Tackling the Tax Code – How the IRS Communicates with Taxpayers

- Forms, instructions, and publications for taxpayers to use in preparing their returns

- News releases, fact sheets, and tax tips

- Instructional audio and video presentations, and

- Various other online tools and resources

(Excerpted from GAO-16-720)

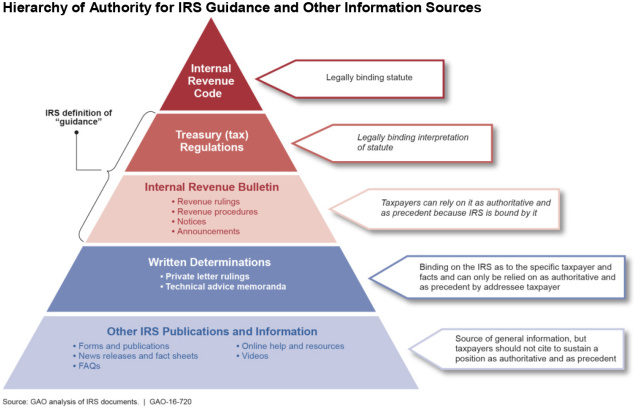

We recently reviewed how the IRS communicates tax law changes and responsibilities to the public, and how it decides what type of guidance to issue. We found that—unlike most other federal agencies—the IRS considers the guidance issued in its weekly Bulletin to be legally binding. So, of all the guidance the IRS issues, the Bulletin is the authoritative source for tax law changes and responsibilities. While the other non-Bulletin materials and resources may be useful to you as you complete your taxes, you can’t rely on them as authoritative resources. But how would you know that? To help taxpayers, we recommended that the IRS more clearly identify this limitation on its non-Bulletin materials and resources. To read more about ways the IRS might increase taxpayers’ knowledge and confidence about the tax system, check out our full report.- Questions on the content of this post? Contact James R. McTigue, Jr. at mctiguej@gao.gov.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.