Watching Out for Synthetic Identity Fraud

As real WatchBlog fans know, over the years we’ve covered identity theft issues for a few reasons:

- Federal information systems often contain information that can be used to steal identities and commit fraud, so we’ve looked at cybersecurity and other issues of technology and privacy.

- The tax system is vulnerable to identity fraud, and we’ve looked at ways that IRS can help prevent and detect it.

- Federal agencies are vulnerable to cyber intrusions and identity theft, so we’ve looked at identity theft services that the government may have to provide to citizens and employees.

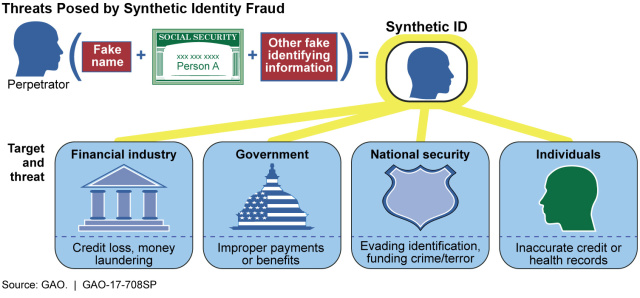

So, today on the WatchBlog, we’re focusing on yet another type of identity theft: “synthetic identity fraud.” This happens when a criminal, for example, steals a Social Security number and creates a fictitious identity with which to commit fraud. We’ll also look at highlights from our panel on the subject.

What’s the point of synthetic identity fraud?

While other types of identity fraud involve stealing a real person’s identity, synthetic identity fraud is about creating a new identity that can be used for any number of criminal activities, such as:

- money laundering

- fraudulently applying for government benefits

- funding terrorism

- entering or moving around the United States undetected

Criminals often create synthetic identities by using Social Security numbers that belong to people who are not actively using credit—particularly children, the elderly, and the homeless. If these people try to use credit in the future, they may find all kinds of inaccurate records attached to their Social Security numbers.

(Excerpted from GAO-17-708SP)

What do the experts say about it?

On February 15, 2017, we convened and moderated a diverse panel of 14 experts—selected with assistance from the National Academy of Science—to discuss the problem of synthetic identity fraud.

These experts told us that this type of fraud has grown significantly in the last five years. In 2016, they said, it led to hundreds of millions of dollars of financial industry losses. Government agencies may face losses, too. For example, one expert said that a state paid an estimated $200 million in unemployment insurance claims from fictitious people.

The panelists identified a number of challenges that public and private institutions face when combating this type of fraud, and identified options to address them, such as

- improving guidance on privacy laws to help financial institutions and law enforcement share information

- exploring innovative ways to detect fraud, such as data mining

- encouraging collaboration among the Social Security Administration and public and private entities.

- Comments on the WatchBlog? Contact blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.