Understanding the Housing Finance System

Excerpted from GAO-15-131

Excerpted from GAO-15-131

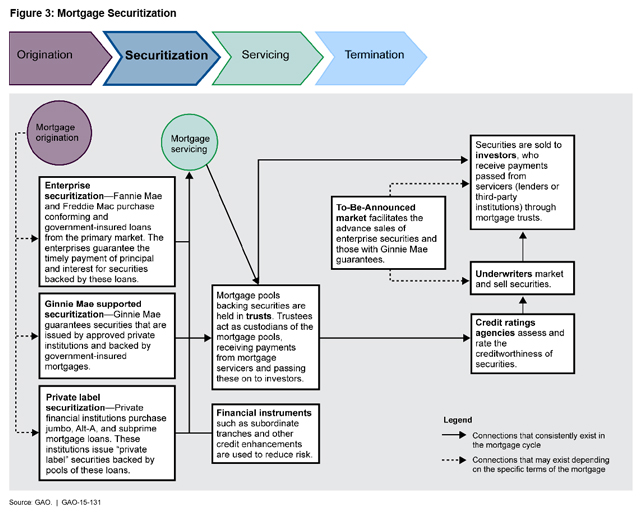

2. Securitization

If a mortgage is sold into the secondary market, as described above, it could be pooled or bundled into “mortgage-backed securities.” Such mortgages are said to be securitized. Securitizing mortgages allows them to be traded on securities markets, similar to the trading of stocks and corporate bonds. This is intended to allow lenders to obtain funds to make more loans, lower mortgage rates for borrowers, and provide those buying the securities with additional investment options. Most mortgages are securitized—almost 80% of new mortgages in 2013. Securities are generally issued by Fannie Mae and Freddie Mac, or by private financial institutions, as shown below. Excerpted from GAO-15-131

Excerpted from GAO-15-131

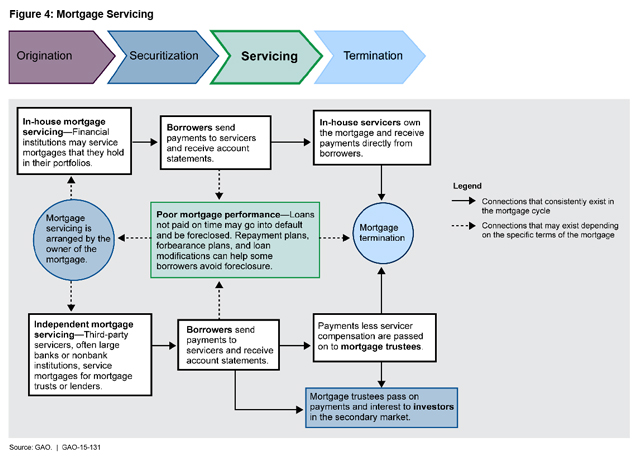

3. Servicing

Throughout the life of a mortgage, it is “serviced.” Servicing refers to a variety of administrative duties, such as sending statements and tax documents to borrowers, answering customer service inquiries, and collecting mortgage payments. Mortgages may be serviced by the lenders that originated them or by third parties that specialize in mortgage servicing. Excerpted from GAO-15-131

Excerpted from GAO-15-131

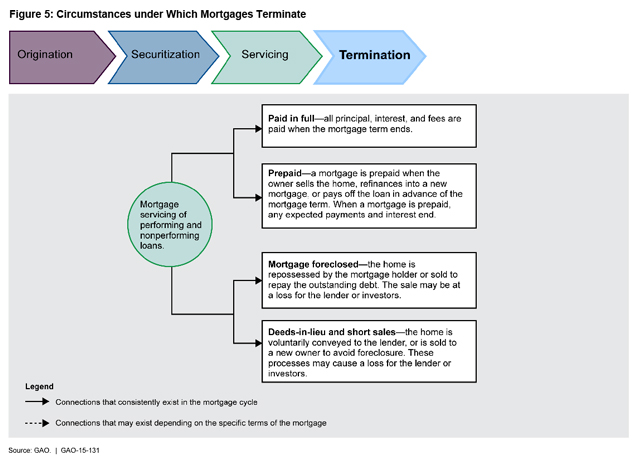

- pays off the full amount of the mortgage plus any interest,

- prepays the mortgage by refinancing it with a new loan, or

- pays off the mortgage when selling the property.

Excerpted from GAO-15-131

Excerpted from GAO-15-131

- Questions on the content of this post? Contact Matt Scirè at sciremj@gao.gov.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.