Tackling the Tax Gap

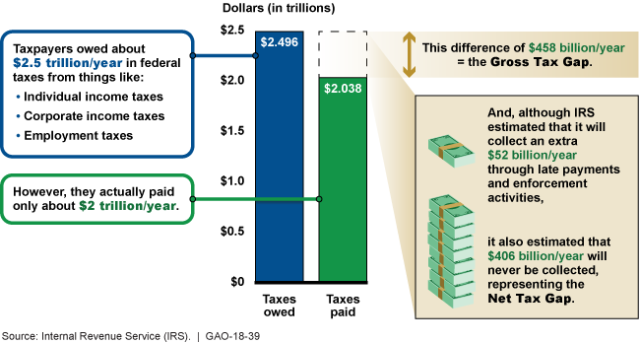

The tax gap is made up of five types of taxes -- individual income, corporate income, employment, estate, and excise taxes. Taxpayers may intentionally or accidentally fail to accurately report tax liabilities on tax returns (underreporting), fail to pay taxes due from filed returns (underpayment), or fail to file a required tax return altogether or on time (nonfiling).

There’s no magic bullet, but there are strategies that could gain millions

Reducing the tax gap would help steer the nation from its unsustainable fiscal path without raising taxes or cutting programs. However, given that it touches many different types of taxes and taxpayers, totally eliminating it is not likely, nor is there one magic bullet that will greatly reduce it.

But if it can reduce it by just 1%, the nation could gain millions in revenue.

IRS must attack the tax gap on multiple fronts and with multiple strategies, such as:

The tax gap is made up of five types of taxes -- individual income, corporate income, employment, estate, and excise taxes. Taxpayers may intentionally or accidentally fail to accurately report tax liabilities on tax returns (underreporting), fail to pay taxes due from filed returns (underpayment), or fail to file a required tax return altogether or on time (nonfiling).

There’s no magic bullet, but there are strategies that could gain millions

Reducing the tax gap would help steer the nation from its unsustainable fiscal path without raising taxes or cutting programs. However, given that it touches many different types of taxes and taxpayers, totally eliminating it is not likely, nor is there one magic bullet that will greatly reduce it.

But if it can reduce it by just 1%, the nation could gain millions in revenue.

IRS must attack the tax gap on multiple fronts and with multiple strategies, such as:

- Using tax gap and other data to develop a strategy to address noncompliance with tax requirements;

- Better using whistleblower information to find taxpayers who aren’t fully paying their taxes;

- Providing better customer services (by phone, mail, and online) to help with tax prep; and

- Improving management of information technology systems and investments.

- Enhancing and expanding third-party information reporting (for example, business’s reporting of payments to nonemployees);

- Enhancing electronic filing;

- Expanding IRS’s authority to correct some tax return errors during processing; and

- Regulating paid preparers.

- Questions on the content of this post? Contact James R. McTigue, Jr. at mctiguej@gao.gov or Jessica Lucas-Judy at LucasJudyJ@gao.gov.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.