manage other refundable tax credits such as the Earned Income Tax Credit. These payments are an economic lifeline for many but also raise concerns about improper payments.

- IRS’s new Taxpayer Experience Office can help improve outreach. IRS recently established the Taxpayer Experience Office to help drive the agency’s strategic direction for improving the taxpayer experience. This is an opportunity for IRS to implement our recommendations to improve outreach efforts to individuals eligible for refundable tax credits.

More from GAO’s Portfolio

Economic Impact Payments and Advance Child Tax Credit Payments: GAO-22-105397 (April 2022), GAO-22-105051 (Oct 2021), GAO-21-551 (July 2021), GAO-21-387 (March 2021), GAO-21-265 (Jan 2021), GAO-21-191 (Nov 2020), GAO-20-701 (Sep 2020), GAO-20-625 (June 2020)

For more information about this Snapshot, contact: Chuck Young, Managing Director, Public Affairs, YoungC1@gao.gov, (202) 512-4800.