Why Don’t More Taxpayers Take Advantage of Free Help Filing Taxes Online?

IRS encourages taxpayers to file their tax returns electronically, which saves IRS money and allows taxpayers to get their refunds faster. IRS’s Free File program provides a free option for getting help filing online through private companies, which have an agreement with IRS and can be found on IRS’s website. One such company, which is no longer a member of the program, recently made headlines after it agreed to pay customers $141 million for allegedly misleading them about free tax filing services.

But even before this, few of the millions of eligible taxpayers actually used the Free File program.

Today’s WatchBlog post looks at some of the reasons why IRS Free File isn’t being used more often, why access to the program is at risk, and what we recommended IRS can do to fix this.

Who Can Use Free File and How Does it Work?

Free File is available to taxpayers with incomes in the bottom 70% of taxpayers. The income limit is adjusted annually for inflation. As stated above, for the 2021 tax season, Free File was available to taxpayers with an income of $73,000 or less. Free File is not available to businesses no matter their size.

To access Free File, taxpayers can visit IRS’s website (IRS.gov), which lists companies that can help taxpayers with their returns online. Those companies ask the taxpayer questions about their tax situation and then prepare and submit taxpayers’ returns to IRS.

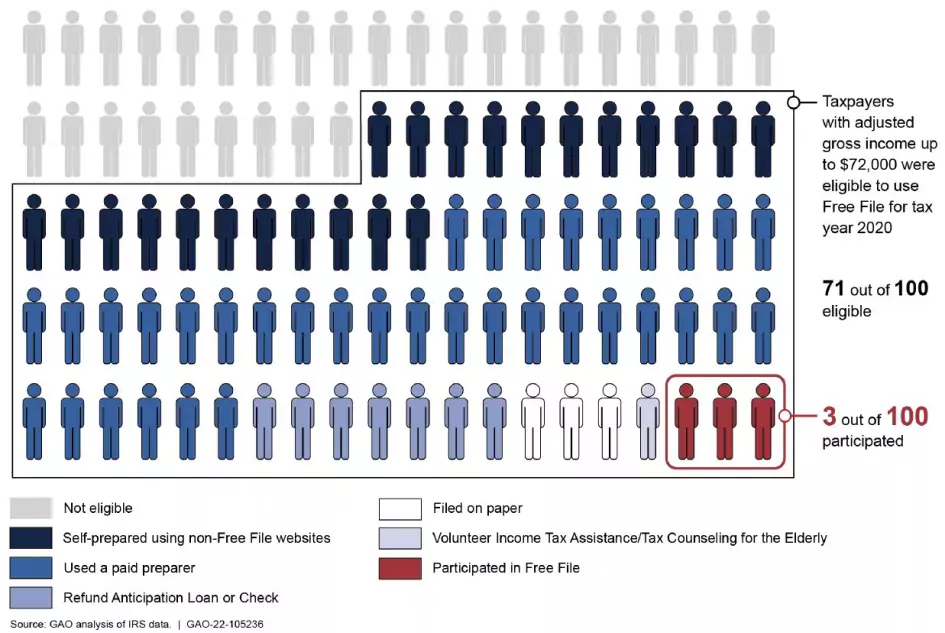

Few Eligible Taxpayers Used Free File for Tax Year 2020

In our new report, we found that during the 2021 filing season (which covered earnings for the 2020 tax year), only 4% of eligible taxpayers used the program. Instead, many used a commercial website outside of the program, which may have charged taxpayers. While 2020 was the most recent year of data available, the low-usage trend has been consistent since the start of the program.

Individual Taxpayers’ Filing Methods by Percentage of Returns for Tax Year 2020

Image

While some taxpayers may prefer or need to speak to a tax professional about their specific situation, the low usage of IRS Free File raises questions about how effectively IRS has gotten the word out.

IRS.gov advertises the program and IRS social media posts mention it. However, officials thought there is confusion because many companies advertise outside the program and some of these ads may mention potential free offers outside the program. While IRS didn’t have a communications plan to grow awareness of the program, officials said they recently developed one. In addition, participating companies do not have an incentive to direct taxpayers to IRS Free File, in lieu of their own services.

Is the IRS Free File the Best Option?

IRS Free File has come with tradeoffs for IRS. IRS did not have to bear the cost of developing its own online filing system, but it also outsourced part of the taxpayer experience, which we found did not meet guidelines for federal digital services.

Another tradeoff is that IRS must rely on the continued participation of private sector companies. The agreement between IRS and participating companies has always allowed companies to leave the program if they wish. IRS has never paid the companies participating for their services. Instead, IRS has historically compensated the companies in an indirect manner. Specifically, IRS has stated that it wouldn’t develop its own online filing services and instead lets the participating companies provide free online filing services to a majority of Americans.

However, in 2019, IRS was no longer prohibited from developing its own online filing service.

Two major companies–H&R Block and Intuit–left the program in 2020 and 2021, respectively. These two companies had prepared approximately 70% of taxpayer returns. While eight companies remain in the program, IRS has little to offer them. IRS’s efforts to negotiate improvements to the taxpayer experience, such as restricting companies’ opportunities to sell paid services to taxpayers using the program, was cited by one company as a reason for leaving. In short, IRS has little leverage. This puts IRS and taxpayers at risk of losing the only guaranteed free option for electronic filing.

We recommended IRS officials identify and develop additional options for free online filing prior to the expiration of the current agreement in October 2023.

Find out more about our work on IRS’s Free File program by checking out our new report.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.